- Analítica

- Disposição do mercado

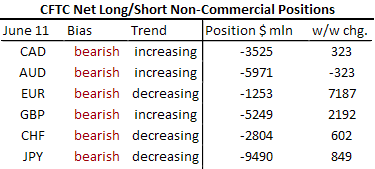

CFTC report from June 14 covered information available on June 11

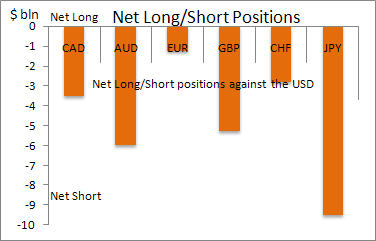

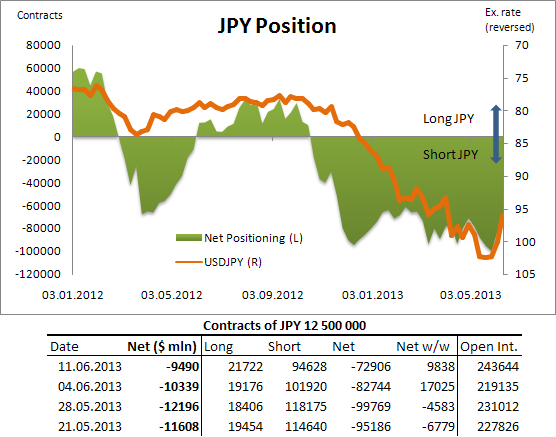

By the Commodity Futures Trading Commission (CFTC) report, all the major currencies keep speculative net short position vs. the US dollar. The largest net short position still belongs the Japanese yen. The Australian dollar got to second place, followed by the British pound, the Canadian dollar, the Swiss franc and the euro.

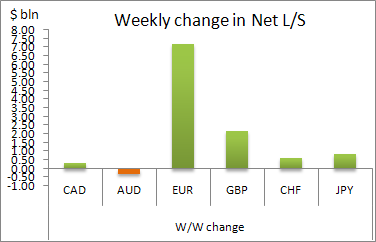

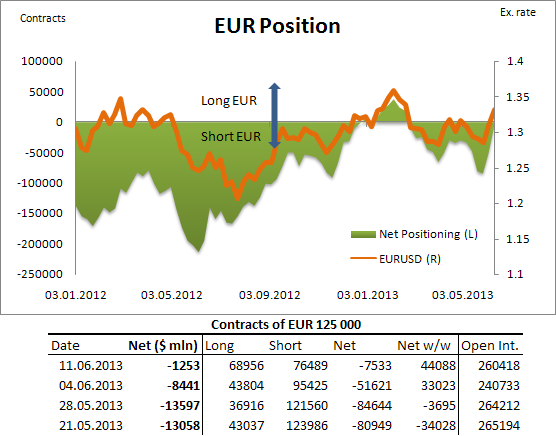

According to the last week results there were significant changes observed in the positioning on the European currency, as well as the British pound. Thus, the euro got significantly closer to a balance with long and short positions, increasing fracture in risk sentiment.

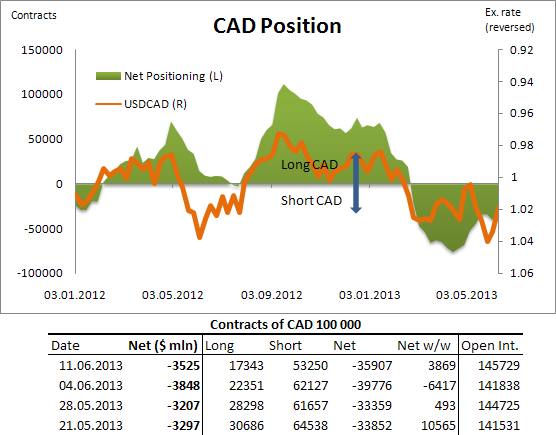

Net short position on the Canadian dollar fell by 0.3 billion USD to -3.5 billion USD. The sentiment remains bearish, and the Canadian dollar is the fourth currency having the largest net short position among the major currencies

