- Analytics

- Technical Analysis

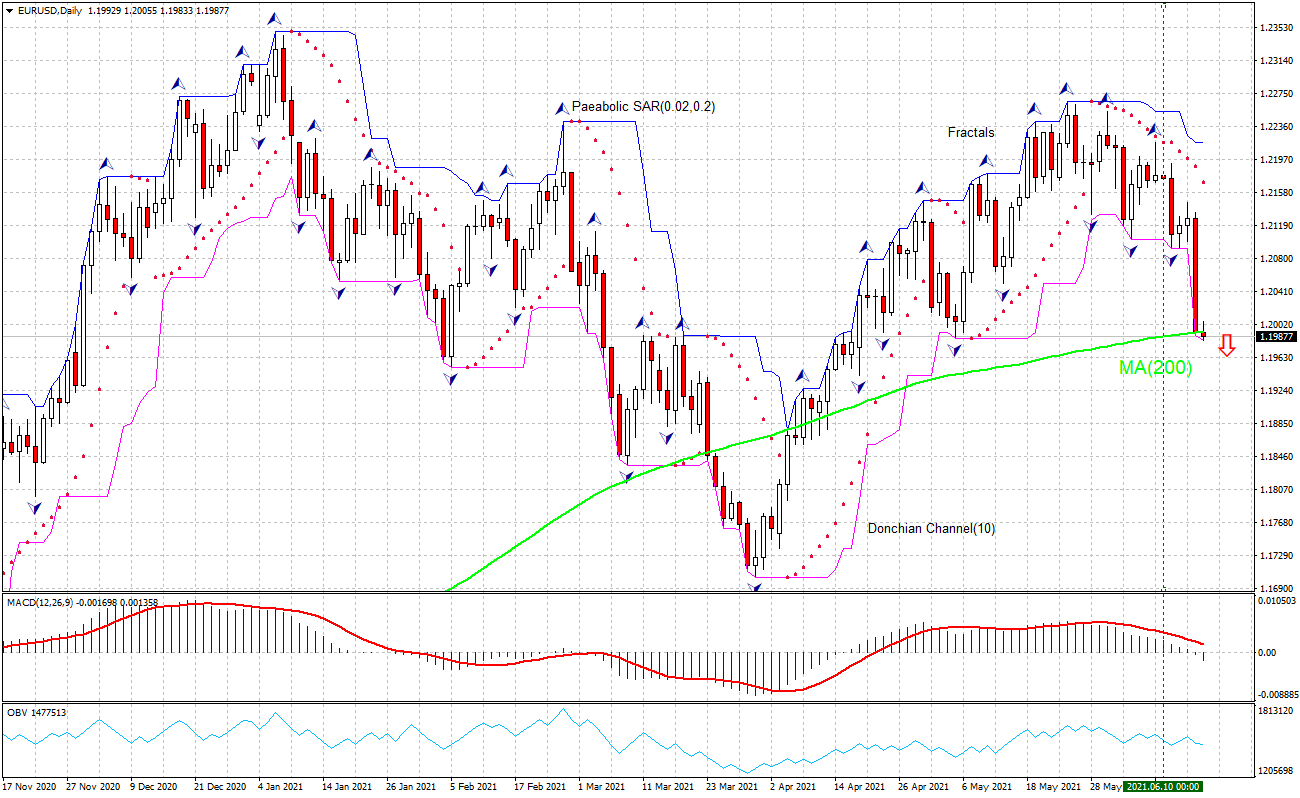

EUR USD Technical Analysis - EUR USD Trading: 2021-06-17

EUR/USD Technical Analysis Summary

Below 1.1989

Sell Stop

Above 1.2217

Stop Loss

| Indicator | Signal |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

| On Balance Volume | Neutral |

EUR/USD Chart Analysis

EUR/USD Technical Analysis

The EURUSD technical analysis of the price chart on daily timeframe shows EURUSD: D1 has fallen below the 200-period moving average MA(200) which is rising still. We believe the bearish movement will continue after the price breaches below the lower bound of the Donchian channel at 1.1989. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 1.2217. After placing the order, the stop loss is to be moved to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Forex - EUR/USD

Fed signaled higher rates in 2023 and start of bond buying taper talks yesterday while the ECB held steady with no tapering talk a week ago. Will the EURUSD retreat continue?

Federal Reserve edged a bit closer to tightening monetary policy at its June 15-16 meeting. US central bank raised its inflation and growth forecast and released projections that showed a majority of Fed officials expect interest rate hikes in 2023. Fed officials on Wednesday penciled in two potential rate hikes in 2023 according to the new Fed ‘dot plot’, sooner than policymakers had previously projected. The Fed also signaled it would now be considering whether to taper its asset purchases meeting by meeting. This is bullish for Dollar. In contrast, the European Central Bank left the policy stance unchanged at its June 10 meeting while stating that bond purchases will “continue to be conducted at a significantly higher pace than during the first months of the year”. Tapering was postponed and the current speed of purchases could be maintained until the bond purchasing program regularly ends in March 2022.This is bearish for EURUSD.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.