- Analisi

- Analisi Tecnica

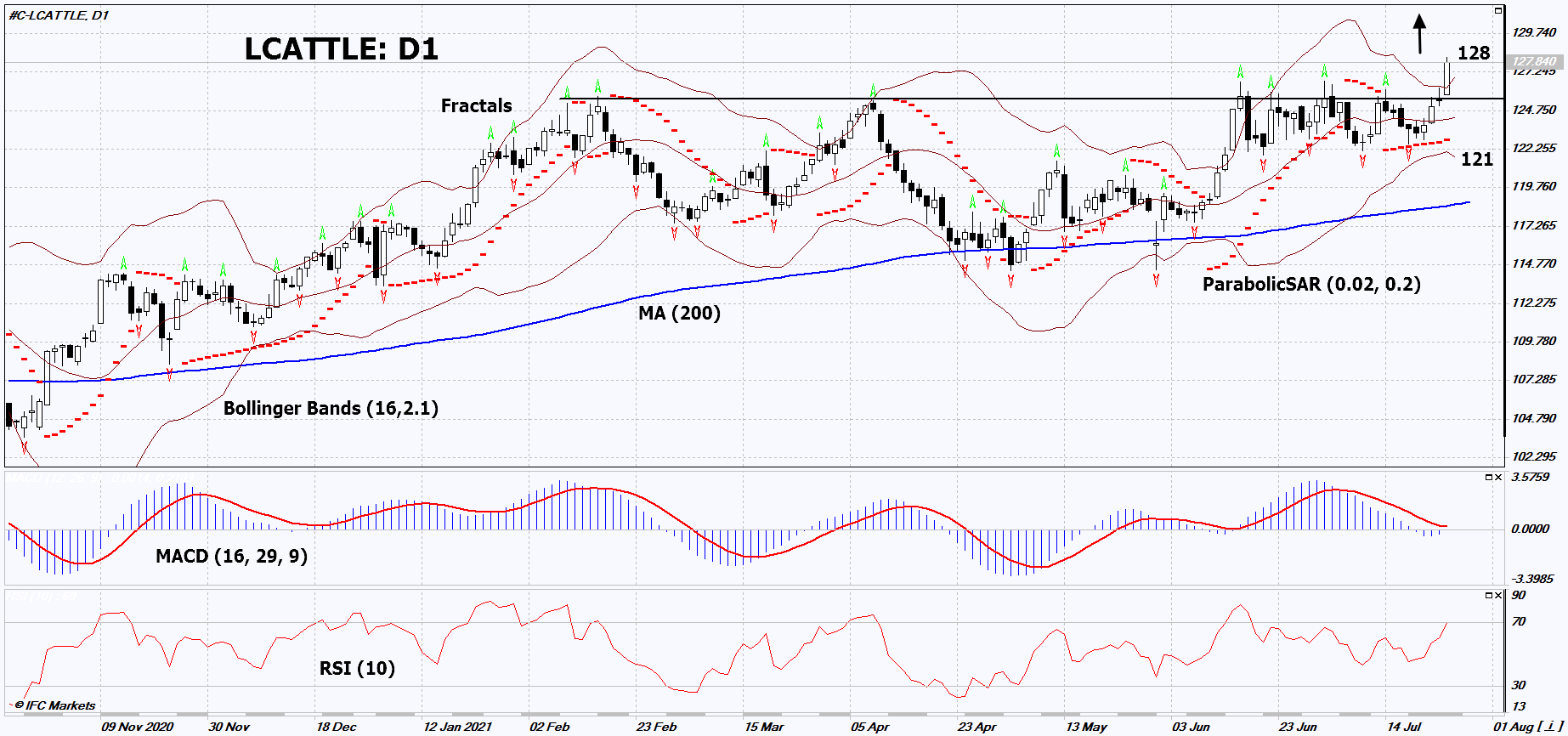

Bovino vivo Analisi Tecnica - Bovino vivo Trading: 2021-07-27

Bovino vivo Technical Analysis Summary

Sopra 128

Buy Stop

Sotto 121

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Sell |

| MA(200) | Neutro |

| Fractals | Buy |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

Bovino vivo Chart Analysis

Bovino vivo Analisi Tecnica

On the daily timeframe, LCATTLE: D1 went up from the neutral channel. A number of technical analysis indicators have generated signals for further growth. We do not rule out a bullish movement if LCATTLE: D1 rises above its last high: 128. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the last 4 lower fractals and the lower Bollinger line: 121. After opening a pending order, move the stop following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (121) without activating the order (128), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

Analisi Fondamentale Materie Prime - Bovino vivo

The United States Department of Agriculture (USDA) reported a decline in the number of cattle (cattle) in the United States. Will the growth of LCATTLE quotes continue?

According to USDA, the number of cattle in the American feedlots (Cattle and calves on feed) as of July 1, 2021 was 11.3 million, a 1.3% decrease compared to the number of livestock on July 1, 2020. In June of this year, 1.67 million head of cattle (Placements in feedlots) were placed on feedlots, which is 7% less than in June 2020. The total number of cattle in the United States on July 1, 2021 decreased to 101 million heads, compared with 102 million last year on the same date. A number of US states are now experiencing drought, which could have a negative impact on the cattle population. Another positive factor for Live cattle futures quotes may be a noticeable reduction in frozen beef stocks. According to the USDA, as of June 30, 2021, they amounted to 398.7 million pounds. This is 3.7% less than at the end of May this year and almost 7% less compared to 2020 on the same date.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.