- Analytik

- Technische Analyse

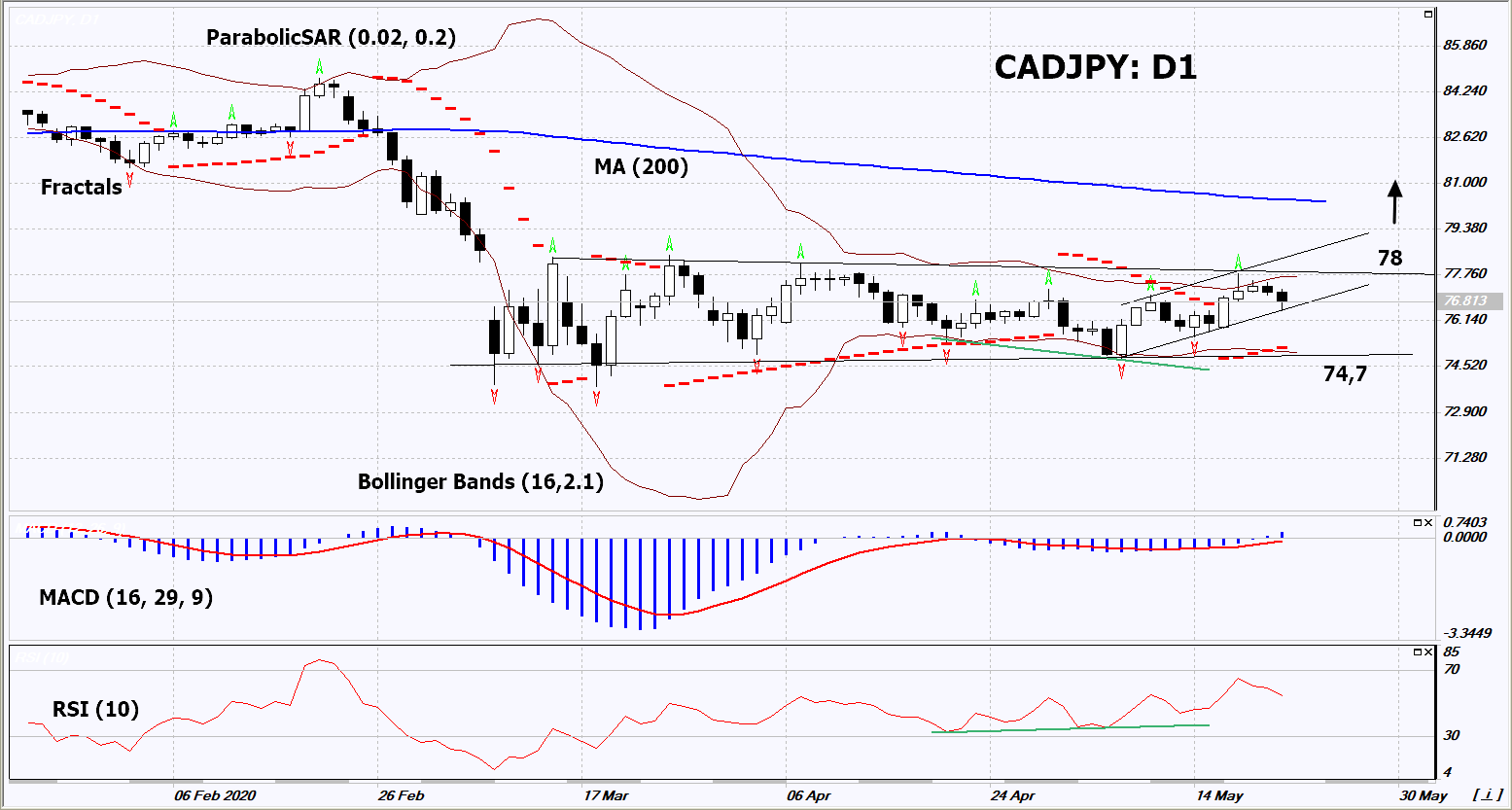

CAD/JPY Technische Analyse - CAD/JPY Handel: 2020-05-25

CAD/JPY Technical Analysis Summary

Above 78

Buy Stop

Below 74,7

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

CAD/JPY Chart Analysis

CAD/JPY Technische Analyse

On the daily timeframe, CADJPY: D1 is in a narrow, short-term, neutral trend. It must be breached up before opening a buy position. A number of indicators of technical analysis formed signals for a further increase. We do not exclude a bullish movement if CADJPY rises above the last upper fractal and the upper Bollinger line: 78. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the lower Bollinger line and the last 2 lower fractals: 74.7. Recall that the record low of this currency pair was in December 1999 and amounted to 68.57, and the maximum in November 2007 was 125.55. After opening the pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss level (74.7) without activating the order (78), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Fundamentale Analyse Forex - CAD/JPY

Oil rises in price in the world market, which supports the Canadian dollar. The Japanese yen may lose some of its attractiveness as a safe heaven currency as Covid-19 risks to the global economy decrease. Will CADJPY quotes grow?

The upward movement shows the strengthening of the Canadian dollar and the weakening of the Japanese yen. The share of energy products in Canada's exports reaches 30%. They include oil and petroleum products, natural gas and coal. The cost of energy products correlates with oil quotes. As a rule, the Canadian dollar strengthens with rising prices for hydrocarbons. There are chances that the Canadian economy can overcome the negative impact of the coronavirus pandemic without heavy losses. Retail sales in Canada decreased by 10% in March 2020 compared to February figures, as expected. However, retail sales except automobiles fell only by 0.4%. This is much better than the forecast of -5%. Another positive factor for the Canadian dollar may be deflation (negative inflation) in April. The consumer price index fell by 0.2% year-on-year. Let's recall that the Bank of Canada rate is + 0.25%. A regular meeting of the Bank of Japan took place on Friday, at which the rate of -0.1% was maintained. The regulator confirmed that it will continue to issue yen in order to support Japanese companies. Inflation in Japan in March was + 0.1% in annual terms. The ratio of inflation and central bank rates of the two countries, theoretically, can support the Canadian dollar against the yen.

Hinweis:

Diese Übersicht hat einen informativen und Tutorencharakter und wird kostenlos veröffentlicht. Alle Daten, die in dieser Übersicht eingeschlossen sind, sind von mehr oder weniger zuverlässigen öffentlichen Quellen erhalten. Außerdem gibt es keine Garantie, dass die angezeigte Information voll und genau ist. Die Übersichten werden nicht aktualisiert. Die ganze Information in jeder Übersicht, einschließlich Meinungen, Hinweise, Charts und alles andere, werden nur für Vertrautmachen veröffentlicht und sind keine Finanzberatung oder Empfehlung. Der ganze Text und sein jeder Teil sowie die Charts können nicht als ein Geschäftsangebot betrachtet werden. Unter keinen Umständen sind IFC Markets und seine Angestellten für die Handlungen, die von jemand anderem während oder nach dem Lesen der Übersicht genommen werden, verantwortlich.