- Analisi

- Analisi Tecnica

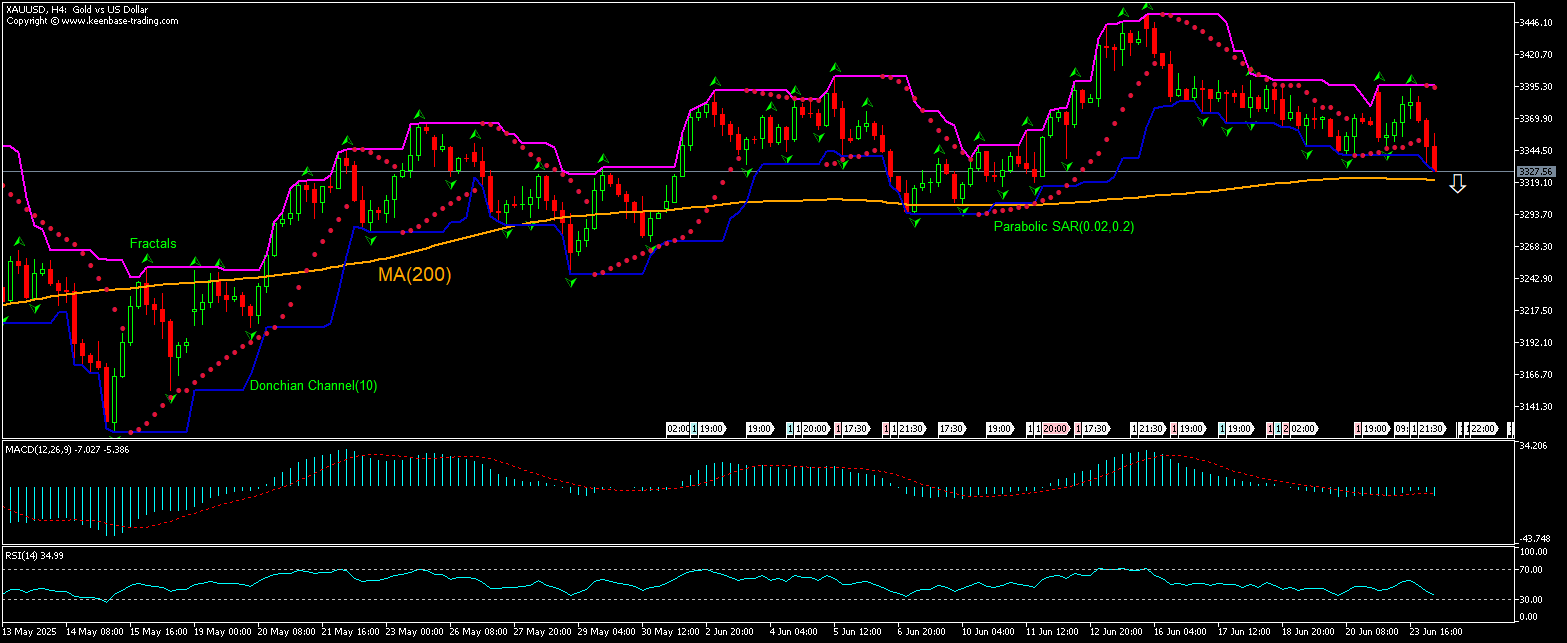

Oro Dollaro Analisi Tecnica - Oro Dollaro Trading: 2025-06-24

Oro Technical Analysis Summary

Sotto 3325.23

Sell Stop

Sopra 3391.78

Stop Loss

| Indicator | Signal |

| RSI | Neutro |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Neutro |

| Parabolic SAR | Sell |

Oro Chart Analysis

Oro Analisi Tecnica

The technical analysis of XAUUSD price on the 1-hour timeframe shows XAUUSD,H1 is testing the 200-period moving average MA(200) as it is retracing down after hitting 2-week high eight days ago. We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 3325.23. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 3391.78. After placing the pending order the stop loss is to be moved every day to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (3391.78) without reaching the order (3325.23) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Analisi Fondamentale PRECIOUS_METALS - Oro

Gold prices are retreating after Iran’s missile attack on a US airbase in Qatar. Will the XAUUSD retreating continue?

Iran responded with a missile attack on a US airbase in Qatar after the US conducted aerial attack on Iran’s nuclear facilities. Usually in periods of heightened geopolitical uncertainty demand for safe haven precious metal rises as investors increase their holdings of gold for the ability of the safe haven asset to preserve its value. Currently though prices have been struggling to hold above $3,400 an ounce as it trades in a sideways pattern. However, major investment banks remain bullish on the safe haven precious metal. UBS particularly remains bullish on gold, maintaining its upside target of $3,800 an ounce. Banks’ bullish sentiment for gold is an upside risk for XAUUSD price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.