- Analytics

- Trading News

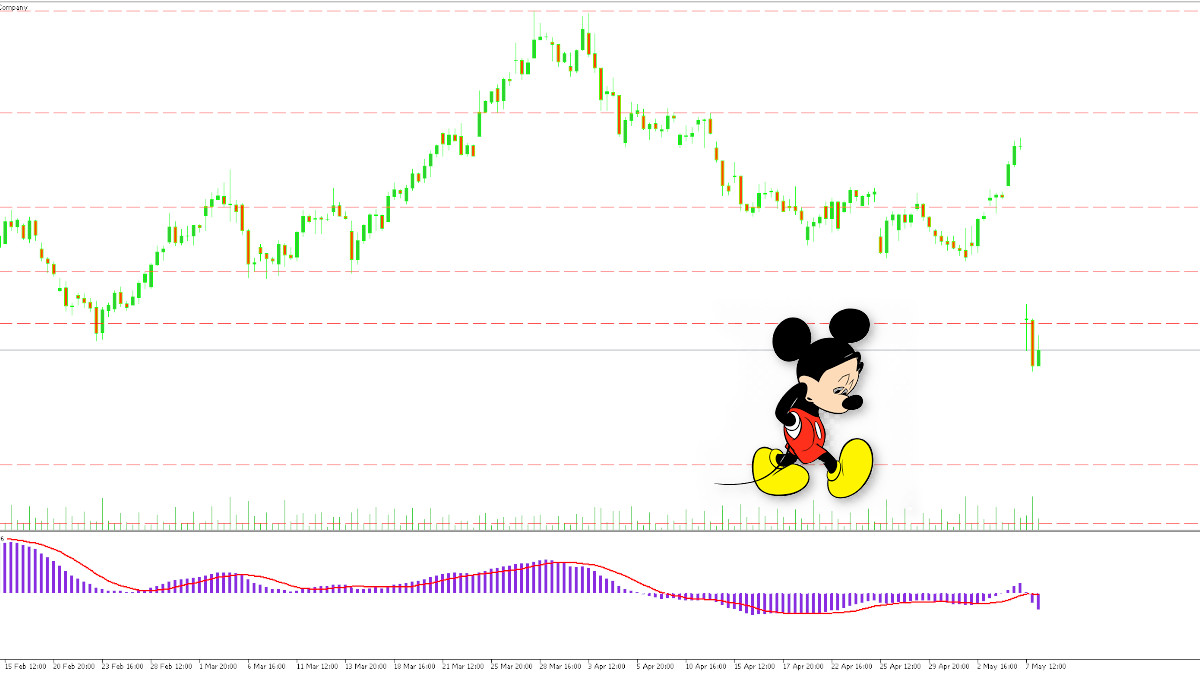

- Why did Disney Stock Drop

Why did Disney Stock Drop

Walt Disney Company (DIS) shares fell sharply on Tuesday after releasing mixed second-quarter earnings. The stock price dropped around 8% despite the company beating earnings estimates thanks to significant cost reductions.

Disney Mixed Earnings Report

Disney pleased investors with its bottom line.

- Adjusted earnings per share (EPS) came in at $1.21, exceeding analyst expectations of $1.10 and reflecting a 30% year-over-year increase.

This improvement stemmed from the company's aggressive cost-cutting measures.

However, revenue fell short of projections.

- Disney generated $22.08 billion in revenue, missing analyst estimates of $22.12 billion. This also represented a slight decline from the previous quarter's $23.5 billion.

Disney Streaming Drives Profits

Disney's Experiences division, which includes theme parks, continued to perform well. Revenue in this segment jumped 10% year-over-year to $8.4 billion. The sports division also showed strength with a 2% revenue increase.

Disney's streaming services were another bright spot.

Direct-to-consumer streaming revenue grew 13% year-over-year, and the segment achieved profitability for the first time, reporting a $47 million profit compared to significant losses in prior quarters.

Disney+ subscriber numbers reached 153.6 million, slightly below analyst expectations but still reflecting a 3% increase from the previous quarter. Hulu subscribers also climbed by 1%.

Disney’s Entertainment Division Disappoints

The company's Entertainment division, movies, television, and streaming properties, was the source of investor disappointment.

- Revenue in this segment declined 5% year-over-year and 2% from the previous quarter, falling to $9.8 billion. Movie revenue plunged 40%, and linear networks saw an 8% decline.

- Disney+ subscriber growth also missed expectations.

Profitability on Track Despite Sell-Off

Despite the stock sell-off, Disney remains confident about its future profitability. The company expects to achieve profitability in its entire streaming business by the fourth quarter and projects $7.5 billion in annual cost savings for 2024.

Investor Reaction and Outlook

The stock price decline might be an overreaction considering the positive streaming performance and cost-cutting. However, Disney's recent stock surge might have led to an overvaluation with a high P/E ratio. While Disney's future growth potential remains strong, the current valuation might be a concern for some investors.