- Analytics

- Market Overview

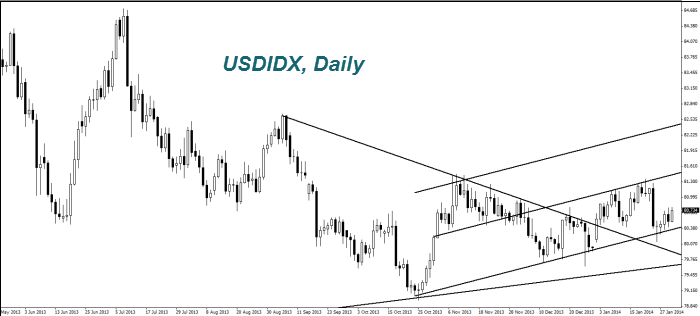

Yesterday, the Fed reduced its program of buying U.S. government bonds by $ 10 billion - 30.1.2014

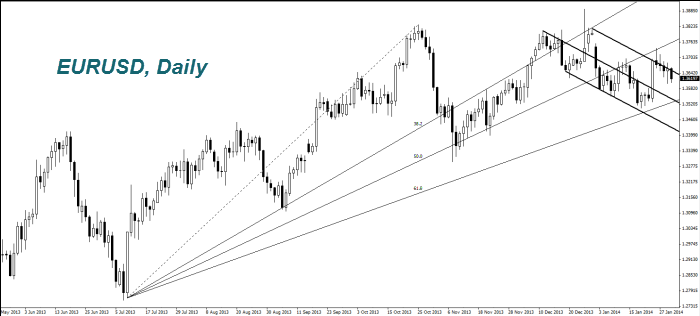

Today at 10-00 and 13-00 GMT (0) we expect a lot of important economic data from the EU. The statistical information for the U.S that can affect the market comes out at 13-30 and 15-00 GMT (0). Overall, the preliminary forecasts for the EU look neutral, but. slightly negative for the U.S.

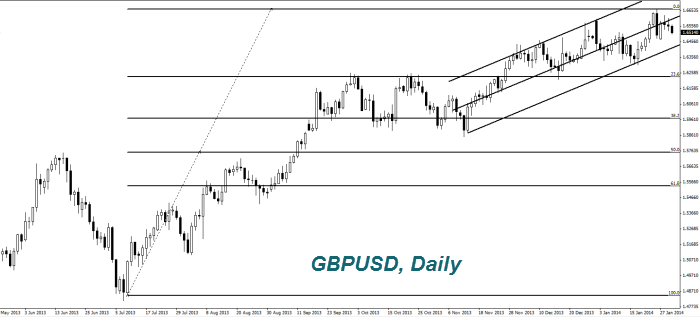

The British pound (GBPUSD) weakens for the third consecutive day. Investors expect important macroeconomic data in terms of mortgage lending in December, which will be released today at 9-30 GMT (0). It is expected that the volume of loans will be the highest in the last six years. The Bank of England may tighten monetary policy to prevent the emergence of a "bubble " in the property market . As it was expected, yesterday's economic data in Japan were negative for the Yen (USDJPY). Recall that its weakening in the chart looks like the rate growth. The volume of retail trade in Japan decreased in December (year to year). Besides it, the volume of curry trade transactions has been decreasing the fourth consecutive week. Today, at 23-30 GMT (0) we expect many macroeconomic data from Japan. The most important of these may be the consumer price index for December. It is projected to be 1.5% on the annual basis. Note that the Bank of Japan stated earlier about the termination of buying Japanese government bonds by printing money, once inflation reaches 2%. In other words, if the CPI is higher than forecast, the Yen may strengthen (falling on the chart) and vice versa. Besides the inflation in Japan we expect the on unemployment data, household spending and industrial production today. The preliminary forecasts, in our opinion, are basically positive for the Yen. The Canadian dollar (USDCAD) continued its weakening (growth chart). Investors believe that this is due to reduction of asset buying from the U.S. Federal Reserve, and the panic in devolving markets. We expect the GDP data for Canada, which will be released on Friday .

See Also