- Analyses

- Top Gagnants / Perdants

Top Gainers and Losers: US dollar and New Zealand dollar

Top Gainers - global market

Over the past 7 days, the US dollar index has grown significantly and updated the maximum since June 2002. Now it is trading above the psychological level of 110 points. Over the past 12 months, the US dollar index has risen by almost 20%. The main positive for the US currency was the increase in the Fed rate to 3.25% from 2.5% at the meeting on September 21. Investors do not rule out that by March 2023 the rate may increase to 4.5%. Bank of Japan maintained a negative rate (-0.1%) at the September 22 meeting. At the same time, BOJ carried out foreign exchange intervention for the first time since 1998. This contributed to the strengthening of the yen. The Canadian dollar and the Norwegian krone weakened amid stagnation in global hydrocarbon prices. These countries actively produce and export oil and natural gas. The New Zealand Trade Balance 12-Months record deficit in August could have contributed to the decline in the New Zealand dollar quotes. Note that the negative balance of New Zealand foreign trade has been observed for 16 months in a row.

1.XRPUSD, +16,6% – Ripple cryptocurrency (XRP)

2. Netflix Inc., +8,6% – American subscription streaming service

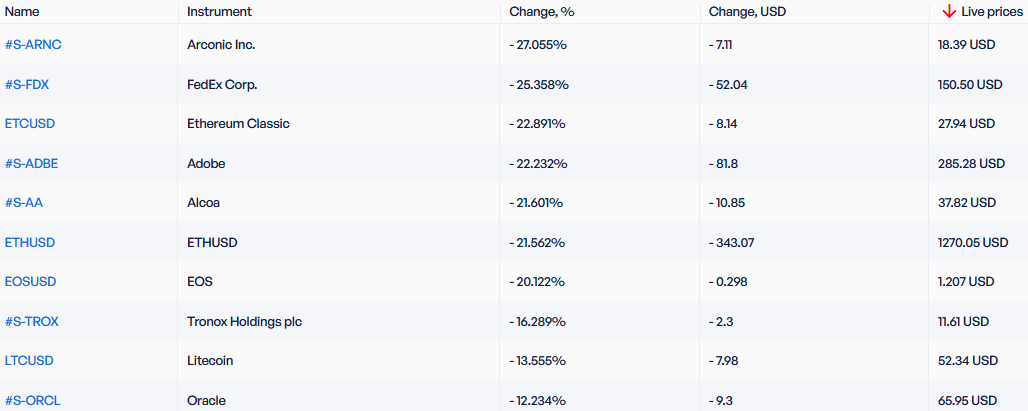

Top Losers - global market

1. Arconic Inc. – American manufacturer of aluminum products

2. FedEx Corporation –American postal and shipping company.

Top Gainers - foreign exchange market (Forex)

1. USDSEK, USDPLN - the growth of these charts means the strengthening of the US dollar against the Swedish krona and Polish zloty.

2. USDNOK, USDCAD - the growth of these charts means the weakening of the Norwegian krone and the Canadian dollar against the US dollar.

Top Losers - foreign exchange market (Forex)

1. NZDJPY, NZDUSD - the decline in these charts means the weakening of the New Zealand dollar against the Japanese yen and the US dollar.

2. CADJPY, GBPJPY - the decline in these charts means the strengthening of the Japanese yen against the Canadian dollar and the British pound.

Nouvel outil analytique exclusif

N'imorte quelle gamme de dates - de 1 jour à 1 an

N'importe quel groupe de trading - Forex, actions, indices etc.

NB:

Cet aperçu a un caractère instructif et didactique, publié gratuitement. Toutes les données, comprises dans l'aperçu, sont reçues de sources publiques, reconnues comme plus ou moins fiables. En outre, rien ne garantit que les informations indiquées sont complètes et précises. Les aperçus ne sont pas mis à jour. L'ensemble de l'information contenue dans chaque aperçu, y compris l'opinion, les indicateurs, les graphiques et tout le reste, est fourni uniquement à des fins de familiarisation et n'est pas un conseil financier ou une recommandation. Tout le texte entier et sa partie, ainsi que les graphiques ne peuvent pas être considérés comme une offre de faire une transaction sur chaque actif. IFC Markets et ses employés, dans n'importe quelle circonstance, ne sont pas responsables de toute action prise par quelqu'un d'autre pendant ou après la lecture de l’aperçu.

Précédent Top Gagnants & Perdants

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Au cours des 7 derniers jours, l'indice du dollar américain a chuté. Comme prévu, la Fed a maintenu le taux à 5,25 % lors de la réunion du 14 juin. Maintenant, les investisseurs regardent les statistiques économiques et tentent de prédire le changement de taux de la Fed lors de la prochaine réunion...

Au cours des 7 derniers jours, l'indice du dollar américain n'a pas beaucoup changé. Il s'est négocié dans une fourchette étroite de 103,2 à 104,4 points pour la 4e semaine. Les investisseurs attendent le résultat de la réunion de la Fed du 14 juin. Les actions de Tesla ont augmenté avec l'ouverture...