- Analytik

- Technische Analyse

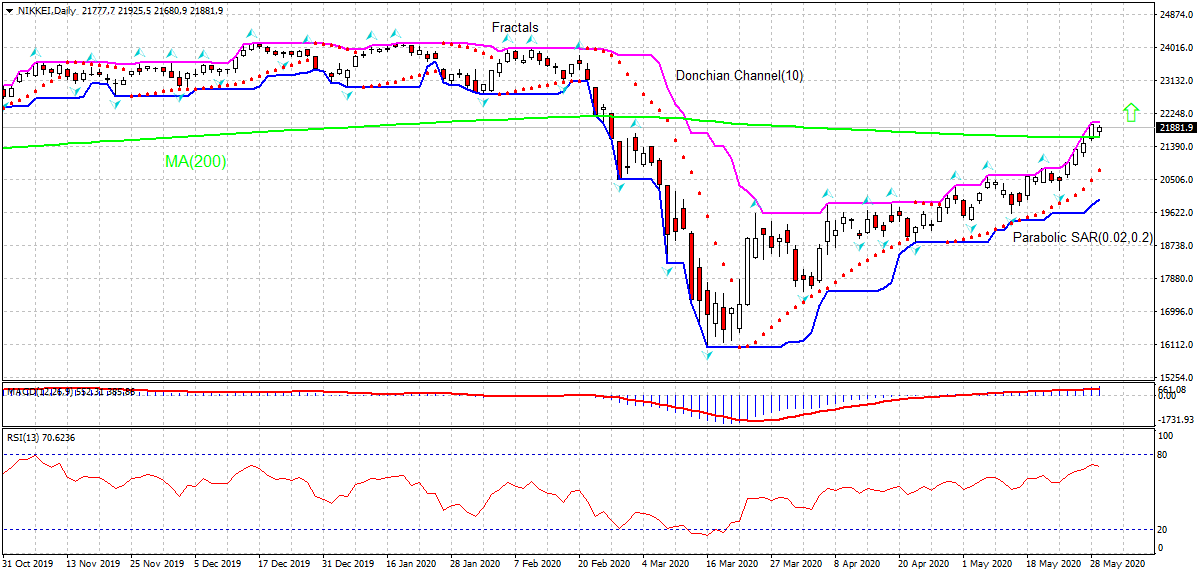

Japanischer Aktienindex Technische Analyse - Japanischer Aktienindex Handel: 2020-05-29

Nikkei (225), Aktienmarktindex Technical Analysis Summary

Above 22005.50

Buy Stop

Below 19969.20

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Nikkei (225), Aktienmarktindex Chart Analysis

Nikkei (225), Aktienmarktindex Technische Analyse

On the daily timeframe the Nikkei: D1 has closed above the 200-day moving average MA(200) after hitting 37-month low in mid-March. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 22005.50. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 19969.20. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (19969.20) without reaching the order (22005.50), we recommend cancelling the order: the market has undergone internal changes which were not taken into account

Fundamentale Analyse Indexe - Nikkei (225), Aktienmarktindex

Japan’s government adopted fourth stimulus package in three months. Will the Nikkei rebound continue?

Japanese economic data of the last couple of weeks were mixed. Machinery orders declined less than forecast in March, while trade deficit narrowed in April. On the other hand, drops in both industrial production and retail sales were bigger than forecast in April. Thus , machinery orders declined 0.7% over year in March after 2.4% fall in February when a 9.5% drop was forecast. Trade deficit narrowed to 930 billion yen after 5.4 billion deficit in March. Industrial production fell 9.1% over year in April after 3.7% decline in March, when 5.1% fall was expected. And retail sales dropped 13.7% over year after 4.7% decline in March when 11.5% drop was expected. Weak data are downside risk for Nikkei. At the same time Japanese government announced fourth aid package to combat coronavirus damage. The $1.1 trillion stimulus package was announced on Wednesday May 27. It includes rent subsidies for individuals as well as small and medium sized businesses; a one-time $1,860 payment to each front-line medical worker and increased subsidies to businesses hit by the pandemic. The stimulus measures boosting government spending and subsidies are bullish for Nikkei.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.