- Analítica

- Líderes de crescimento e queda

Top Gainers/Losers: Euro and American Dollar

Top Gainers – The World Market

Top Gainers – The World Market

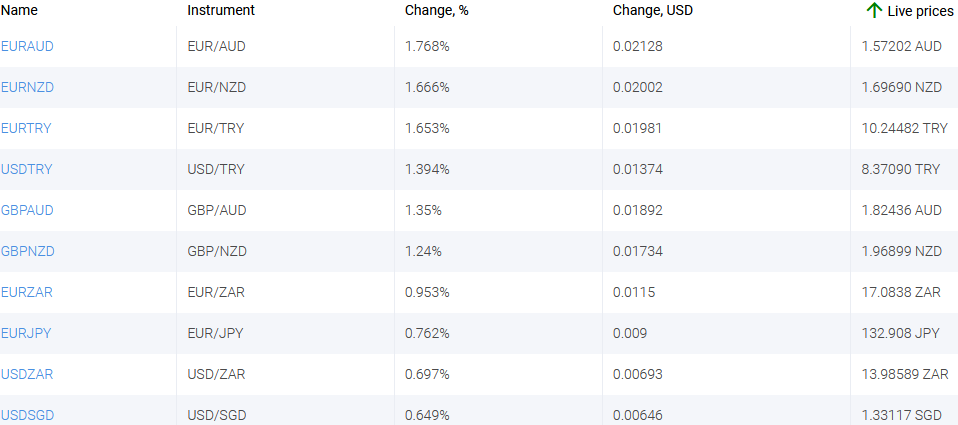

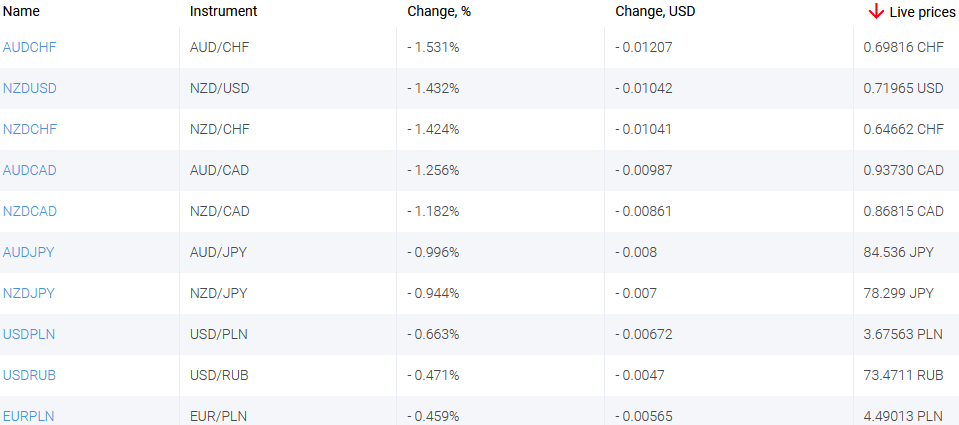

Over the past 7 days, the US dollar continued to weaken. Investors questioned the Fed's monetary tightening at its next meeting on June 16. The euro has strengthened as some market participants see it as an alternative to the US dollar. In addition, inflation remains low in the EU, in contrast to the US. In April, core inflation in the Eurozone was only 0.7% in annual terms. Copper fell after the Chinese authorities announced that too strong growth in the cost of non-ferrous metals and other raw materials could negatively affect the Chinese economy and they will make efforts to limit it. In the same context, there was a weakening of the currencies of such commodity countries as the New Zealand and Australian dollars.

1.Isuzu Motors Limited, +21,9% – Japanese manufacturer of commercial vehicles, trucks and industrial motors

2. COMMERZBANK AG, +11,5% – German bank

Top Losers – The World Market

Top Losers – The World Market

1. Canadian Pacific Railway Limited – Canadian railway company

2. Antofagasta PLC – copper producer from Chile.

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. EURTRY, USDTRY - the growth of these charts means the strengthening of the euro and the US dollar against the Turkish lira.

2. EURAUD, EURNZD - the growth of these charts means the weakening of the Australian and New Zealand dollars against the euro.

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. AUDCHF, AUDCAD - the drop in these charts means the weakening of the Australian dollar against the Swiss franc and the Canadian dollar.

2. NZDUSD, NZDCHF - the drop in these charts means the strengthening of the US dollar and Swiss franc against the New Zealand dollar.

Nova ferramenta analítica exclusiva

Qualquer período- de 1 dia a 1 ano

Todos os grupos- Forex, Ações, Índices, etc.

Nota de rodapé:

Esta visão geral é apenas para fins informativos e educacionais, e é publicada de forma gratuita. Todos os dados contidos neste documento são obtidos de fontes públicas que são consideradas mais ou menos confiáveis. Ao mesmo tempo, não há garantias de que as informações são completas e precisas. No futuro, as visões separadas não são atualizadas. Todas as informações em cada visão geral, incluindo opiniões, índices, gráficos etc., são apresentadas apenas para fins informativos e não são aconselhamentos financeiros ou recomendações. Todo o texto e qualquer parte dele, assim como os gráficos não podem ser considerados como uma oferta para realizar quaisquer transações com qualquer ativo. A empresa IFC Markets e seus funcionários sob nenhumas circunstâncias não são responsáveis por quaisquer acções, realizados por uma pessoa durante ou depois de ler a visão geral.

Líderes Anteriores em Crescimento e Queda

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...