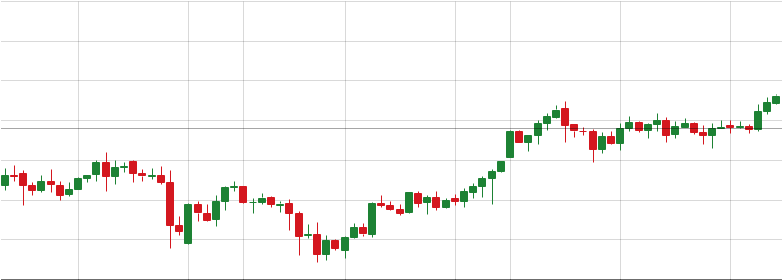

국제 유가 - WTI 가격

이 페이지에는 사용 가능한 8개의 시간대 중 하나를 선택하여 WTI 라이브 차트 및 차트의 역학을 포함하여 WTI에 대한 전체 정보가 포함되어 있습니다. 하단 패널에서 기간의 시작과 끝을 이동하면 해당 상품의 현재 및 과거 가격 움직임을 모두 볼 수 있습니다.

또한 차트의 왼쪽 상단 모서리에 있는 버튼을 통해 WTI 라이브 차트의 표시 유형(양초 또는 선 차트)을 선택할 수 있습니다. 아직 어떤 상품을 거래할지 결정하지 못한 모든 고객은 OIL의 전체 특성을 읽고 차트에서 그 성과를 보는 것이 최종 결정을 내리는 데 도움이 될 것이므로 올바른 위치에 있습니다.

IFC Markets에서 제공하는 상품 유형에 대한 필터가 있기 때문에 모든 상품을 쉽게 찾을 수 있으며 유형을 선택하면 해당 필터 바로 옆에서 모든 상품 목록을 볼 수 있습니다.

유가 - 원유 가격

- 1분

- 5분

- 15분

- 30분

- 1시간

- 4시간

- 1일

- 1주

FAQs

What is the current price of Oil?

As of Mar 9, the current price of oil is 98.6000.

Why Trade Oil?

Main reasons to trade oil, is price fluidity. Crude oil can be refined into a variety of forms such as petroleum naphtha, gasoline, diesel fuel, asphalt base, heating oil, kerosene, liquefied petroleum gas, jet fuel and fuel oils, which expand the market pool and increase demand. Trading can be done either by speculating on its market price, or exchanging the physical commodity.

How to Trade Oil?

Oil can be traded several ways:

- Long-term contracts between oil producer and consumer

- Through Futures

- On OTC market

Each method has specific goal. To learn which method is the right one for you, follow the link see the article “How to Trade Oil”.

What are the Biggest oil Companies?

1. China Petroleum & Chemical Corp. (SNP) - Revenue (TTM): $355.8 billion

2. PetroChina Co. Ltd. (PTR) - Revenue (TTM): $320.0 billion

3. Saudi Arabian Oil Co. (Saudi Aramco) (Tadawul: 2222) - Revenue (TTM): $286.9 billion

4. Royal Dutch Shell PLC (RDS.A) - Revenue (TTM): $263.1 billion

5. BP PLC (BP) - Revenue (TTM): $230.7 billion

6. Exxon Mobil Corp. (XOM) - Revenue (TTM): $213.9 billion

7. Total SE (TOT) - Revenue (TTM): $146.1 billion

8. Chevron Corp. (CVX) - Revenue (TTM): $115.0 billion

9. Marathon Petroleum Corp. (MPC) - Revenue (TTM): $102.4 billion

10. PJSC Lukoil (LUKOY) - Revenue $99.1 billion

What is Brent Oil?

Brent crude oil is one of the most popular oil benchmarks in the world, it’s recovered from the North Sea. Brent makes such a good benchmark because it is easy to refine into products such as diesel, gasoline, petrol, and other end products, which are in a great and consistent demand.

What is WTI Oil?

West Texas Intermediate (WTI) is a light, sweet crude oil (petroleum with less than 0.5% sulfur is called sweet) considered one of the main global oil benchmarks, along with Brent oil. WTI is a blend of several oils drilled and processed in the United States, primarily serves as a benchmark for the US oil market.

기술적 분석

기술적 분석은 가격 기록을 기반으로 시장 역학을 연구하고 평가하는 방법입니다. 주요 목적은 기술 분석 도구를 통해 향후 금융 상품의 가격 역학을 예측하는 것입니다. 기술 분석가는 이 시장 분석 방법을 사용하여 다양한 통화 및 통화 쌍의 가격을 예측합니다. 이러한 유형의 분석을 통해 거래 상품의 과거 가격 연구를 기반으로 시장 예측을 할 수 있습니다.

또한 OIL 달러: OIL 예측의 가격 역학에 대한 최신 기술적 분석을 참조하십시오.

WTI유 News