The greenback is gaining ground against its major peers on Thursday morning as previously Moody’s said that US economy credit rating would not be affected during talks of increasing Debt ceiling and they expect that eventually lawmakers would approve enhancement of borrowing limit. Thus, fears over another debt ceiling crisis are fading with the US dollar index trading higher early on Thursday, advancing by 0.18%, rising from 80.25 to 80.40. We are slightly cautious today due to risk of second quarter final growth data in the evening projected to be at 2.7% mildly higher than previous reading at 2.5%.

In Asian trading on Thursday the Euro versus the greenback eased from resistance at 1.3536 to support at 1.3510, perhaps as investors were collecting profits from yesterday upside following upbeat German Consumer Confidence indicator. In addition, the

EURUSD was fading due to greenback getting stronger, although in technical terms the pair in the medium term remains bullish and could revisit 7-month highs at 1.3568.

The British pound surged by 0.75% to 1.6087 against the US dollar this morning and maintained its ground as the US dollar was strengthening indicating that British pound remains strong, supported by stronger than projected CBI realized Sales yesterday. Investors are monitoring later today UK second quarter final growth data expected to confirm previous reading at 0.7%.

Global equities were under selling pressure due to risk-off triggered by US budget talks and expectations that Fed would taper assets by end of October with S&P 500 falling for a fifth consecutive day to 1692.77 and

Dow Jones Industrial Average losing 0.40%. Asian stocks followed with Hang Seng declining by 0.15% and Shanghai losing by 1.91%, however NIKKEI 225 gained by 1.22%, backed by renewed talks that the Japanese government may cut corporate tax. Therefore, as demand was increasing for Japanese equities the Yen as a safer currency was losing ground with the USDJPY bouncing up from 98.26 to 99.08.

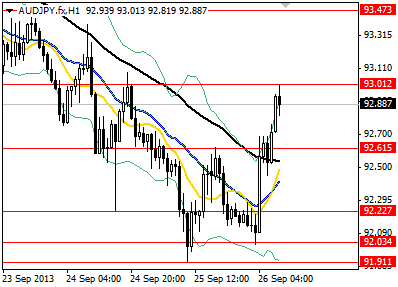

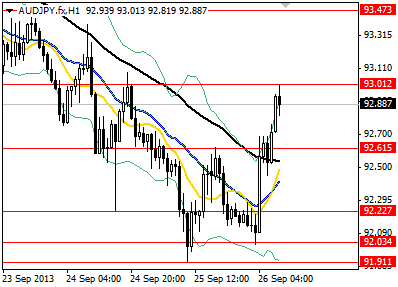

The Aussie on the other hand corrected against the US dollar yesterday to as low as 0.9341 and early today resumed its upside reaching 0.9940. The AUDJPY cross was largely benefited by bullish AUDUSD and USDJPY in recent trading, climbing from 92.03 to 93.01, providing a 1.08% upside. We would expect the pair to consolidate somewhat below 93.01 before it resumes its upside with possible target around 93.47.

AUDJPY