- Analytik

- Technische Analyse

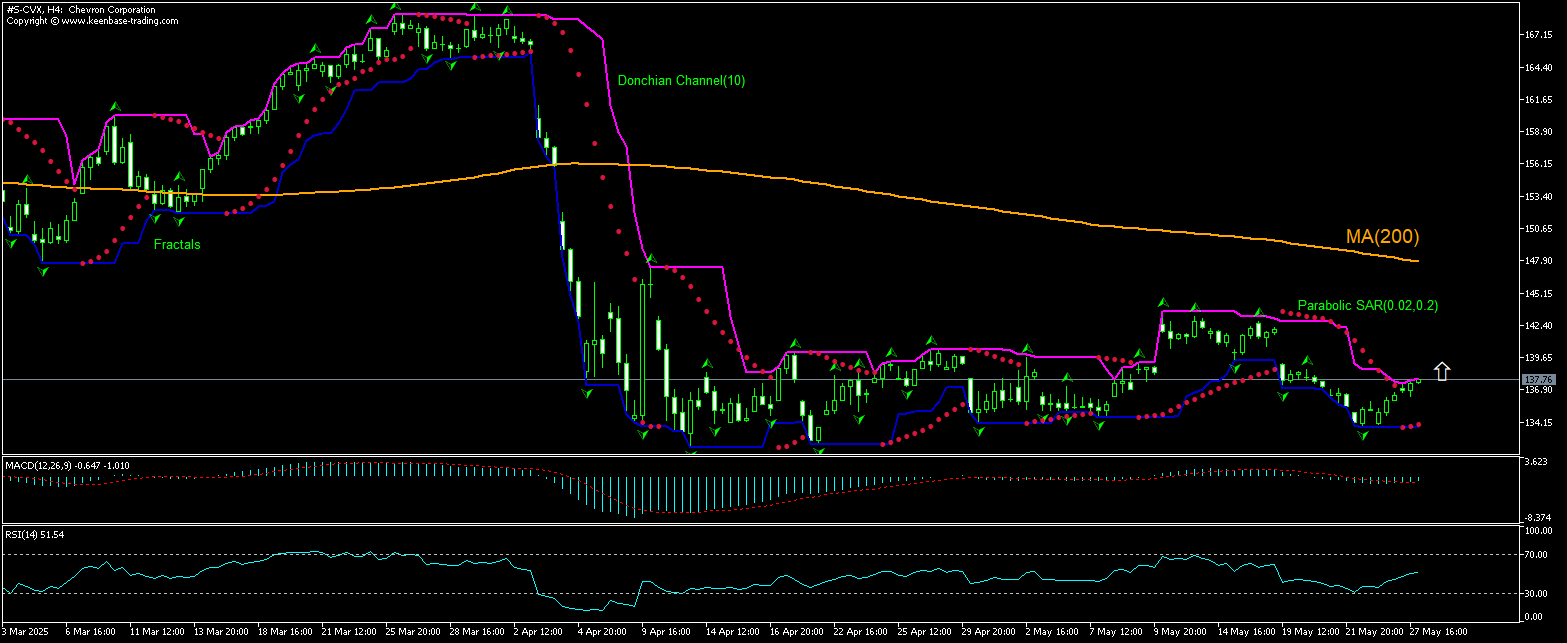

Chevron Technische Analyse - Chevron Handel: 2025-05-28

Chevron Technical Analysis Summary

Above 137.71

Buy Stop

Below 133.91

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Buy |

Chevron Chart Analysis

Chevron Technische Analyse

The technical analysis of the Chevron Corporation stock price chart on 4-hour timeframe shows #S-CVX,H4 is rebounding toward the 200-period moving average MA(200) following a retreat from four-week high two weeks ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 137.71. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 133.91. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (133.91) without reaching the order (137.71), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamentale Analyse Aktien - Chevron

Chevron Corporation stock rose yesterday ahead of news the company is expected to receive a license to keep oil assets in Venezuela. Will the Chevron Corporation price advancing persist?

Chevron Corporation is an American energy company engaged in the hydrocarbon exploration and petrochemical manufacturing. Company’s market capitalization is $238.75 billion. Chevron Corporation’s stock trades at price-to-earnings (P/E) ratio of 15.61 for trailing twelve months (ttm), Forward P/E of 15.70 and Price/Sales ratio (ttm) of 1.28. Over the past 12 months, it has generated revenue of $195.11 billion, Return on Assets (ttm) of 5.23% and Return on Equity (ttm) of 10.08%. There were reports yesterday the US government is preparing to grant Chevron a limited license to keep its oil-producing assets in Venezuela. While the license would enable Chevron to maintain key infrastructure in Venezuela, it would prevent the company from exporting oil from the country. The purpose of the US ban to expand Chevron activities or export oil is to continue preventing any possible payments to President Nicolas Maduro's administration. The aim of the license is ensuring the company can promptly resume operations if relations between the two nations improve while reducing the risk of Venezuela seizing Chevron’s assets.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.