- Analítica

- Líderes de crescimento e queda

Top Gainers and Losers: Swiss Franc and South African Rand

Top Gainers - global market

Over the past 7 days, the change in the US dollar index has been minimal again. As expected, the Fed raised the rate by 0.5% to 4.5% at the December 14 meeting. At first, this caused a negative reaction in the Forex market. Investors decided that the rate would stabilize around 5%. Thus, its growth in 2023 will be minimal despite the relatively high inflation of 7.1% y/y in November. At the end of last week, the dollar index won back almost all losses due to good US economic indicators University of Michigan Consumer Sentiment and lower inflation in industry. The Swiss franc strengthened significantly due to the increase in the Swiss National Bank (SNB) rate to 1% from 0.5%. The South African Parliament refused to impeach the incumbent President Cyril Ramaphosa, the very discussion of this issue had a negative impact on the rate of the South African rand.

1. Heating oil futures CFD, +16.8% – American heating oil

2. Wynn Macau, Limited, +15.7% – casino and hotel management company in Macau

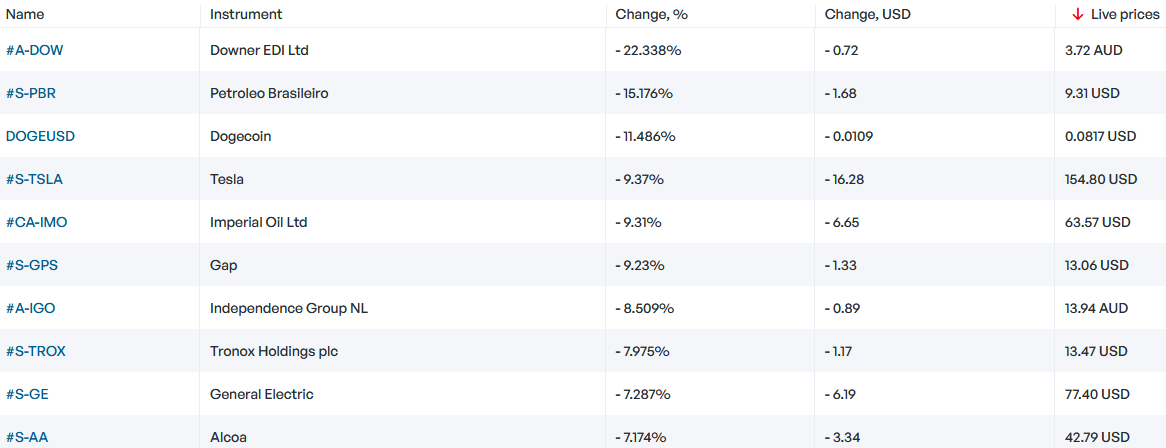

Top Losers - global market

1. PetróleoBrasileiro S.A. - Petrobras – Brazilian oil company

2. Downer EDI Limited – Australian multi-disciplinary holding.

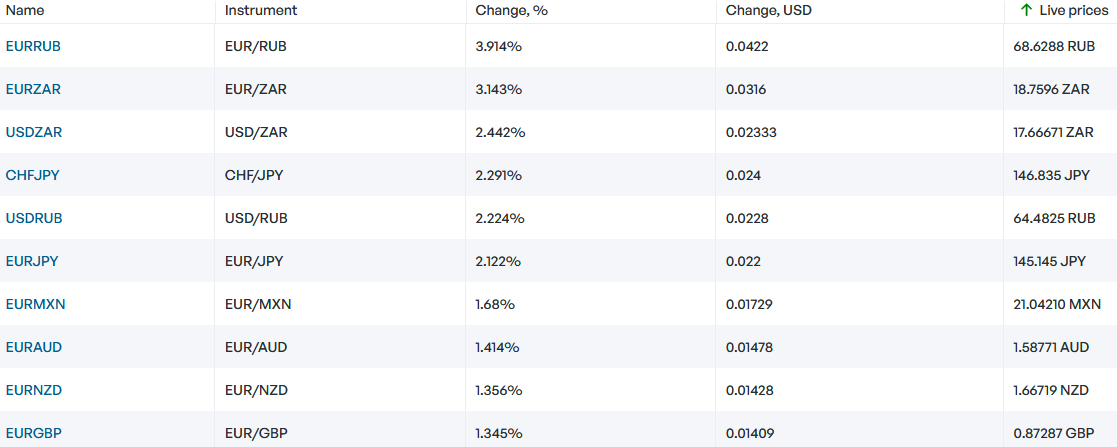

Top Gainers - foreign exchange market (Forex)

1. EURZAR, USDZAR - the growth of these graphs means the strengthening of the euro and the US dollar against the South African rand.

2. CHFJPY, EURJPY - the growth of these graphs means the weakening of the Japanese yen against the Swiss franc and the euro.

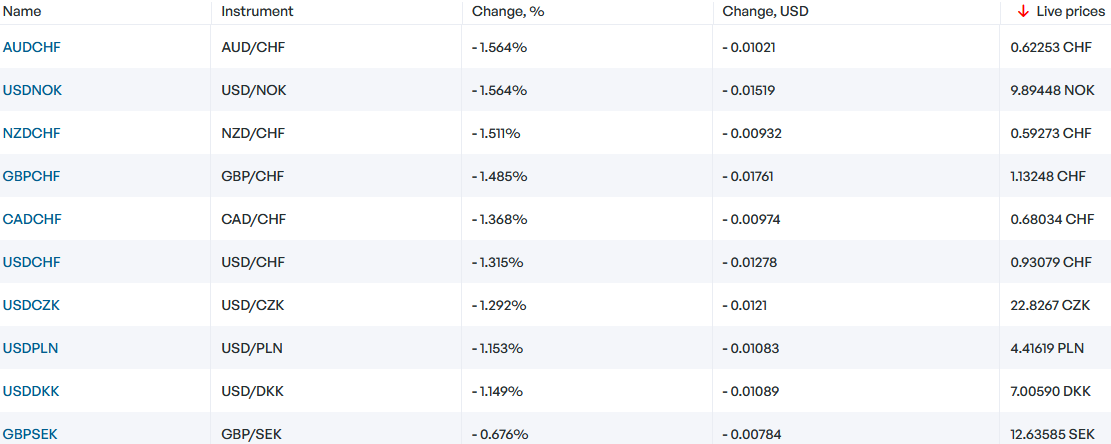

Top Losers - foreign exchange market (Forex)

1. AUDCHF, USDNOK - the fall of these graphs means the weakening of the Australian dollar against the Swiss franc and the US dollar against the Norwegian krone.

2. NZDCHF, GBPCHF - the fall of these graphs means the strengthening of the Swiss franc against the New Zealand dollar and the British pound.

Nova ferramenta analítica exclusiva

Qualquer período- de 1 dia a 1 ano

Todos os grupos- Forex, Ações, Índices, etc.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.

Líderes Anteriores em Crescimento e Queda

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...