In yesterday session data favored the greenback that has been strengthening against the Euro, the Japanese Yen and Swissy but has been in consolidation versus the Aussie, the Canadian and the Sterling. In general the US dollar index surged to

resistance at 82.62 underpinned by stronger US Jobless claims, followed by private sector ADP non-farm report coming out in line with expectations.

Moreover, the US ISM Non-Manufacturing PMI rose to the outstanding 58.6 for August, beating estimates at 55.2 and was up compared to 56 for July. Confidence indicators are further strengthening increasing potentials for reducing asset purchases in addition to that we are closely monitoring NFP report since this would be a determining factor for Fed’s policy.

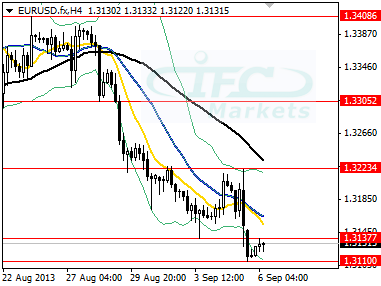

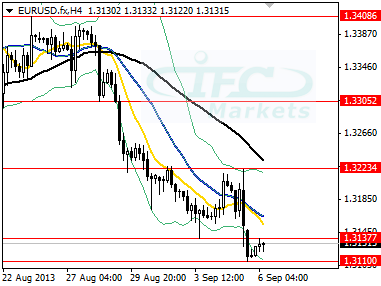

The Euro sank from resistance at 1.3217 to a new 6-week low at 1.3110, against the US dollar after ECB left its monetary policy unchanged with the key rate at 0.50%. Mario Draghi said that economic activity is picking up but downside risks remain strong. Addionaly, ECB growth forecast for the 2013 was upgraded to -0.4% from -0.6% but for 2014 growth downgraded to 1% from 1.1%. We consider the ECB current policy not so clear compared to BOE and FED with investors being concerned about it and that weighs on the Euro that drops even though recent confidence indicators and GDP data should have underpinned it.

For sure US dollar’s strength in recent sessions also had its own significant part in

EURUSD downward development. Another currency pair displaying greenback’s strength was the

USDJPY that inched above 100 reaching at 100.23 but quickly retreated to 99.70 as major resistance area around 100 weighs on the pair. At the same time the cable advanced yesterday to resistance at 1.5661 backed by stronger Service PMI reading as well as on unchanged monetary policy by BOE, however as soon as US data were released the pair dipped to support at 1.5572, consolidating mainly in the area of 1.5661/1.5574.

We would prefer in today’s trading to hold a limited trading position in market before Non-Farm Payrolls report to avoid surprises, even though we believe that it would be in line with estimates.