- 분석

- 기술적 분석

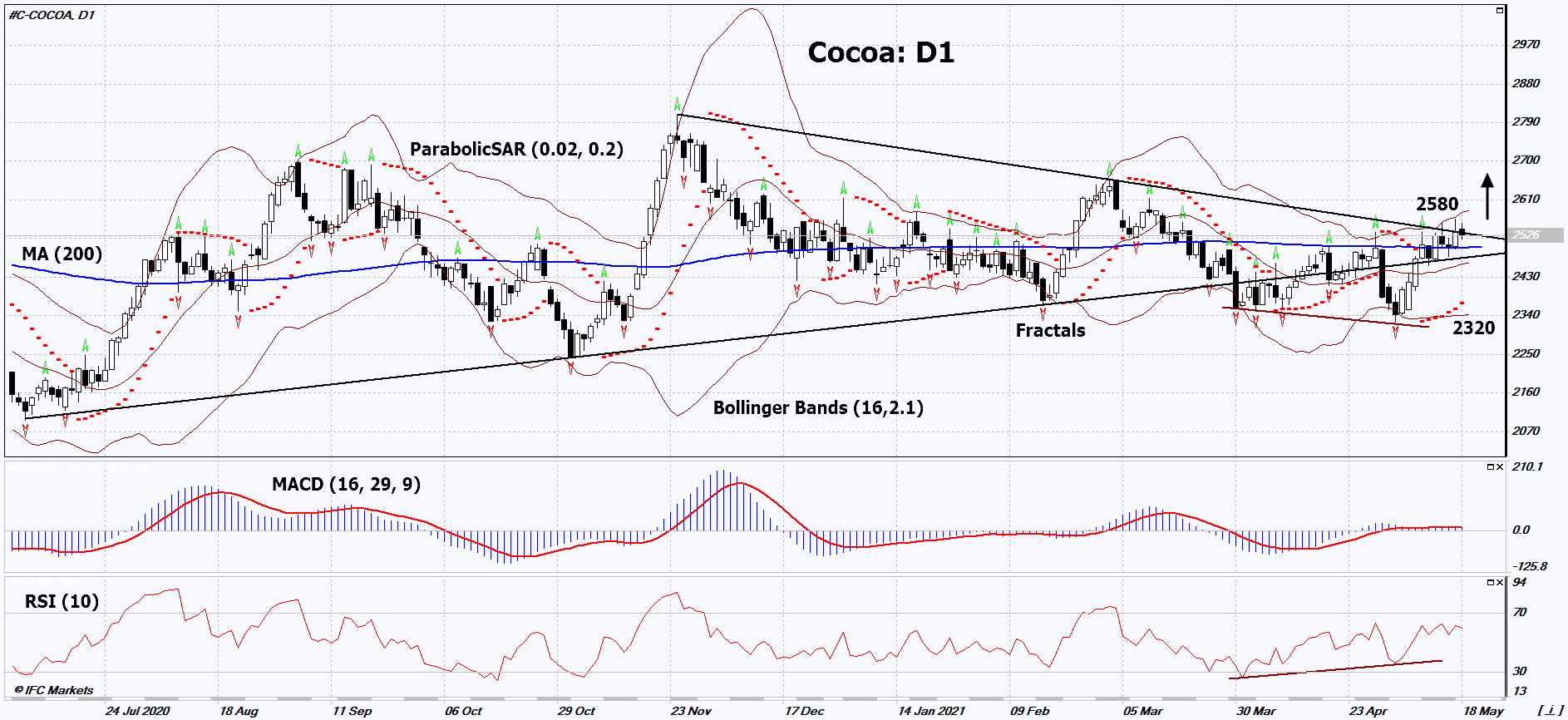

코코아 기술적 분석 - 코코아 거래: 2021-05-19

코코아 기술적 분석 요약

위에 2580

Buy Stop

아래에 2320

Stop Loss

| 인디케이터 | 신호 |

| RSI | 구매 |

| MACD | 중립적 |

| MA(200) | 구매 |

| Fractals | 구매 |

| Parabolic SAR | 구매 |

| Bollinger Bands | 중립적 |

코코아 차트 분석

코코아 기술적 분석

On the daily timeframe, Cocoa: D1 went up from the downtrend and moved into the previous uptrend. A number of technical analysis indicators have formed signals for further increase. We do not rule out a bullish movement if Cocoa rises above the last maximum and upper Bollinger band: 2580. This level can be used as an entry point. The initial risk limitation is possible below the Parabolic signal, the last lower fractal, the lower Bollinger band and the 200-day moving average line: 2320. After opening a pending order, we can move the stop-loss following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit / loss ratio in our favor. After the transaction, the most cautious traders can switch to the four-hour chart and set a stop-loss, moving it in the direction of the trend. If the price overcomes the stop-loss (2320) without activating the order (2580), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

귀금속 - 코코아 기본 분석

Cocoa production in Côte d'Ivoire may decline due to the lack of electricity. Will the Cocoa quotes rise?

State electricity supplier Compagnie Ivoirienne d'Electricite has reported cutting electricity supplies in Côte d'Ivoire to 12 hours every 2 days for the next two months. This can reduce the processing, transportation and grinding of the cocoa beans. The main reason for this decision was the drought in West Africa and the reduction of hydropower resources at six hydroelectric power stations owned by the company. So far, there have been no reports from farmers that drought could damage the cocoa crop in Côte d'Ivoire. If such information nevertheless appears, then this may provoke an increase in quotations, since this country grows about a third of the world's cocoa beans. The share of all of West Africa in world cocoa production exceeds 70%. In addition, there are many net-short open positions of cocoa on the London Stock Exchange. Their volume is now at its maximum in 9 months. If these exchange positions close, the quotes may have an upward impulse. In addition, the National Confectioners Association of Cocoa Bean Processors notes a recovery in chocolate demand. At the end of the Q1 of 2021, beans processing in North America increased by 2%, and in Asia - by 3.1%.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.