- Analisi

- Analisi Tecnica

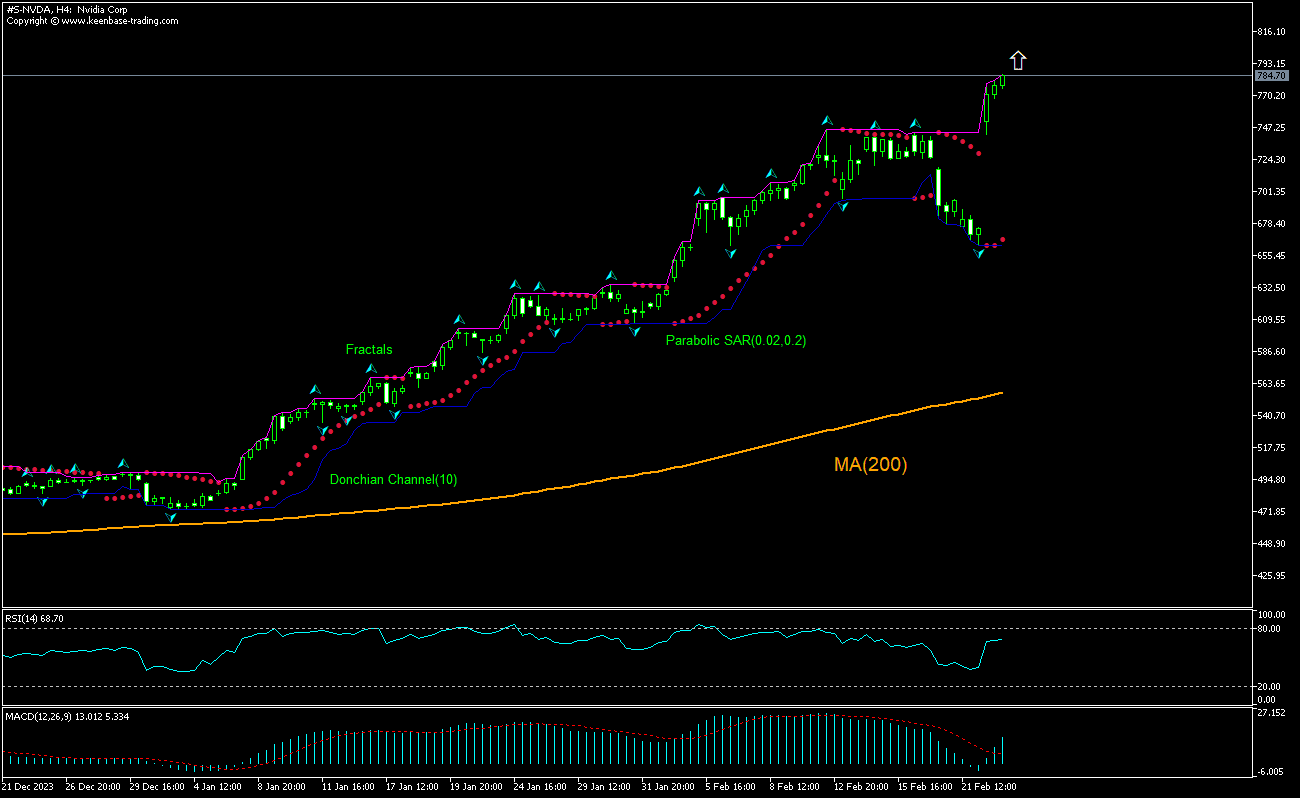

Nvidia Corp. Analisi Tecnica - Nvidia Corp. Trading: 2024-02-23

Nvidia Corp. Technical Analysis Summary

Sopra 785.43

Buy Stop

Sotto 696.12

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | Neutro |

| Parabolic SAR | Buy |

Nvidia Corp. Chart Analysis

Nvidia Corp. Analisi Tecnica

The technical analysis of the Nvidia stock price chart on 4-hour timeframe shows #S-NVDA,H4 is rebounding above 200-period moving average MA(200) after retracing down following a record high closing ten days ago. We believe the bullish momentum will persist after the price breaches above the upper boundary of Donchian channel at 785.43. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 696.12. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (696.12) without reaching the order (785.43), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Azioni - Nvidia Corp.

Nvidia stock price jumped after the chip maker forecast next quarter revenue above analysts' estimates. Will the Nvidia stock price continue rebounding?

Nvidia reported on Wednesday fourth quarter revenue of $22.1 billion, versus forecasts of $20.4 billion. The company recorded revenue growth of 409% over the same period a year ago, and a 27% rise over quarter. Data center revenue grew 410% over year to a record $18.4 billion in the fourth quarter. Gaming revenue grew 56% from a year ago to $2.9 billion. As to next quarter guidance, Nvidia expects first quarter revenue of about $24 billion, plus or minus 2%, compared with Wall Street consensus estimate of $21.9 billion. Shares rallied 16.4% on the day after quarterly report, adding $273 billion in wealth to its shareholders.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.