- Analisi

- Analisi Tecnica

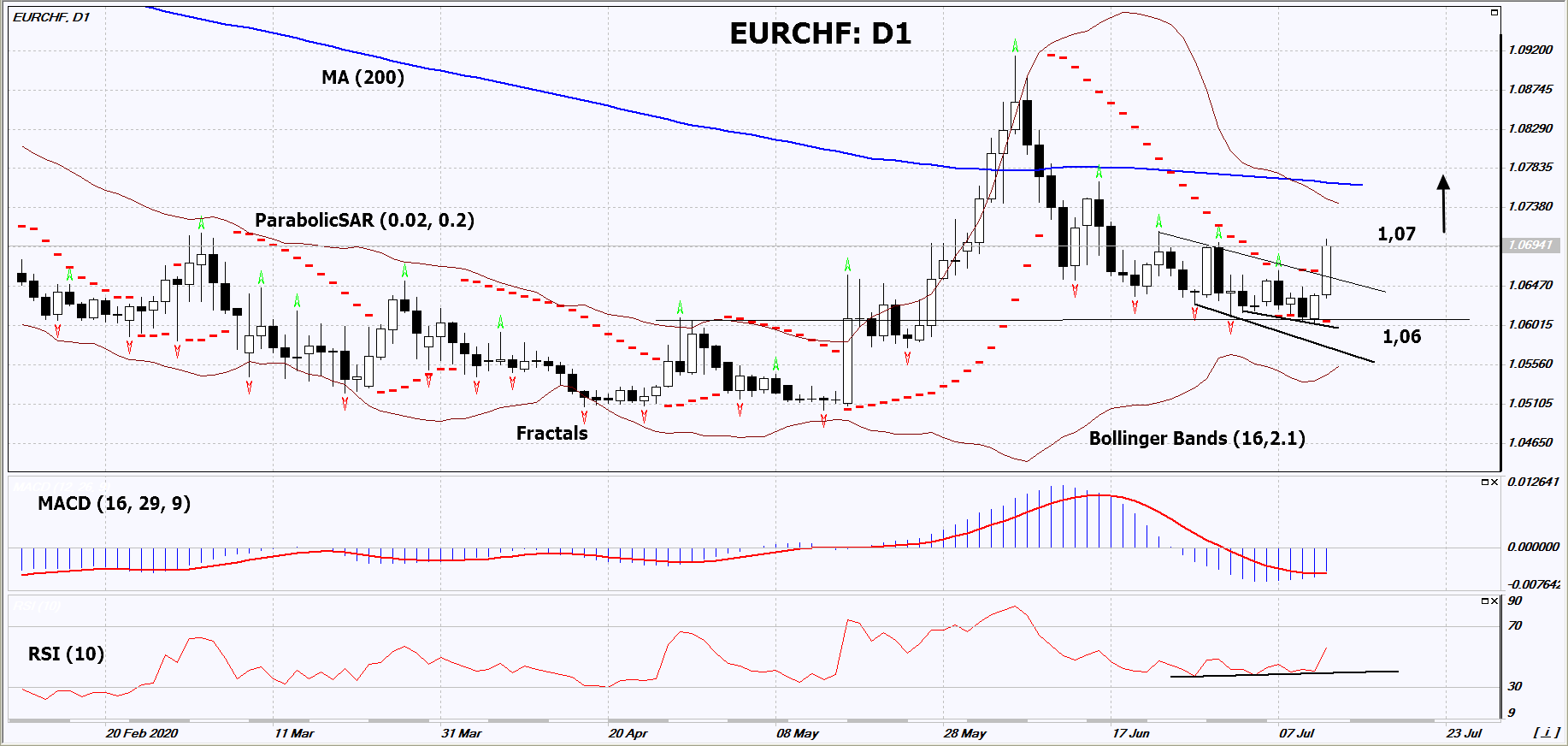

EUR/CHF Analisi Tecnica - EUR/CHF Trading: 2020-07-14

Euro Franco Svizzero Technical Analysis Summary

Sopra 1,07

Buy Stop

Sotto 1,06

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutro |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutro |

Euro Franco Svizzero Chart Analysis

Euro Franco Svizzero Analisi Tecnica

On the daily timeframe, EURCHF: D1 exceeded the resistance line of the short-term downtrend. Now it is trying to continue the upward trend. A number of indicators of technical analysis formed signals for a further increase. We do not exclude bullish movement if EURCHF rises above its last maximum: 1.07. This level can be used as an entry point. We can set a stop loss below the Parabolic signal and the last low: 1.06. After opening the pending order, we move the stop loss after the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss level (1.06) without activating the order (1.07), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Analisi Fondamentale Forex - Euro Franco Svizzero

Important financial events are awaited in Switzerland and the Eurozone this week. Will the EURCHF quotes continue to grow?

The upward movement means the strengthening of the euro and the weakening of the Swiss franc. The speech of the head of the Swiss National Bank (SNB) Thomas Jordan is expected on July 14. Market participants believe that he will confirm his department's commitment to a super-soft monetary policy. This may weaken the franc. Recall that the SNB rate is negative and has been -0.75% since the beginning of 2015. On Monday, two more companies (Pfizer and BioNTech) announced the creation of a Covid-19 vaccine. This is a negative factor for the “safe haven currencies” - the Swiss franc and yen. The EU leaders' summit will be held on July 17-18. They will discuss the functioning of the anti-crisis fund. Before it begins, there may be some positive statements from the ECB, which will hold its regular meeting just the day before - July 16. The ECB’s rate of 0% ( since March 2016) is not expected to change.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.