- Análisis

- Análisis Técnico

EUR/USD Análisis Técnico - EUR/USD Trading: 2021-06-17

EUR/USD Resumen de análisis técnico

Por debajo de 1.1989

Sell Stop

Por encima de 1.2217

Stop Loss

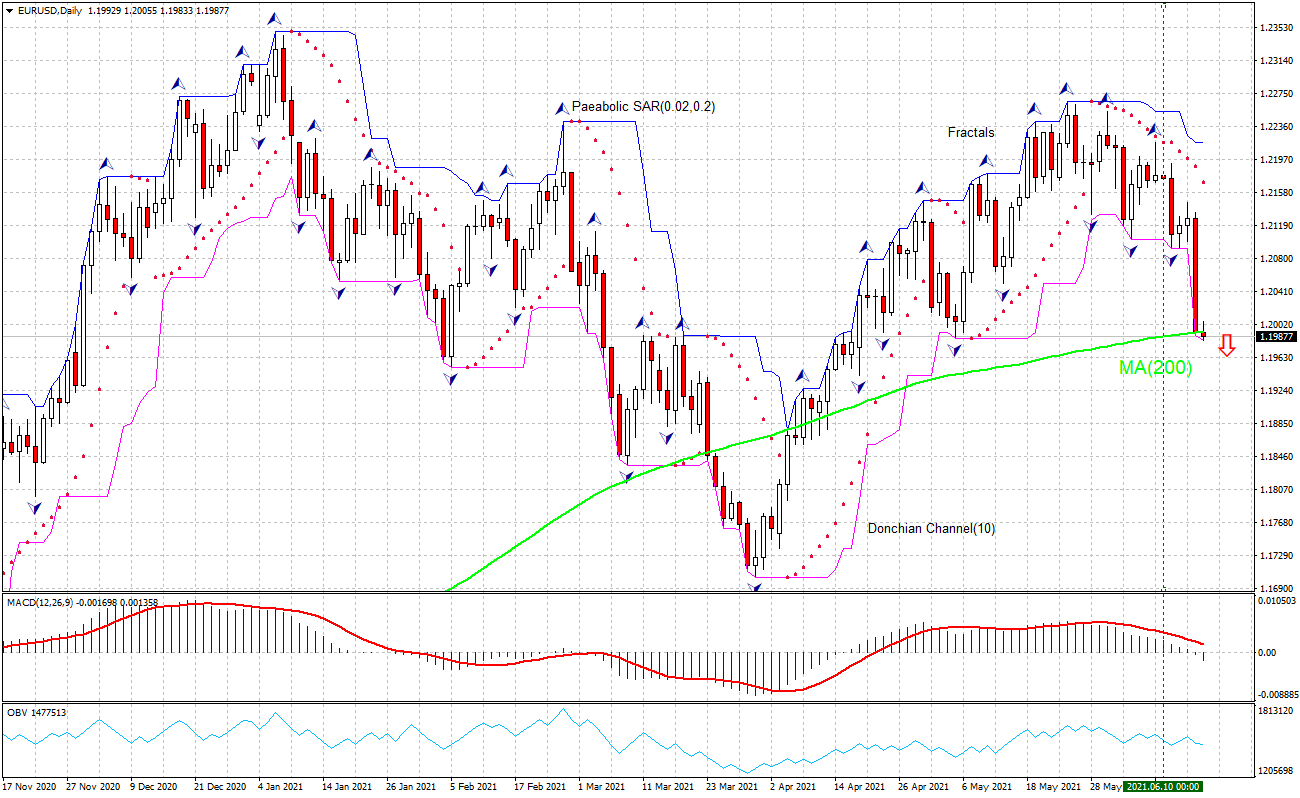

| Indicador | Señal |

| MACD | Vender |

| Donchian Channel | Vender |

| MA(200) | Vender |

| Fractals | Vender |

| Parabolic SAR | Vender |

| On Balance Volume | Neutral |

EUR/USD Análisis gráfico

EUR/USD Análisis técnico

The EURUSD technical analysis of the price chart on daily timeframe shows EURUSD: D1 has fallen below the 200-period moving average MA(200) which is rising still. We believe the bearish movement will continue after the price breaches below the lower bound of the Donchian channel at 1.1989. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 1.2217. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Análisis fundamental de Forex - EUR/USD

Fed signaled higher rates in 2023 and start of bond buying taper talks yesterday while the ECB held steady with no tapering talk a week ago. Will the EURUSD retreat continue?

Federal Reserve edged a bit closer to tightening monetary policy at its June 15-16 meeting. US central bank raised its inflation and growth forecast and released projections that showed a majority of Fed officials expect interest rate hikes in 2023. Fed officials on Wednesday penciled in two potential rate hikes in 2023 according to the new Fed ‘dot plot’, sooner than policymakers had previously projected. The Fed also signaled it would now be considering whether to taper its asset purchases meeting by meeting. This is bullish for Dollar. In contrast, the European Central Bank left the policy stance unchanged at its June 10 meeting while stating that bond purchases will “continue to be conducted at a significantly higher pace than during the first months of the year”. Tapering was postponed and the current speed of purchases could be maintained until the bond purchasing program regularly ends in March 2022.This is bearish for EURUSD.

Explore nuestras

Condiciones de Trading

- Spreads desde 0.0 pip

- 30,000+ Instrumentos de Trading

- Nivel de Stop Out - Solo 10%

¿Listo para Operar?

Abrir Cuenta Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.