- Análisis

- Principales Ganadores/Perdedores

Top Gainers and Losers: euro and US dollar

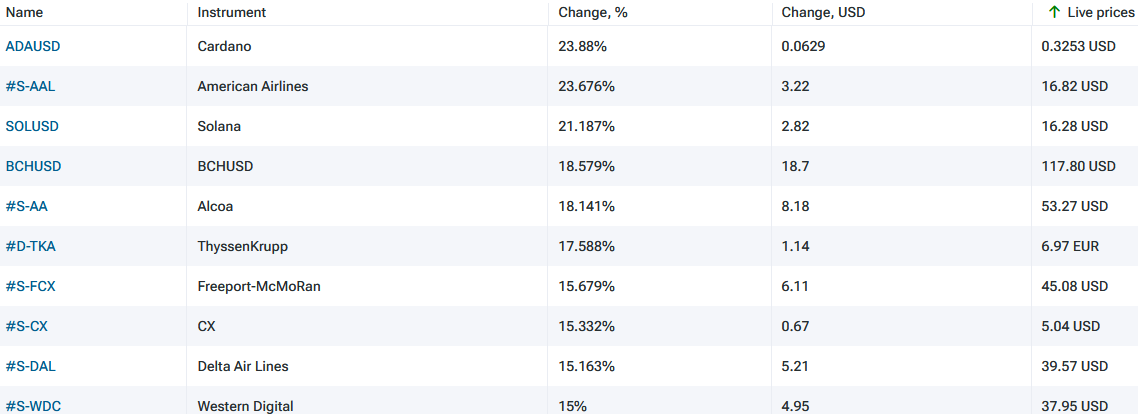

Top Gainers - global market

Over the past 7 days, the US dollar index fell and hit a 7-month low. The change in the United States Consumer Price Index (CPI) m/m in December turned out to be negative (-0.1%) for the first time since May 2020. Investors believe that the beginning of the decline in inflation may limit further tightening of the Fed's monetary policy. Accordingly, the US dollar was among the leaders of the weakening last week. The euro, on the contrary, strengthened due to the statement of the European Central Bank about plans to raise its rate by 1.25% during 2023. Now it is 2.5%. Recall that inflation in the EU for December in the 2nd assessment will be published on January 18. Preliminarily, it amounted to 9.2% y/y. The strengthening of the yen was supported by investors' expectations that the Bank of Japan would somehow tighten its monetary policy at the January 18 meeting. The strengthening of the Chinese yuan was supported by a good foreign trade performance in December (China Trade Balance) and relatively low inflation (+1.8% y/y). US natural gas quotes continued to decline for the 4th week in a row due to warmer weather, as well as due to reduced industrial production and demand for gas in Europe.

1. ADAUSD, +23.9% – Cryptocurrency Cardano (ADA)

2. American Airlines Group Inc., +23.7% – American airline

Top Losers - global market

1. VIX Index – CFD on CBOE Volatility Index (Chicago Board Options Exchange)

2. Henry Hub Natural Gas Futures – CFDs on American gas futures.

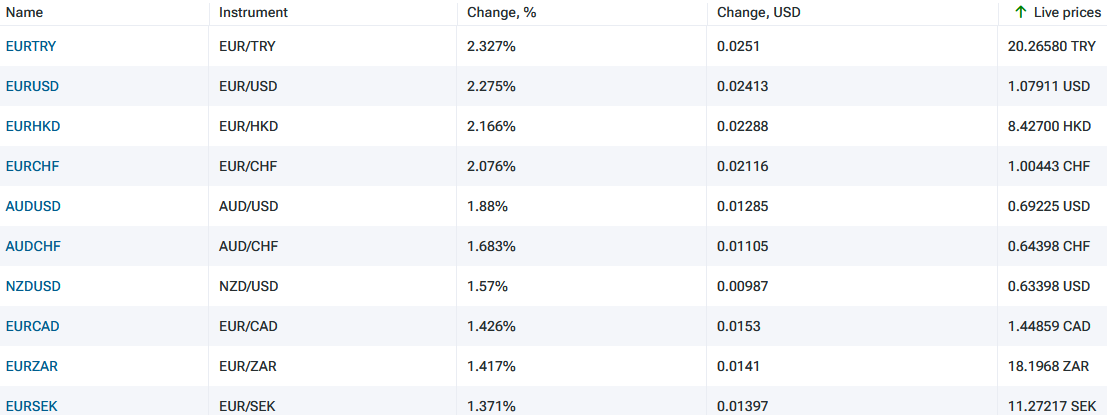

Top Gainers - foreign exchange market (Forex)

1. EURTRY, EURUSD - the growth of these graphs means the strengthening of the euro against the Turkish lira and the US dollar.

2. EURHKD, EURCHF - the growth of these graphs means the weakening of the Hong Kong dollar and the Swiss franc against the euro.

Top Losers - foreign exchange market (Forex)

1. USDCNH, USDMXN - the fall of these graphs means the weakening of the US dollar against the Chinese yuan and the Mexican peso.

2. USDJPY, USDDDK - the fall of these graphs means the strengthening of the Japanese yen and the Danish krone against the US dollar.

Nueva herramienta analítica exclusiva

Cualquier rango de fechas - de 1 día a 1 año

Cualquier grupo de trading: Forex, Acciones, Índices, etc.

Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.

Anterior Top Ganadores y Perdedores

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Durante los últimos 7 días, el índice del dólar estadounidense ha disminuido. Como era de esperar, la Reserva Federal (Fed) mantuvo su tasa de interés en 5,25% durante la reunión del 14 de junio. Ahora, los inversores están monitoreando las estadísticas económicas y tratando de pronosticar el...

Durante los últimos 7 días, el índice del dólar estadounidense no ha cambiado mucho. Ha estado cotizando en un rango estrecho de 103,2-104,4 puntos por cuarta semana. Los inversores esperan el resultado de la reunión de la Fed del 14 de junio. Las acciones de Tesla subieron por la apertura de nuevas...