- Analyses

- Analyse technique

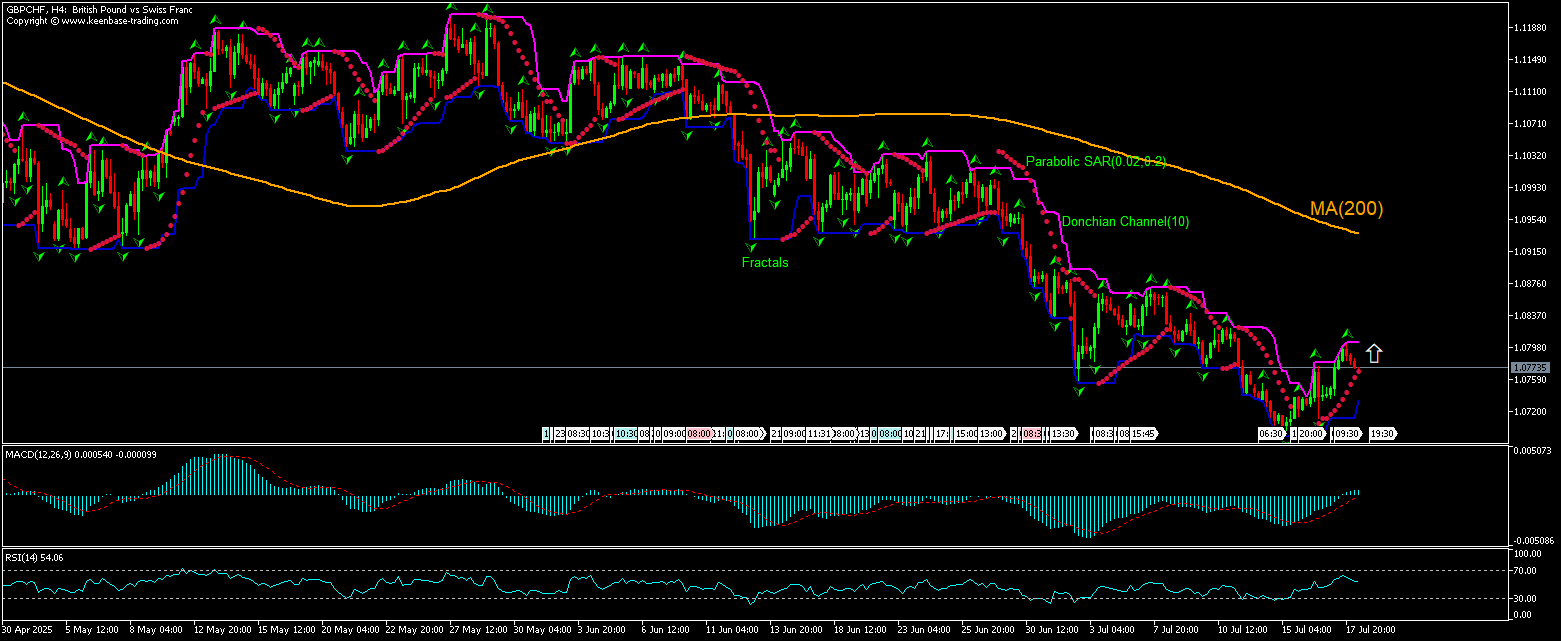

GBP/CHF Analyse technique - GBP/CHF Trading: 2025-07-18

GBP/CHF Résumé de l'Analyse Technique

Supérieur de 1.08044

Buy Stop

Inférieur à 1.07110

Stop Loss

| indicateur | Signal |

| RSI | Neutre |

| MACD | Acheter |

| Donchian Channel | Neutre |

| MA(200) | Vendre |

| Fractals | Acheter |

| Parabolic SAR | Acheter |

GBP/CHF Analyse graphique

GBP/CHF Analyse technique

L'analyse technique du graphique du prix GBPUSD sur une période de 4 heures montre que GBPUSD,H4 retrace vers le haut sous la moyenne mobile sur 200 périodes MA(200) après avoir atteint son plus bas niveau sur trois mois il y a trois jours. Nous pensons que l'élan haussier se poursuivra après la rupture des prix au-dessus de la limite supérieure du canal de Donchian à 1,08044. Un niveau supérieur peut servir de point d'entrée pour placer un ordre d'achat en attente. Le stop loss peut être placé sous 1,07110. Après le placement de l'ordre, le stop loss sera déplacé vers le prochain indicateur bas fractal, en suivant les signaux Paraboliques. Ainsi, nous modifions le ratio profits/pertes attendus jusqu'au point mort. Si le prix atteint le niveau du stop loss sans atteindre l'ordre, nous recommandons l'annulation de l'ordre : le marché a subi des changements internes qui n'ont pas été pris en compte.

Analyse Fondamentale de Forex - GBP/CHF

Le nombre de personnes demandant des allocations de chômage au Royaume-Uni a augmenté plus que prévu en juin. Le rebond du prix GBPUSD va-t-il s'inverser?

Le nombre de personnes demandant des allocations chômage au Royaume-Uni a augmenté plus que prévu en juin : l'Office national des statistiques du Royaume-Uni a indiqué que le nombre de demandeurs d'allocations chômage a augmenté de 25 900 en juin, après une hausse révisée à la baisse de 15 300 le mois précédent, alors qu'une hausse de 17 900 était prévue. Et l'évolution de l'indice des revenus moyens (la moyenne mobile sur 3 mois se terminant en mai par rapport à la même période un an plus tôt) représentant l'évolution du prix que les entreprises et le gouvernement paient pour la main-d'œuvre, y compris les primes, a augmenté à un rythme inchangé de 5,0 % après un rythme de 5,4 % au cours des trois mois se terminant en avril. En même temps, le taux de chômage a légèrement augmenté pour atteindre 4,7 %, contre un taux stable de 4,6 % prévu. Une hausse plus rapide que prévu du nombre de chômeurs au Royaume-Uni est baissière pour la livre et la paire de devises GBPCHF. Cependant, la situation actuelle est haussière pour la paire

Explorez nos

conditions de trading

- Spreads à partir de 0.0 pip

- Plus de 30,000 instruments de trading

- Stop Out Level - Only 10%

Prêt à trader?

Ouvrir un compte NB:

Cet aperçu a un caractère instructif et didactique, publié gratuitement. Toutes les données, comprises dans l'aperçu, sont reçues de sources publiques, reconnues comme plus ou moins fiables. En outre, rien ne garantit que les informations indiquées sont complètes et précises. Les aperçus ne sont pas mis à jour. L'ensemble de l'information contenue dans chaque aperçu, y compris l'opinion, les indicateurs, les graphiques et tout le reste, est fourni uniquement à des fins de familiarisation et n'est pas un conseil financier ou une recommandation. Tout le texte entier et sa partie, ainsi que les graphiques ne peuvent pas être considérés comme une offre de faire une transaction sur chaque actif. IFC Markets et ses employés, dans n'importe quelle circonstance, ne sont pas responsables de toute action prise par quelqu'un d'autre pendant ou après la lecture de l’aperçu.