- Analisi

- Analisi Tecnica

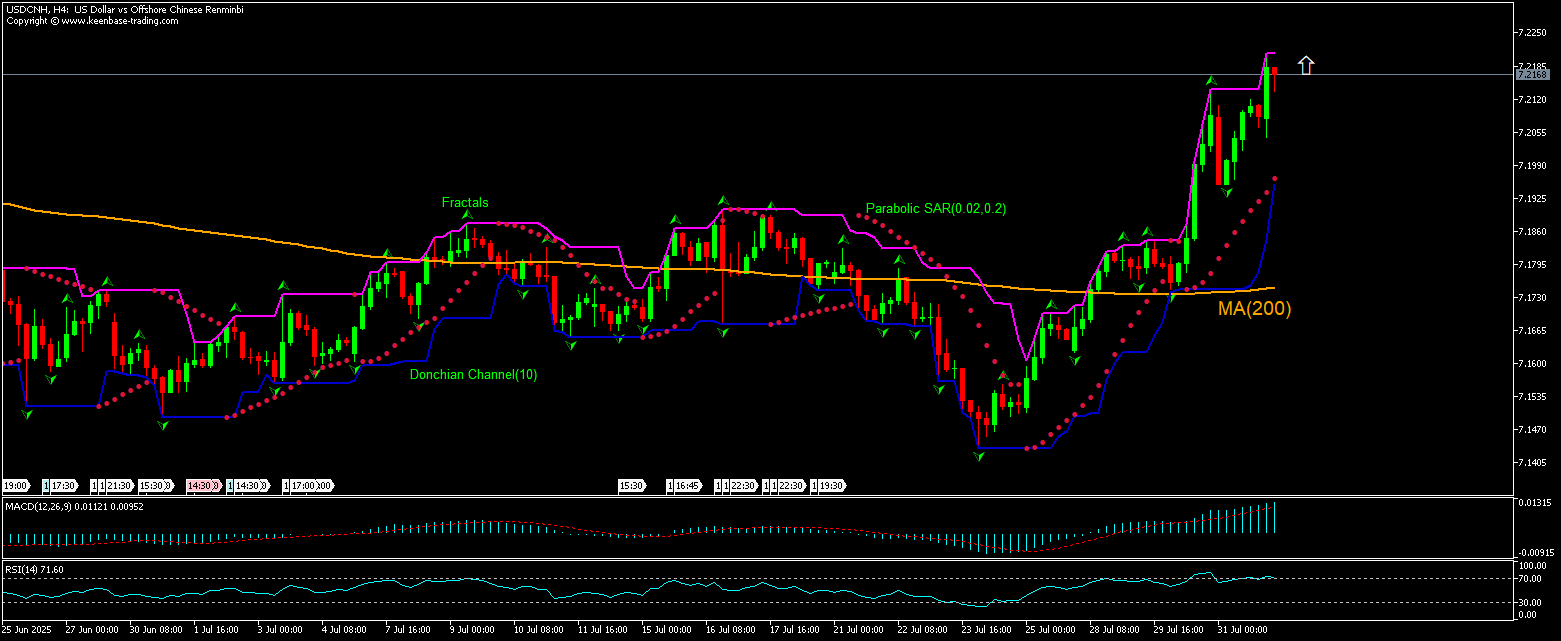

USD/CNH Analisi Tecnica - USD/CNH Trading: 2025-08-01

USD/CNH Technical Analysis Summary

Sopra 7.2221

Buy Stop

Sotto 7.2026

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Neutro |

| Fractals | Buy |

| Parabolic SAR | Buy |

USD/CNH Chart Analysis

USD/CNH Analisi Tecnica

The technical analysis of the USDCNH price chart on 4-hour timeframe shows USDCNH,H4 is advancing above the 200-period moving average MA(200) after returning above MA(200) following a retreat to 9-month low a week ago. RSI indicator is in overbought zone. We believe the bullish movement will continue after the price breaches above the upper bound of the Donchian channel at 7.2221. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 7.2026. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Forex - USD/CNH

China’s manufacturing sector activity declined in July. Will the USDCNH price rebounding persist?

China’s manufacturing sector unexpectedly shrank: the SP Global reported the Caixin Manufacturing PMI fell to 49.5 for July from 50.4 for June when a decline to 50.2 was forecast. Readings above 50.0 indicate industry expansion, below indicate contraction. Business activity in manufacturing sector contracted driven by a sharper decline in new export orders. It was the second month since October 2023 that output fell due to a slowdown in new orders growth. Employment declined and supplier performance continued to deteriorate due to shipment delays and supplier shortages. After falling over the previous two months, purchasing activity expanded despite a rise in input costs for the first time in five months driven by higher raw material prices. At the same time selling prices fell as market competition intensified. While this was the second contraction in factory activity in three months, business sentiment improved on hopes of better economic conditions and expectations that promotional efforts will help boost sales in the year ahead though overall optimism remained below the series average. Chinese manufacturing activity contraction is bearish for Chinese yuan and bullish for USDCNH pair.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.