- Phân tích dữ liệu

- Phân tích kỹ thuật thị trường

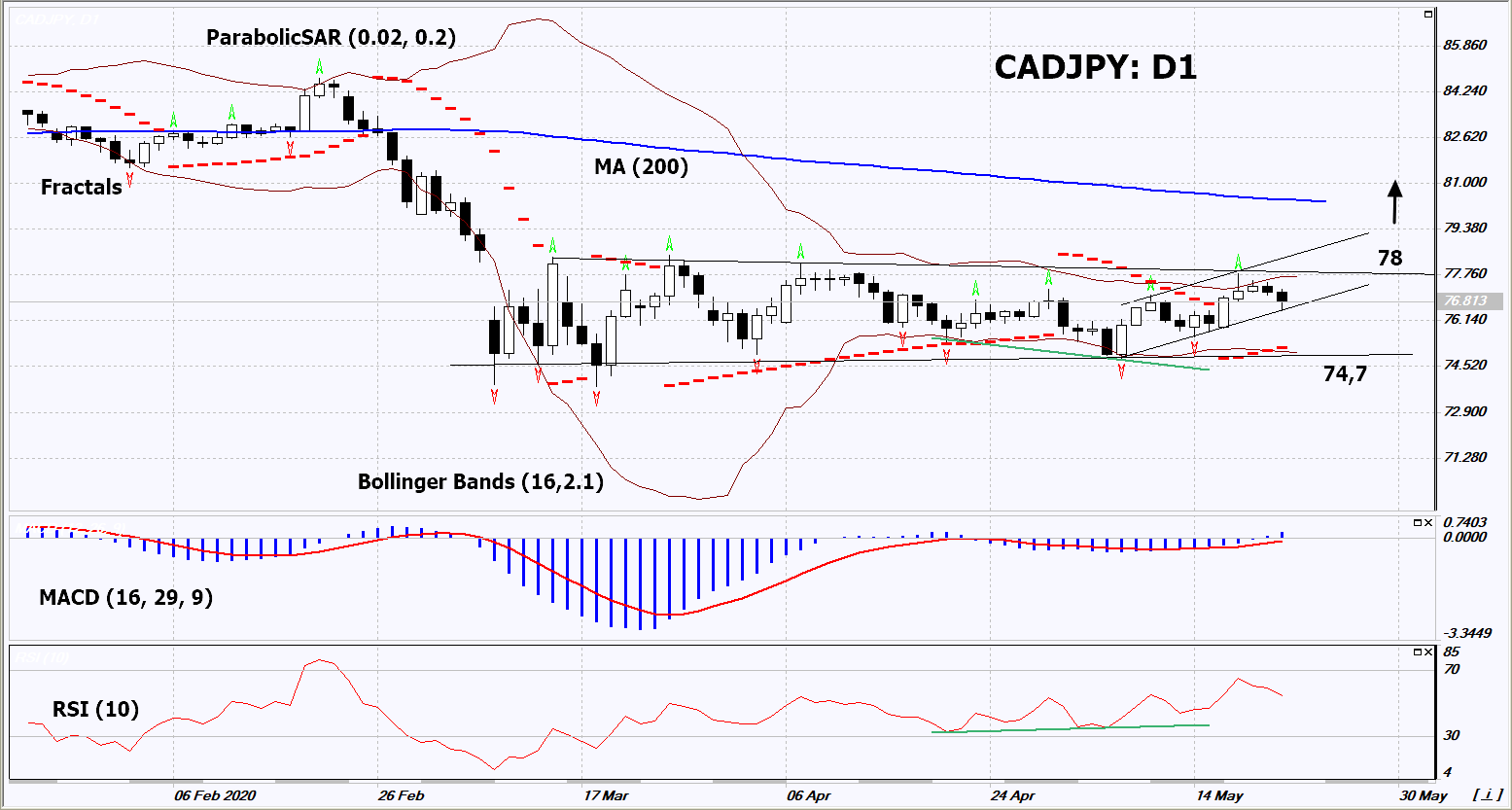

CAD/JPY Phân tích kỹ thuật - CAD/JPY Giao dịch: 2020-05-25

CAD/JPY Tổng quan phân tích kỹ thuật

Trên 78

Buy Stop

Dưới 74,7

Stop Loss

| Chỉ thị | Tín hiệu |

| RSI | Mua |

| MACD | Mua |

| MA(200) | Trung lập |

| Fractals | Trung lập |

| Parabolic SAR | Mua |

| Bollinger Bands | Trung lập |

CAD/JPY Phân tích biểu đồ

CAD/JPY Phân tích kỹ thuật

On the daily timeframe, CADJPY: D1 is in a narrow, short-term, neutral trend. It must be breached up before opening a buy position. A number of indicators of technical analysis formed signals for a further increase. We do not exclude a bullish movement if CADJPY rises above the last upper fractal and the upper Bollinger line: 78. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the lower Bollinger line and the last 2 lower fractals: 74.7. Recall that the record low of this currency pair was in December 1999 and amounted to 68.57, and the maximum in November 2007 was 125.55. After opening the pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss level (74.7) without activating the order (78), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

Phân tích vĩ mô Forex - CAD/JPY

Oil rises in price in the world market, which supports the Canadian dollar. The Japanese yen may lose some of its attractiveness as a safe heaven currency as Covid-19 risks to the global economy decrease. Will CADJPY quotes grow?

The upward movement shows the strengthening of the Canadian dollar and the weakening of the Japanese yen. The share of energy products in Canada's exports reaches 30%. They include oil and petroleum products, natural gas and coal. The cost of energy products correlates with oil quotes. As a rule, the Canadian dollar strengthens with rising prices for hydrocarbons. There are chances that the Canadian economy can overcome the negative impact of the coronavirus pandemic without heavy losses. Retail sales in Canada decreased by 10% in March 2020 compared to February figures, as expected. However, retail sales except automobiles fell only by 0.4%. This is much better than the forecast of -5%. Another positive factor for the Canadian dollar may be deflation (negative inflation) in April. The consumer price index fell by 0.2% year-on-year. Let's recall that the Bank of Canada rate is + 0.25%. A regular meeting of the Bank of Japan took place on Friday, at which the rate of -0.1% was maintained. The regulator confirmed that it will continue to issue yen in order to support Japanese companies. Inflation in Japan in March was + 0.1% in annual terms. The ratio of inflation and central bank rates of the two countries, theoretically, can support the Canadian dollar against the yen.

Lưu ý:

Bài tổng quan này mang tính chất tham khảo và được đăng miễn phí. Tất cả các dự liệu trong bài viết được lấy từ các nguồn thông tin mở và được công nhận đang tin cậy. Nhưng không có bất kỳ đảm bảo nào rằng thông tín hoàn toàn đang tin cậy. Sau này không điều chỉnh lại nữa. Tất cả thông tin trong bài tổng quan, bao gồm ý kiến, chỉ số, biểu đồ và khác chỉ mang tính chất tham khảo và không phải là lời khuyên đầu tư. Tất cả bài viết này không được xem xét như lời khuyên thúc đẩy để giao dịch. Công ty IFC Markets và nhân viên không chịu trách nghiệm cho bất kỳ quyết định của khách hàng sau khi đọc xong bài tổng quan.