- Analytik

- Technische Analyse

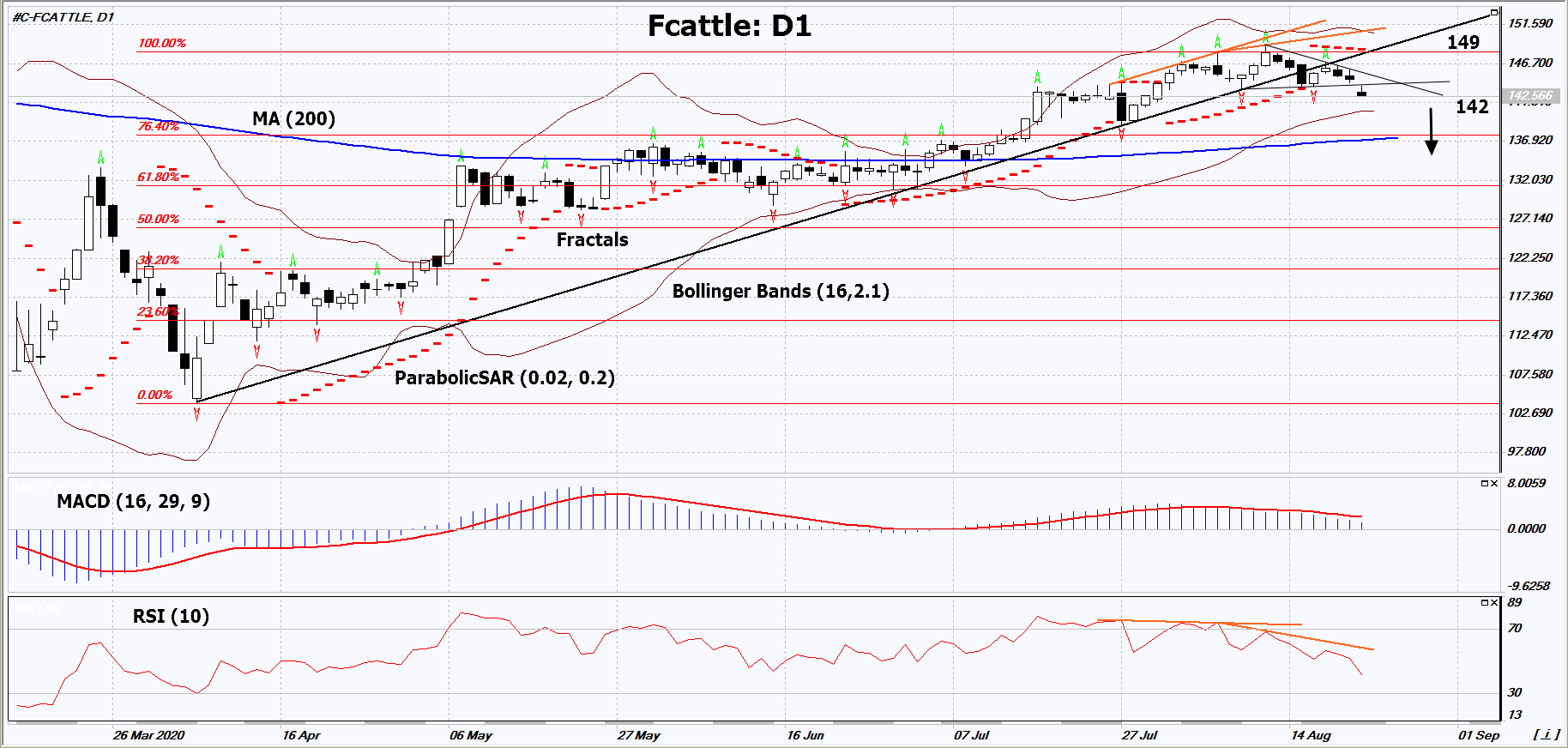

Mastrind Technische Analyse - Mastrind Handel: 2020-08-25

Mastrind Technical Analysis Summary

Below 142

Sell Stop

Above 149

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Sell |

| MA(200) | Neutral |

| Fractals | Sell |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutral |

Mastrind Chart Analysis

Mastrind Technische Analyse

On the daily timeframe, Fcattle: D1 is correcting down from its 10-month high. It got out of the growing trend. A number of technical analysis indicators generated signals for further decline. We do not rule out a bearish move if Fcattle falls below its last minimum: 142. This level can be used as an entry point. We can set a stop loss above the last upper fractal and Parabolic signal: 149. After opening a pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss (149) without activating the order (142), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Fundamentale Analyse Rohstoffe - Mastrind

The United States Department of Agriculture (USDA) published its monthly Cattle on Feed report. Will Fcattle quotations go down?

The USDA report notes that the number of cattle placed in feedlots during July 2020 increased by 11% compared to July 2019 and reached 1.89 million. At the same time, the total livestock, which on August 1, 2020, was in feedlots, increased by 1% compared to last year and amounted to 11.3 million heads. This is the highest amount since the USDA started publishing statistics in 1996. It can be assumed that the American beef supply has practically recovered after the quarantine due to the coronavirus. At the same time, according to the USDA, since the beginning of 2020, the cattle slaughter is 1.06 million less than last year as of the current date. In theory, this may indicate that demand has not fully recovered yet.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.