- Analisi

- Analisi Tecnica

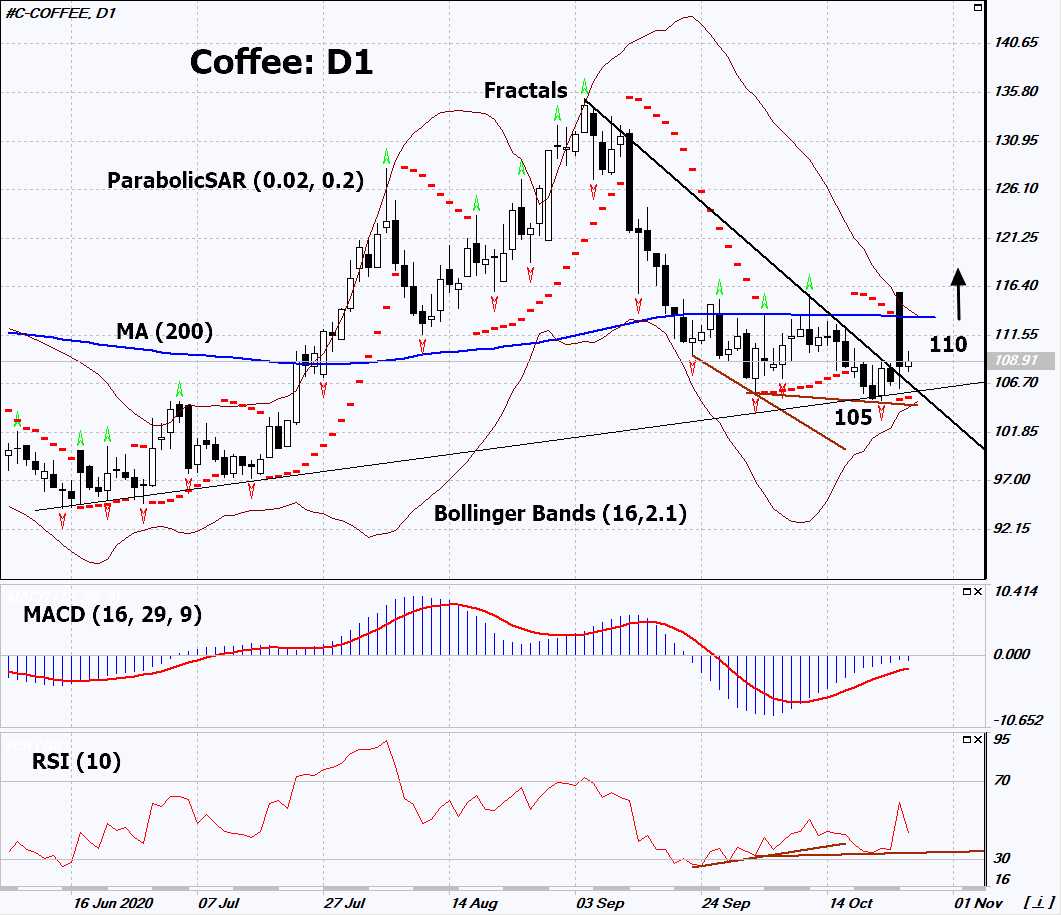

Caffè Arabica Analisi Tecnica - Caffè Arabica Trading: 2020-10-28

Caffè Arabica Technical Analysis Summary

Sopra 110

Buy Stop

Sotto 104,9

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutro |

| Fractals | Neutro |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutro |

Caffè Arabica Chart Analysis

Caffè Arabica Analisi Tecnica

On the daily timeframe, Coffee: D1 breached up the downtrend resistance line. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish move if Coffee rises above the last maximum: 110. This level can be used as an entry point. We can place a stop loss below the Parabolic signal, the lower Bollinger line and the last lower fractal: 104.9. After opening a pending order, we can move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the 4-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (104.9) without activating the order (110), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Analisi Fondamentale Materie Prime - Caffè Arabica

A drought in Brazil could lead to lower crop. Will the Coffee quotes grow ?

The Brazilian agency Somar Meteorologia reported that the state of Minas Gerais received only 62% of the historical rainfall for this time of year. This state is Brazil's main Arabica coffee growing region. At the same time, the Vietnamese National Center for Hydro Meteorological Forecasting reported flooding in the Central Highland area and damage to robusta coffee trees due to Typhoon Molave. US Climate Prediction Center forecasts a drought in Brazil in Q4 this year, with the natural phenomenon of La Nina emerging. Earlier, Coffee's quotes fell by almost a third due to the forecast of the Brazilian agency Conab’s forecast of a 38% increase in harvest this year to 47.4 million bags. If this estimate is revised downward due to drought, an upward correction is possible.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.