- Innovations

- Portfolio Quoting Method

- Theoretical bases

Theoretical bases

The concept of GeWorko Method is similar to currency exchange rate, when the value of the base currency is expressed in units of the quoted one, but in this method the base and the quoted currencies are replaced by two combinations of assets or two portfolios. The sum of the values of all assets in each portfolio, taking into consideration weight coefficients, gives an absolute dollar-denominated value to it. When comparing the value of the portfolio in the base part with that in the quoted part, the method calculates a ratio, which is considered to be the “price” of the new composite instrument and can be interpreted as the value of the base portfolio, expressed in units of the quoted one. Here it is assumed that all used assets have a value, expressed in US Dollars (or just converted into USD).

For the practical application of GeWorko Method a technology, called Personal Composite Instrument (PCI), has been developed. The technology is implemented on NetTradeX trading terminal as a convenient interface for creating, modifying, reflecting on the charts and trading PCI.

In the process of creating a personal instrument by combining assets, portfolios B (base) and Q (quotation) are created:

Vi- volume, the number of units of asset i in portfolio B

K- the number of assets in portfolio B

Vj- volume, the number of units of asset j in portfolio Q.

N- the number of assets in portfolio Q

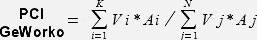

PCI, created by GeWorko Method, can be presented by the following equation:

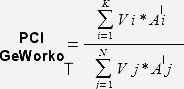

In order to calculate the value of PCI at a particular moment in time T it is necessary to carry out the calculation according to the following formula:

- value per unit of asset i in portfolio B at the moment T, expressed in USD

- value per unit of asset i in portfolio B at the moment T, expressed in USD  - value per unit of asset j in portfolio Q at the moment T, expressed in USD

- value per unit of asset j in portfolio Q at the moment T, expressed in USD