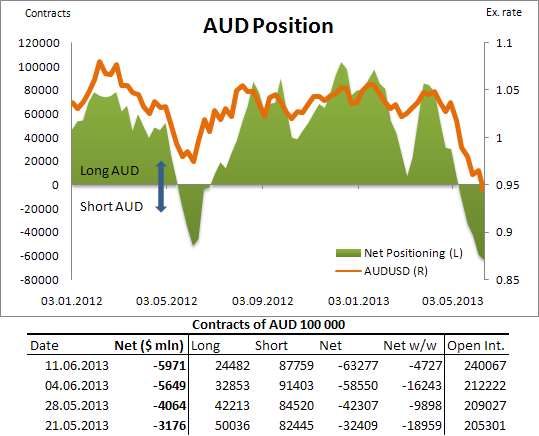

The Australian dollar was the only currency having the net short position that has grown last week, reflecting the more and more negative sentiment. Last week, the position volume of the was -5.9 billion USD, while it recorded the twelfth consecutive negative change in positioning. The Australian dollar moved on to the second place by the largest net short position being behind only the Japanese yen.

The European currency surprised for the second time in a row: the net short position is rapidly declining by 7.2 billion USD. Euro takes the last place in the 6-majors largest net short position ranking, reflecting the least negative sentiment – that is the signal to those who are thinking about strategic currency selling.

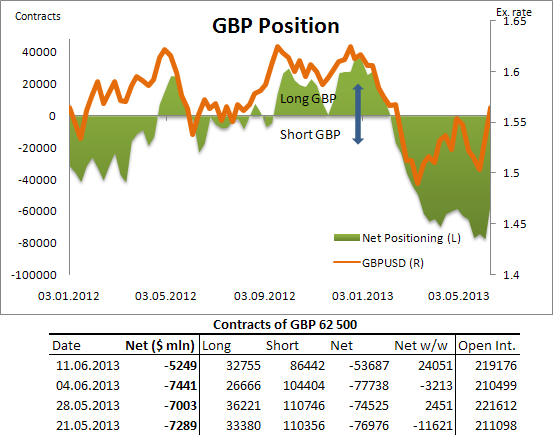

The net on the British pound fell by 2.2 billion USD to -5.2 billion USD. Dominated by The bearish sentiment is dominating.

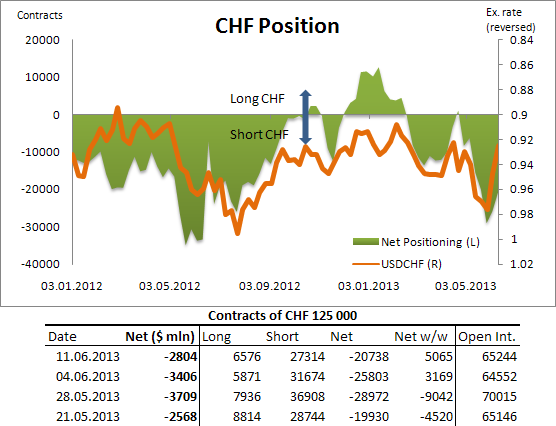

The net short position on the Swiss franc fell by 0.6 billion USD, reaching -2.8 billion USD. The sentiment is bearish.

Yen holds the leadership by the largest net short position against the U.S. dollar, despite its decline last week by 0.8 billion USD to -9.5 billion USD. In principle, we are already used to seeing the consolidation in positioning around the mark at -10 billion. The sentiment remains bearish.

Nova ferramenta analítica exclusiva

Qualquer período- de 1 dia a 1 ano

Todos os grupos- Forex, Ações, Índices, etc.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.

Ultimas previsões

- 18mar2021Líderes de Crescimento e Queda: dólar canadense e iene japonês

Nos últimos 7 dias, os preços do petróleo, dos metais não ferrosos e outras matérias-primas minerais, embora tenham descido, mesmo assim, se mantiveram em um nível elevado. Graças a isso, houve um fortalecimento das moedas dos países de commodities: o dólar canadense, os dólares australiano...

- 10mar2021Líderes de Crescimento e Queda: Dólar canadense e dólar neozelandês

Nos últimos 7 dias, os preços do petróleo continuaram subindo. Devido a isso, houve um fortalecimento das moedas dos países produtores de petróleo: o rublo russo e o dólar canadense. O dólar da Nova Zelândia enfraqueceu após a publicação de indicadores econômicos negativos: ANZ Business Confidence...

- 4mar2021Líderes de Crescimento e Queda: Dólar americano e rand sul-africano

Nos últimos 7 dias, os preços do petróleo continuaram crescendo. Os metais preciosos, incluindo ouro, caíram de preço. Neste contexto, se verificou o aumento das ações petrolíferas, o fortalecimento do rublo russo e o enfraquecimento dos dólares australiano e neozelandês, bem como do rand sul-africano....