- Analisi

- Analisi Tecnica

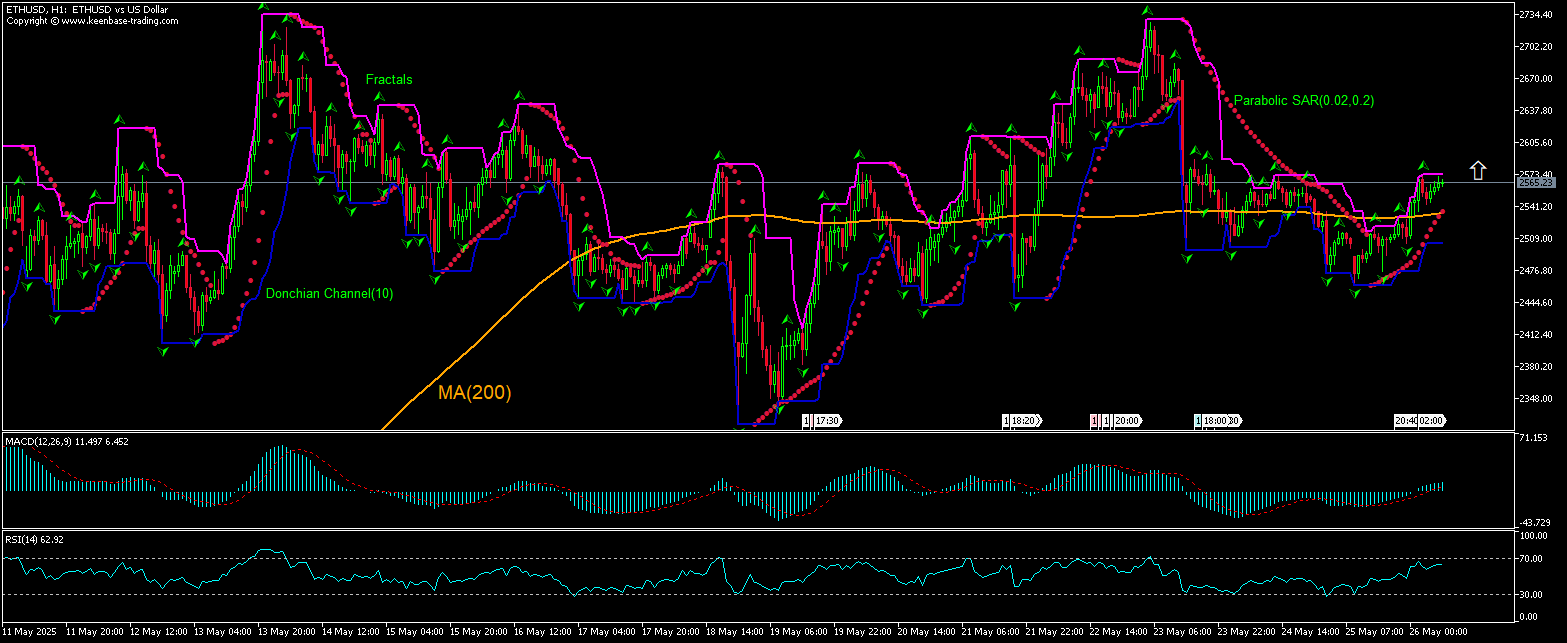

Ethereum / USD Analisi Tecnica - Ethereum / USD Trading: 2025-05-26

Ethereum / USD Technical Analysis Summary

Sopra 2572.90

Buy Stop

Sotto 2533.63

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Buy |

| Donchian Channel | Neutro |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Ethereum / USD Chart Analysis

Ethereum / USD Analisi Tecnica

The ETHUSD technical analysis of the price chart on 1-hour timeframe shows ETHUSD: H1 is rising after breaching above the 200-period moving average MA(200) as it rebounded after a drop to five-day low yesterday. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 2572.90. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 2533.63. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Cripto - Ethereum / USD

Ethereum prices rose as Bitcoin broke into new record territory last week. Will the ETHUSD price continue advancing?

Ethereum rose more than 40% in the last month and prices tracked Bitcoin movement as the cryptocurrency leader broke into new record territory last week. ETHUSD then retreated, unable to breach above $2734. Glassnode post on May 25 notes there is a significant cluster of investor cost basis levels around $2,800, meaning that many holders had bought at that level and were underwater for months as prices retreated from that level. And as ETHUSD approaches this level, they may see it as a chance to exit at break-even which could add significant sell-side pressure to the market. However, the current setup is bullish for ETHUSD.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.