- 분석

- 시장 개요

Democrats win US Senate elections in Georgia - 7.1.2021

오늘의 마켓 개요

일간 인기 뉴스

Democrats won the US Senate elections in Georgia. They will now control the entire Senate. US President Joe Biden will be able to implement his reforms faster. Investors now hopethat increased economic stimulus will outweigh the negative effects of higher corporate taxes. This supports the growth of stock indices. Gold is falling in price amid increasing yields on US government bonds. Oil is rising in price today for the third day in a row thanks to a combination of positive factors.

Forex 뉴스

The US dollar index went down on Wednesday, but started to rise slightly this morning. The index is currently being traded below the significant level of 90 points. Two Democratic candidates won the Georgia Senate election yesterday. Now it will be much easier for the new US president Joe Biden (also a Democrat representative) to implement his reforms after taking office on January 20. However, investors' views have now changed, and they now believe that the US democratic authorities will, in any case, increase foreign debt to stimulate the US economy. This may turn out to be a negative factor for the dollar rate, but it may raise US government bond yields and support stock prices. The Democrats' planned increase in corporate taxes was put on a back burner. So far, the protests by the former US President Donald Trump's supporters in Washington have not had any impact on the financial markets. Today the US will publish data on unemployment for the week and trade balance for November. Three directors of Fed regional offices are also expected to speak. The forecasts are moderately negative. The EU will publish inflation for December.

주식 마켓 뉴스

| ASX 200 Index | --- | --- | --- |

| Dow Jones Index | --- | --- | --- |

| GB 100 Index | --- | --- | --- |

| Nasdaq Index | --- | --- | --- |

| Nikkei Index | --- | --- | --- |

| S&P 500 Index | --- | --- | --- |

On Tuesday, the Dow Jones and S&P 500 stock indexes rallied for the second day in a row, while the Nasdaq dropped slightly. Investors decided that the Democrats' victory in the US Senate elections in Georgia was still positive for the stock market. They hope that the increase in economic stimulus will outweigh the negative impact of higher corporate taxes. Yesterday's US economic statistics were neutral. Industrial orders rose and business activity in the services sector (Markit Services PMI) declined. Labor market figures from the independent agency ADP were unexpectedly much worse than the preliminary forecasts. Investors ignored them in anticipation of the publication of the official Non-Farm Payrolls report tomorrow, January 8. This morning, there has been a steady increase in futures on US stock indices. European exchanges are also experiencing price gains. FTSE 100 (+3.5%) is leading the growth. It has grown by 6% since the beginning of 2021, thanks to the successful Brexit.

상품 마켓 뉴스

World oil prices are rising today for the third day in a row. This is facilitated by the worsening of tensions in the Persian Gulf, the reduction in Saudi Arabian oil production and thus of the OPEC+ production in total. In addition, according to the US Energy Information Administration, oil reserves in the United States fell by 8 million barrels over the week. This is much more than expected. Another negative factor was the Democrats' victory in the Senate. Investors fear that the fiscal policy of new President Joe Biden will lead to a reduction in US oil production.

금 마켓 뉴스

| 금 | --- | --- | --- |

Gold quotes dropped markedly on Wednesday. Investors are ignoring both the political risks caused by the protests of Donald Trump's supporters and the increase in the number of coronavirus cases worldwide. Precious metals are falling in price amid rising US government bond yields. Thus, the yield on 10-year issues reached its maximum since March of this year at 1.06% per annum (gold then cost about $ 1640 per ounce).

암호화

| Bitcoin/USD | --- | --- | --- |

| Ethereum / USD | --- | --- | --- |

INSTRUMENT_TRADING_NEWS

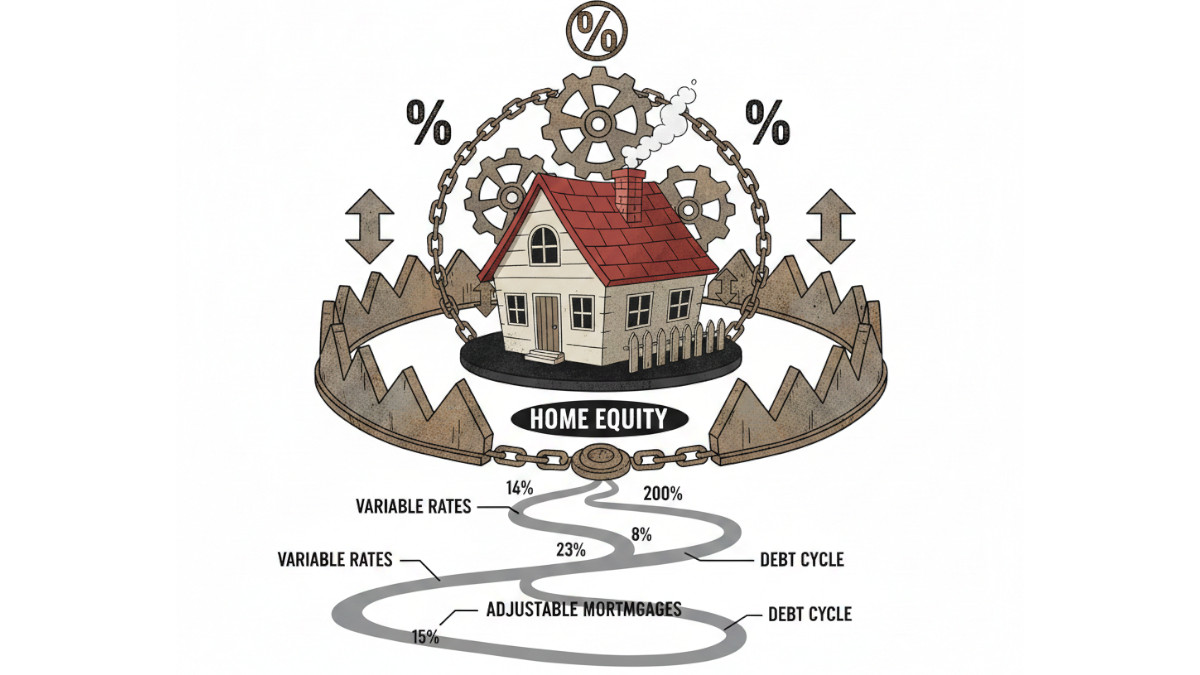

The 2026 Rate Trap

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account