- Analytik

- Technische Analyse

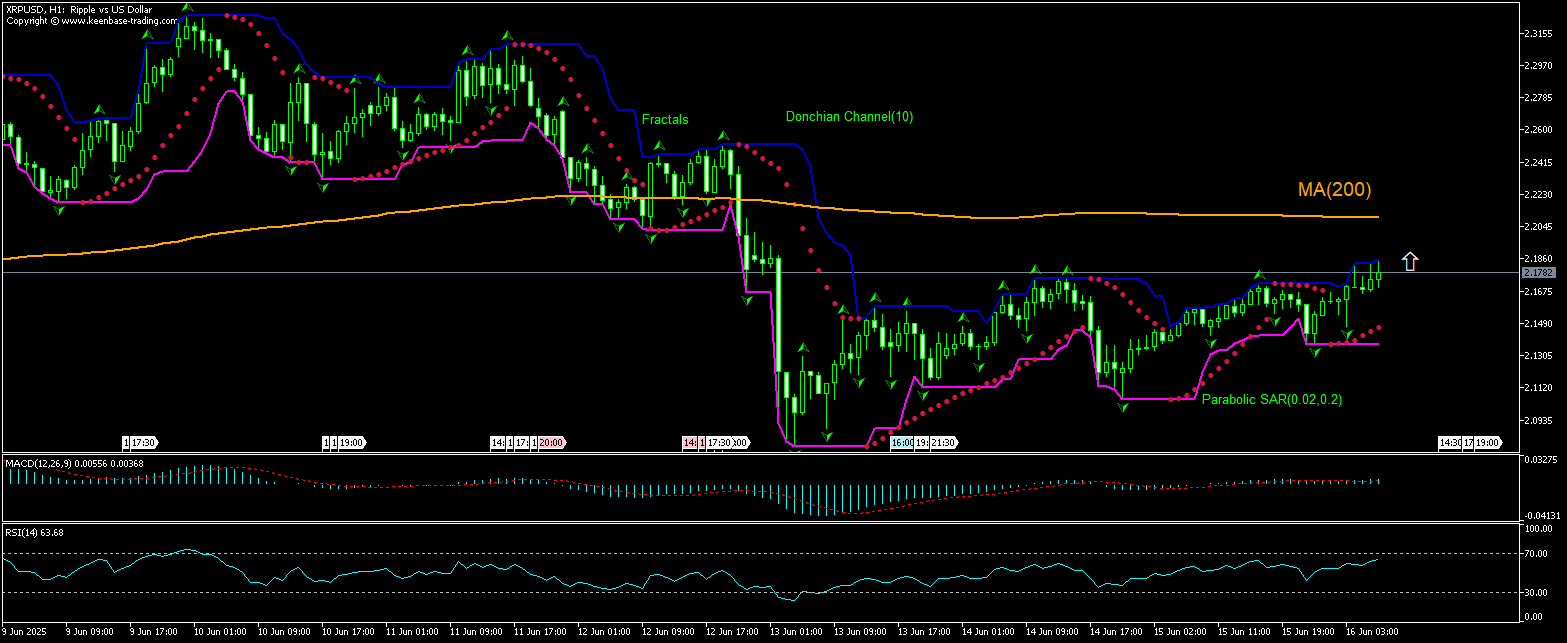

XRPUSD Technische Analyse - XRPUSD Handel: 2025-06-16

XRPUSD Technical Analysis Summary

Above 2.1858

Buy Stop

Below 2.1499

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Sell |

| Fractals | Buy |

| Parabolic SAR | Buy |

XRPUSD Chart Analysis

XRPUSD Technische Analyse

The XRPUSD technical analysis of the price chart on 1-hour timeframe shows XRPUSD,H1 is retracing up toward the 200-period moving average MA(200) as it rebounds from ten-day low it hit three days ago. We believe the bullish momentum will continue after the price breaches above the upper bound of Donchian channel at 2.1858. A level below this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 2.1499. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Cryptovaluta - XRPUSD

Ripple CEO Brad Garlinghouse says XRP is positioned to capture 14% of SWIFT’s cross-border payments market within five years. Will the XRPUSD price continue rebounding?

Ripple CEO says the blockchain-based Ripple Payments system with its XRP and Ripple USD (RLUSD) will benefit from shifting dynamics in payments settlement marklets. The SWIFT Worldwide Interbank Financial Telecommunication (SWIFT), which has long dominated the interbank communication and settlement space, is used as a tool for two main purposes: secure messaging and payment settlement. Garlonghouse says SWIFT’s model relies on multiple intermediaries, manual processes, and often inconsistent messaging standards. Its procedures are vulnerable to errors as a typo in an account number, an incorrect SWIFT code or incomplete payment instructions can all cause a transaction to fail. The model has high fees and slow settlement times. Ripple promotes its blockchain-based Ripple Payments system as an advanced alternative, leveraging XRP and the Ripple USD (RLUSD) stablecoin to offer real-time, transparent, and lower-cost settlements across borders. The crypto firm claims its platform has access to over 90% of the world’s FX markets as it seeks to reduce operational risks. Expectations of winning higher share of cross-border payments market are bullish for XRPUSD price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.