- Analisi

- Analisi Tecnica

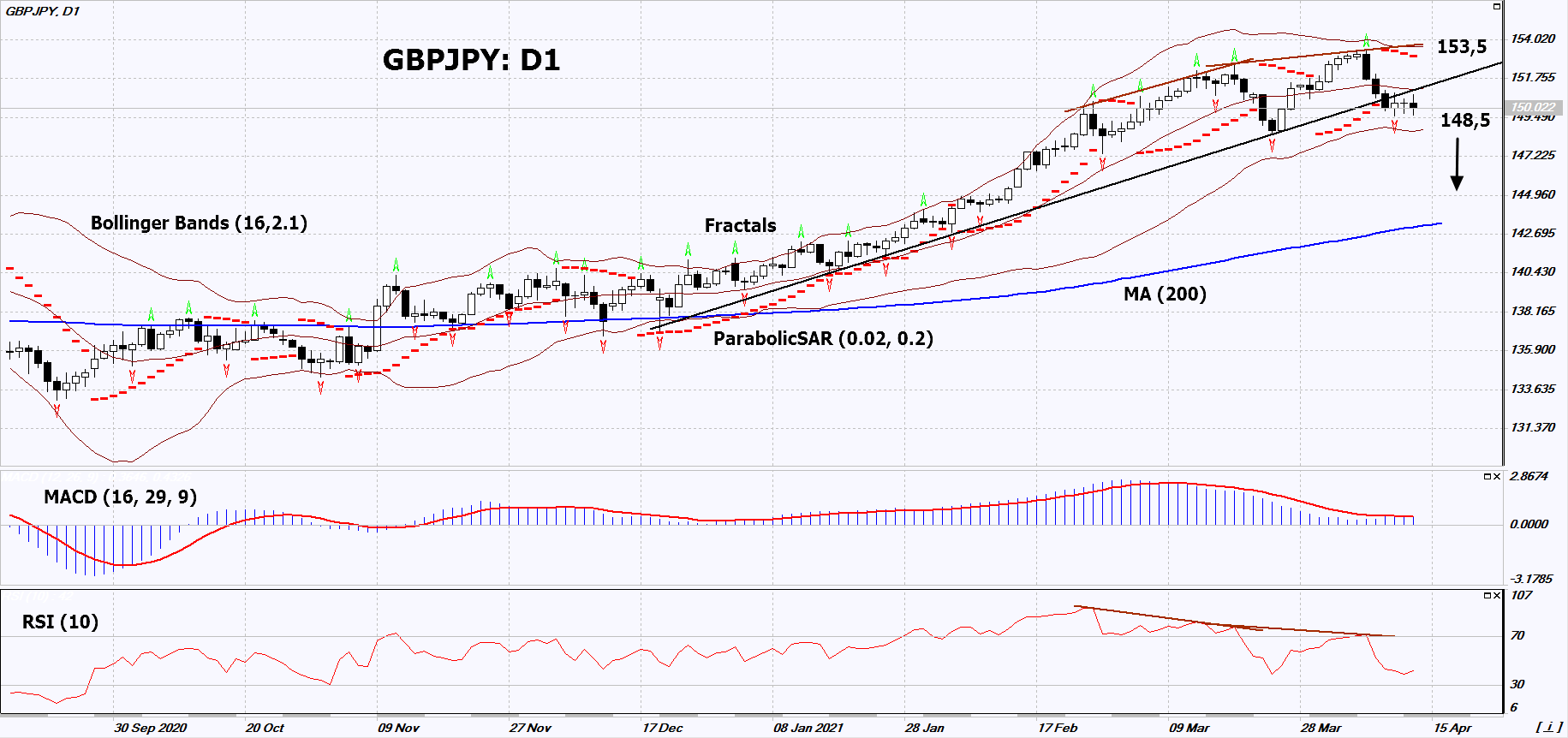

GBP/JPY Analisi Tecnica - GBP/JPY Trading: 2021-04-14

Sterlina Yen Giapponese Technical Analysis Summary

Sotto 148.5

Sell Stop

Sopra 153.5

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Neutro |

| MA(200) | Neutro |

| Fractals | Neutro |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutro |

Sterlina Yen Giapponese Chart Analysis

Sterlina Yen Giapponese Analisi Tecnica

On the daily timeframe, GBPJPY: D1 broke down the uptrend support line. A number of technical analysis indicators formed signals for a further drop. We do not exclude a bearish move if GBPJPY: D1 falls below the last 2 lower fractals and the lower Bollinger band: 148.5. This level can be used as an entry point. We can place a stop loss above the maximum since April 2018, the last high fractal, the upper Bollinger band and the Parabolic signal: 153.5. After opening a pending order, we can move the stop loss to the next fractal high following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (153.5) without activating the order (148.5), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Analisi Fondamentale Forex - Sterlina Yen Giapponese

British economy is recovering slowly. Will the GBPJPY quotes continue to fall?

The downward movement indicates the weakening of the British pound against the Japanese currency. British February economic data turned out to be worse than forecasts: trade balance (-16.4 billion pounds) and construction volumes (-4.3%). Industrial production (-3.5%) and manufacturing production (-4.2%) were better than projected, but they still declined in February, in annual terms. The information of the possible leave of Andrew Haldane, chief economist at the Bank of England (BoE), also negatively affected the pound. Previously, he advocated tightening the monetary policy of the British regulator. Note that on April 14, Jonathan Haskel, who is a member of the BoE Monetary Policy Committee, will make a speech. Also on April 14, Fed Chair Jerome Powell, as well as Haruhiko Kuroda, the head of the Bank of Japan, will deliver a speech. All this can affect the GBPJPY dynamics. UK Labour Productivity data for the 4th quarter will be published, too. The Japanese yen is strengthening for the second week in a row amis positive economic data and lower US Treasury bond yields. Japan's Machinery Orders data for February will be released on April 14: the outlook is positive. Previously, Machine Tool Orders for March showed impressive growth. In the previous week, several positive Japanese economic indicators were published at once, including the Eco Watchers Survey, consumer confidence index, current account balance, and others.

Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.