- Analisi

- Analisi Tecnica

Gold Ruble Analisi Tecnica - Gold Ruble Trading: 2021-02-10

XAU RUB Technical Analysis Summary

Sotto 133600

Sell Stop

Sopra 142200

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Neutro |

| MA(200) | Neutro |

| Fractals | Neutro |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutro |

XAU RUB Chart Analysis

XAU RUB Analisi Tecnica

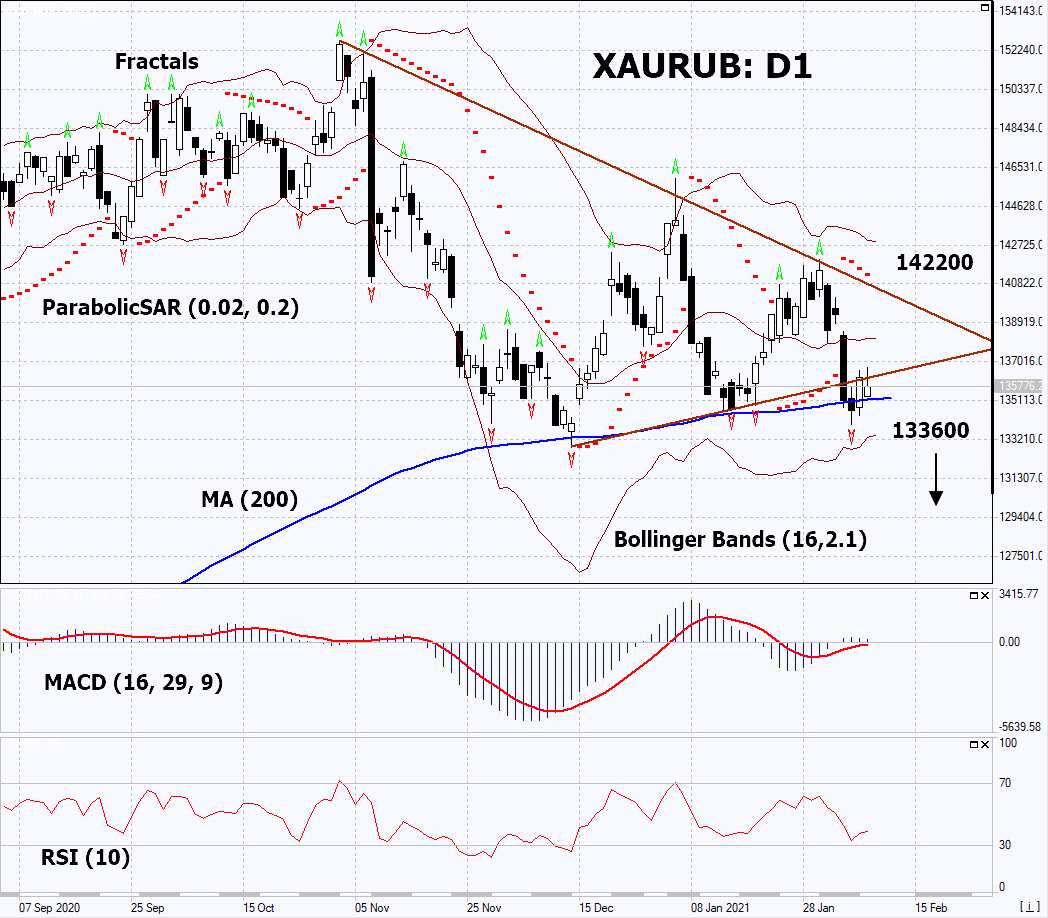

On the daily timeframe, XAURUB: D1 broke down the uptrend support line and went down from the triangle. A number of technical analysis indicators formed signals for a further drop, despite the fact that in the last 2 days there has been a slight increase and a return to the broken trend line. We do not rule out a bearish movement if XAURUB falls below its last lower fractal and 200-day moving average line: 133600. This level can be used as an entry point. We can place a stop loss above the last upper fractal and Parabolic signal: 142200. After opening a pending order, we can move the stop loss following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (142200) without activating the order (133600), it is recommended to delete the order: the market sustains internal changes that are usually not taken into account.

Analisi Fondamentale PCI - XAU RUB

In this review, we propose to consider the &XAURUB Personal Composite Instrument (PCI). It reflects the changes in the value of gold against the Russian ruble. Will the XAURUB quotes downgrade?

The downward tendency means a slump in gold prices denominated in Russian rubles. Precious metals prices may stabilize during the Chinese New Year. Chinese people will get 7 days off on February 11-17 this year. The gold dynamics may be affected by the US inflation data due out on February 10, and the speech of the Federal Reserve Chair Jerome Powell. The Russian ruble may grow amid rising world oil prices. Hydrocarbons account for about 70% of Russian exports. Against this background, Morgan Stanley Bank announced an increase in investments in the ruble. Other Western investors are likely to join it.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.