- Analyses

- Top Gagnants / Perdants

Top Gainers and Losers: euro and US dollar

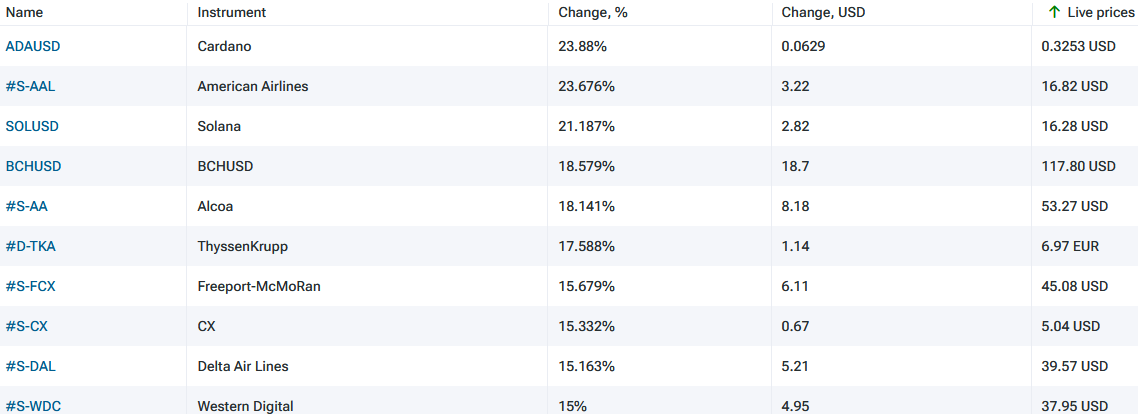

Top Gainers - global market

Over the past 7 days, the US dollar index fell and hit a 7-month low. The change in the United States Consumer Price Index (CPI) m/m in December turned out to be negative (-0.1%) for the first time since May 2020. Investors believe that the beginning of the decline in inflation may limit further tightening of the Fed's monetary policy. Accordingly, the US dollar was among the leaders of the weakening last week. The euro, on the contrary, strengthened due to the statement of the European Central Bank about plans to raise its rate by 1.25% during 2023. Now it is 2.5%. Recall that inflation in the EU for December in the 2nd assessment will be published on January 18. Preliminarily, it amounted to 9.2% y/y. The strengthening of the yen was supported by investors' expectations that the Bank of Japan would somehow tighten its monetary policy at the January 18 meeting. The strengthening of the Chinese yuan was supported by a good foreign trade performance in December (China Trade Balance) and relatively low inflation (+1.8% y/y). US natural gas quotes continued to decline for the 4th week in a row due to warmer weather, as well as due to reduced industrial production and demand for gas in Europe.

1. ADAUSD, +23.9% – Cryptocurrency Cardano (ADA)

2. American Airlines Group Inc., +23.7% – American airline

Top Losers - global market

1. VIX Index – CFD on CBOE Volatility Index (Chicago Board Options Exchange)

2. Henry Hub Natural Gas Futures – CFDs on American gas futures.

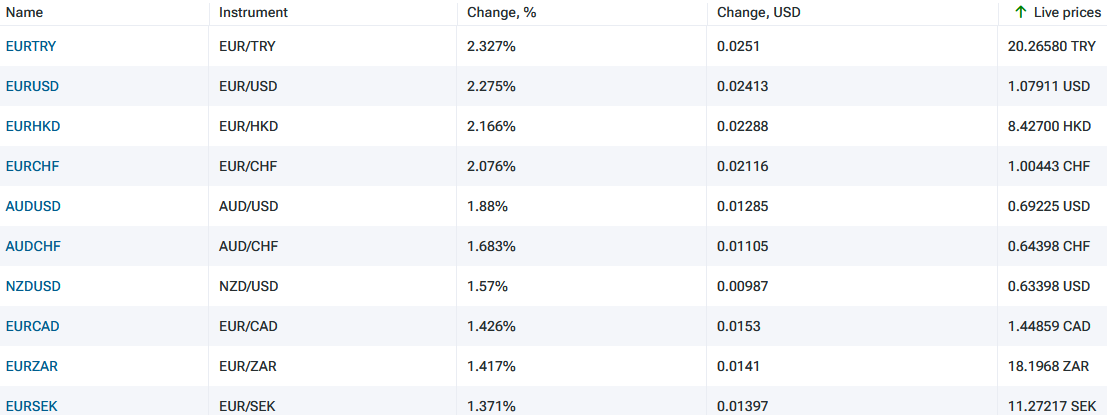

Top Gainers - foreign exchange market (Forex)

1. EURTRY, EURUSD - the growth of these graphs means the strengthening of the euro against the Turkish lira and the US dollar.

2. EURHKD, EURCHF - the growth of these graphs means the weakening of the Hong Kong dollar and the Swiss franc against the euro.

Top Losers - foreign exchange market (Forex)

1. USDCNH, USDMXN - the fall of these graphs means the weakening of the US dollar against the Chinese yuan and the Mexican peso.

2. USDJPY, USDDDK - the fall of these graphs means the strengthening of the Japanese yen and the Danish krone against the US dollar.

Nouvel outil analytique exclusif

N'imorte quelle gamme de dates - de 1 jour à 1 an

N'importe quel groupe de trading - Forex, actions, indices etc.

NB:

Cet aperçu a un caractère instructif et didactique, publié gratuitement. Toutes les données, comprises dans l'aperçu, sont reçues de sources publiques, reconnues comme plus ou moins fiables. En outre, rien ne garantit que les informations indiquées sont complètes et précises. Les aperçus ne sont pas mis à jour. L'ensemble de l'information contenue dans chaque aperçu, y compris l'opinion, les indicateurs, les graphiques et tout le reste, est fourni uniquement à des fins de familiarisation et n'est pas un conseil financier ou une recommandation. Tout le texte entier et sa partie, ainsi que les graphiques ne peuvent pas être considérés comme une offre de faire une transaction sur chaque actif. IFC Markets et ses employés, dans n'importe quelle circonstance, ne sont pas responsables de toute action prise par quelqu'un d'autre pendant ou après la lecture de l’aperçu.

Précédent Top Gagnants & Perdants

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Au cours des 7 derniers jours, l'indice du dollar américain a chuté. Comme prévu, la Fed a maintenu le taux à 5,25 % lors de la réunion du 14 juin. Maintenant, les investisseurs regardent les statistiques économiques et tentent de prédire le changement de taux de la Fed lors de la prochaine réunion...

Au cours des 7 derniers jours, l'indice du dollar américain n'a pas beaucoup changé. Il s'est négocié dans une fourchette étroite de 103,2 à 104,4 points pour la 4e semaine. Les investisseurs attendent le résultat de la réunion de la Fed du 14 juin. Les actions de Tesla ont augmenté avec l'ouverture...