- Innovations

- Synthetic Instruments

Synthetic Instruments

This unique technology allows

The creation of such synthetic instruments as new cross rates, correlations between various assets, currency indexes, stock portfolios, portfolios for pair trading and many more.

The variety of such instruments is limited only by the trader's imagination.

You can create synthetic instruments on your own by reading the quick guide for creating synthetic instruments.

Synthetic instruments created by the Portfolio Quotation method are used for

Trading Advantages of Synthetic Instruments

- Add base and quoted assets in the synthetic instrument, which will result in opening both long and short positions, while making deals.

- Give each component (asset) an individual weight in units of the asset volume – in the U.S. dollars, in percents of the total portfolio volume (base or quoted); the U.S. dollar, as an asset, can be added both to the base and quoted portfolios.

- Create instruments in form of portfolios with various degrees of complexity, from very simple, including only two assets, to complex combinations, consisting of dozens of assets.

- Get the historical prices of the created synthetic instrument.

- Simple and user-friendly interface for creating synthetic instruments.

- Maintain the database of the created synthetic instrument.

Use synthetic instruments created by our analysts

To use synthetic instruments from the library, trader needs only to download the instruments from the library to the trading terminal and start trading them

0+ New

Instruments and Indices

Nevertheless, PCI Library contains only examples of personal composite instruments which can be created with the new technology.

The main advantage of the new technology is that you may create any instruments on your choice, analyze and trade them in NetTradeX trading terminal.

Quick Guide for Creating and Trading Synthetic Instruments

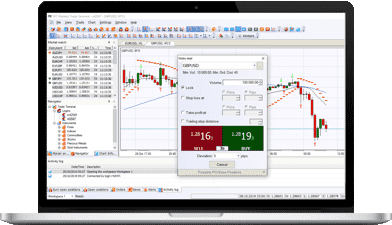

Synthetic Instruments (in the terminal - Personal Composite Instruments(PCI)), created through the Portfolio Quoting Method (GeWorko), are realized on trading-analytical platform NetTradeX PC and are considered an efficient tool for financial analysts, managers of mutual and investment funds and traders.

In order to create a new synthetic instruments by Portfolio Quoting Method (GeWorko), right-click on "Market watch" window and select "Create PCI" option from the drop-down menu. More

Through trading-analytical platform NetTradeX you can get deep price history of any of your personal composite instruments, which will be updated in real time mode. Price history can be presented in the form of different chart types (bars, candlesticks and lines) at various time frames. To open a chart of price history of the created instrument, you should: More

To add the synthetic instrument of interest to the list of instruments used, you may open the context menu in "Market watch" window or click on "Trade -> Add instruments to use..." in the menu bar. More

Through synthetic instrument creation module you will be able not only to create new instruments and open charts for full-scale technical analysis, but also to trade the instruments, created by yourself. More

After creating and placing a synthetic instrument in the “Market watch” window, it may be traded as a common instrument, set pending and linked orders Take Profit and Stop Loss. More

NEW TO TRADING OR WANT TO

IMPROVE YOUR LEVEL?

Check out our Trading Academy with

professional video lessons

and articles.