- Analisi

- Analisi Tecnica

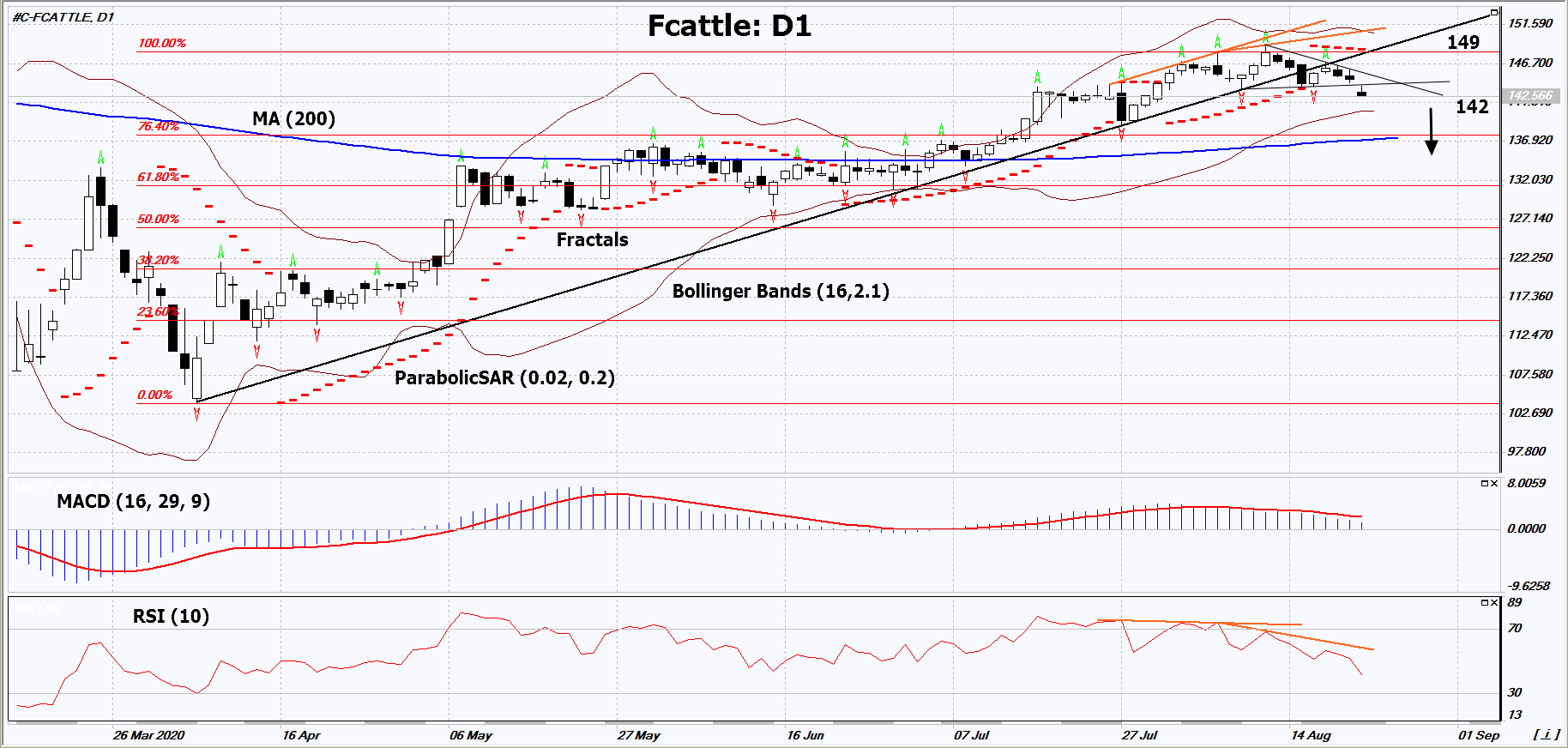

Bovini giovani Analisi Tecnica - Bovini giovani Trading: 2020-08-25

Bovini giovani Technical Analysis Summary

Sotto 142

Sell Stop

Sopra 149

Stop Loss

| Indicator | Signal |

| RSI | Sell |

| MACD | Sell |

| MA(200) | Neutro |

| Fractals | Sell |

| Parabolic SAR | Sell |

| Bollinger Bands | Neutro |

Bovini giovani Chart Analysis

Bovini giovani Analisi Tecnica

On the daily timeframe, Fcattle: D1 is correcting down from its 10-month high. It got out of the growing trend. A number of technical analysis indicators generated signals for further decline. We do not rule out a bearish move if Fcattle falls below its last minimum: 142. This level can be used as an entry point. We can set a stop loss above the last upper fractal and Parabolic signal: 149. After opening a pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal maximum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss (149) without activating the order (142), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Analisi Fondamentale Materie Prime - Bovini giovani

The United States Department of Agriculture (USDA) published its monthly Cattle on Feed report. Will Fcattle quotations go down?

The USDA report notes that the number of cattle placed in feedlots during July 2020 increased by 11% compared to July 2019 and reached 1.89 million. At the same time, the total livestock, which on August 1, 2020, was in feedlots, increased by 1% compared to last year and amounted to 11.3 million heads. This is the highest amount since the USDA started publishing statistics in 1996. It can be assumed that the American beef supply has practically recovered after the quarantine due to the coronavirus. At the same time, according to the USDA, since the beginning of 2020, the cattle slaughter is 1.06 million less than last year as of the current date. In theory, this may indicate that demand has not fully recovered yet.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.