- Analisi

- Analisi Tecnica

CAD rispetto alle Valute Analisi Tecnica - CAD rispetto alle Valute Trading: 2020-05-19

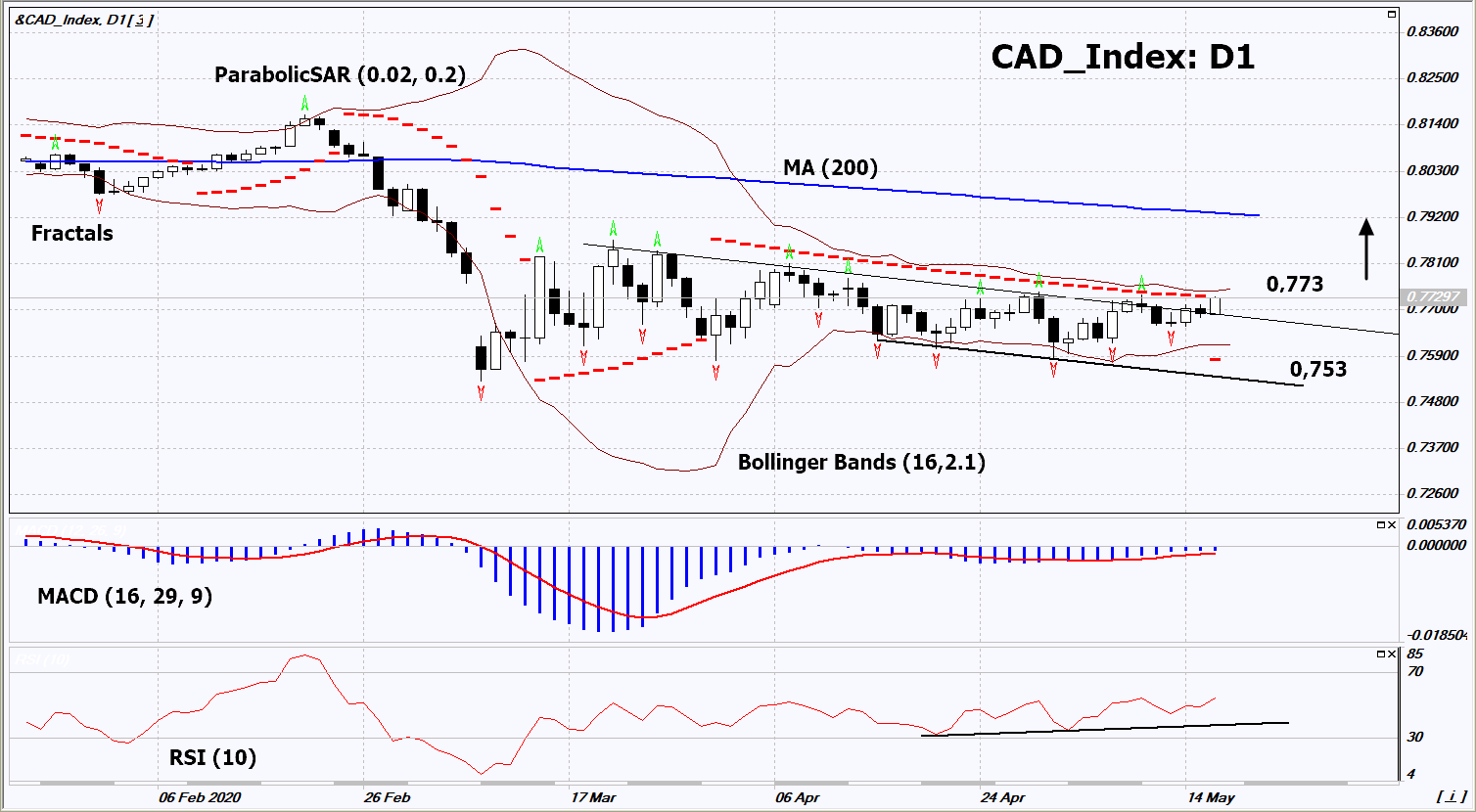

CAD currency index Technical Analysis Summary

Sopra 0,773

Buy Stop

Sotto 0,753

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutro |

| Fractals | Neutro |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

CAD currency index Chart Analysis

CAD currency index Analisi Tecnica

On the daily timeframe, CAD_Index: D1 broke through the upper border of the downtrend. A number of indicators of technical analysis formed signals for a further increase. We do not exclude a bullish movement if CAD_Index rises above its last upper fractal and Bollinger Upper Line: 0.773. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the lower Bollinger line and the lowest since 2016: 0.753. After opening the pending order, we move the stop loss after the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit / loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss level (0.753) without reaching the order (0.773), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Analisi Fondamentale PCI - CAD currency index

In this review, we propose to consider a personal composite instrument (PCI) "CAD currency index." This is the Canadian dollar currency index, which rises with the strengthening of the Canadian currency. Is the growth of &CAD_Index quotes possible?

The share of energy products in Canada's exports reaches 30%. They include oil and petroleum products, natural gas and coal. The cost of energy products is correlated with oil quotes. As a rule, the Canadian dollar strengthens with rising hydrocarbons prices. West Texas Intermediate (WTI) oil is getting more expensive for the 5th day in a row and has already surpassed the psychological level of $ 30 per barrel. Investors believe that as quarantine is lifted in all countries of the world, fuel demand will recover. In particular, the demand for oil in China approached the “pre-quarantine” level. Citibank raised its forecast for WTI to $ 42 per barrel by the end of the year. On Monday, the United States announced successful trials of the vaccine against Covid-19, which contributed to a strong increase in oil prices. Inflation data will be released in Canada on Wednesday, and retail sales on Friday.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.