- マーケット分析

- テクニカル分析

CAD/JPY テクニカル分析 - CAD/JPY 取引:2020-05-25

CAD/JPY テクニカル分析のサマリー

Above 78

Buy Stop

Below 74,7

Stop Loss

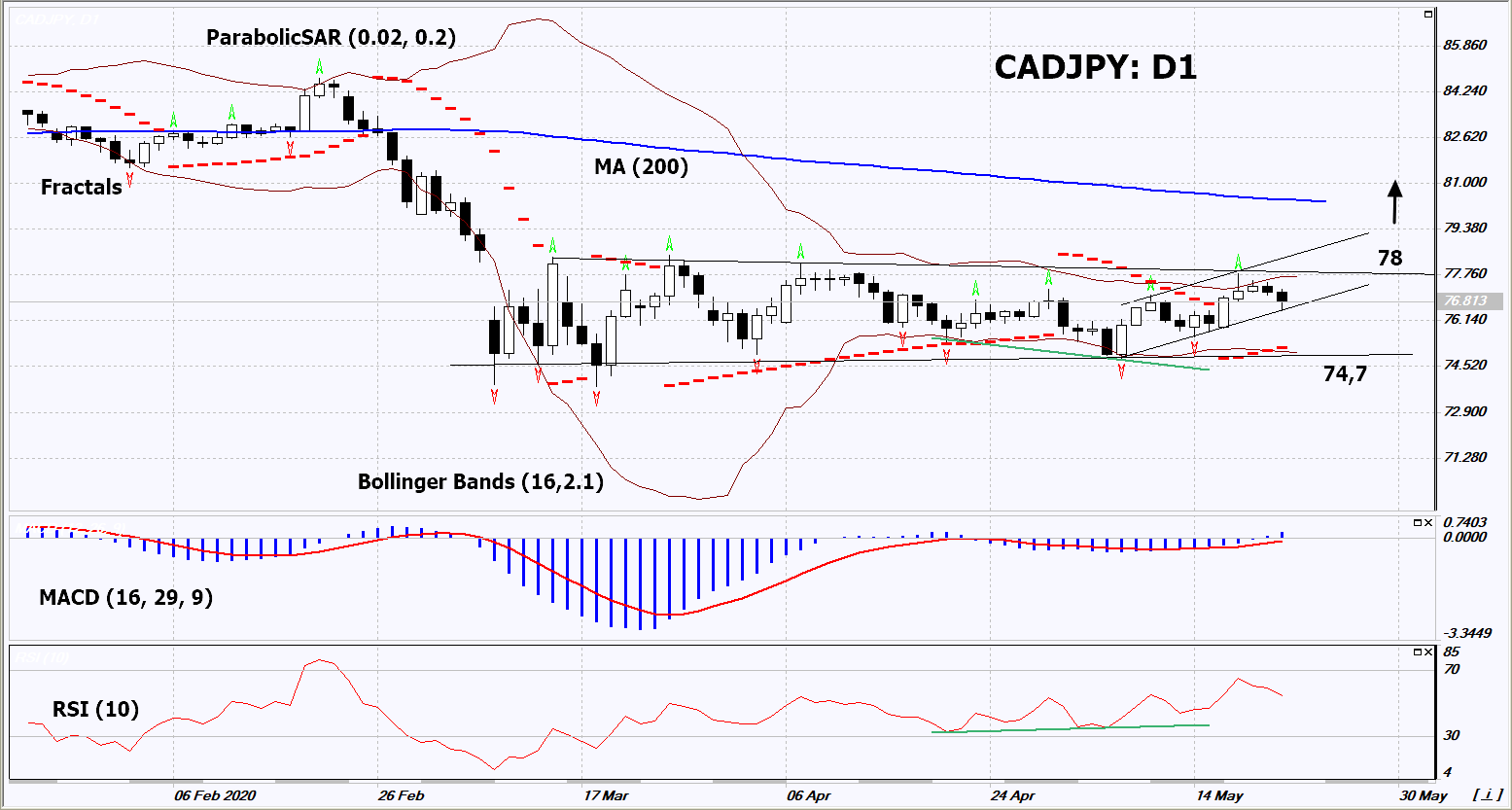

| インジケーター | シグナル |

| RSI | 買い |

| MACD | 買い |

| MA(200) | 横ばい |

| Fractals | 横ばい |

| Parabolic SAR | 買い |

| Bollinger Bands | 横ばい |

CAD/JPY チャート分析

CAD/JPY テクニカル分析

On the daily timeframe, CADJPY: D1 is in a narrow, short-term, neutral trend. It must be breached up before opening a buy position. A number of indicators of technical analysis formed signals for a further increase. We do not exclude a bullish movement if CADJPY rises above the last upper fractal and the upper Bollinger line: 78. This level can be used as an entry point. We can set a stop loss below the Parabolic signal, the lower Bollinger line and the last 2 lower fractals: 74.7. Recall that the record low of this currency pair was in December 1999 and amounted to 68.57, and the maximum in November 2007 was 125.55. After opening the pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal minimum. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to a four-hour chart and set a stop loss, moving it in the direction of the trend. If the price meets the stop loss level (74.7) without activating the order (78), it is recommended to delete the order: the market sustains internal changes that have not been taken into account.

分析 外為 - CAD/JPY

Oil rises in price in the world market, which supports the Canadian dollar. The Japanese yen may lose some of its attractiveness as a safe heaven currency as Covid-19 risks to the global economy decrease. Will CADJPY quotes grow?

The upward movement shows the strengthening of the Canadian dollar and the weakening of the Japanese yen. The share of energy products in Canada's exports reaches 30%. They include oil and petroleum products, natural gas and coal. The cost of energy products correlates with oil quotes. As a rule, the Canadian dollar strengthens with rising prices for hydrocarbons. There are chances that the Canadian economy can overcome the negative impact of the coronavirus pandemic without heavy losses. Retail sales in Canada decreased by 10% in March 2020 compared to February figures, as expected. However, retail sales except automobiles fell only by 0.4%. This is much better than the forecast of -5%. Another positive factor for the Canadian dollar may be deflation (negative inflation) in April. The consumer price index fell by 0.2% year-on-year. Let's recall that the Bank of Canada rate is + 0.25%. A regular meeting of the Bank of Japan took place on Friday, at which the rate of -0.1% was maintained. The regulator confirmed that it will continue to issue yen in order to support Japanese companies. Inflation in Japan in March was + 0.1% in annual terms. The ratio of inflation and central bank rates of the two countries, theoretically, can support the Canadian dollar against the yen.

【重要な注意事項】:

本レポートは、当社の親会社であるアイエフシーマーケットが作成したものの邦訳です。本レポートには、当社のサービスと商品についての情報を含みますが、お客様の投資目的、財務状況、資金力にかかわらず、情報の提供のみを目的とするものであり、金融商品の勧誘、取引の推奨、売買の提案等を意図したものではありません。 本レポートは、アイエフシーマーケットが信頼できると思われる情報にもとづき作成したものですが、次の点に十分ご留意ください。アイエフシーマーケットおよび当社は、本レポートが提供する情報、分析、予測、取引戦略等の正確性、確実性、完全性、安全性等について一切の保証をしません。アイエフシーマーケットおよび当社は、本レポートを参考にした投資行動が利益を生んだり損失を回避したりすることを保証または約束あるいは言外に暗示するものではありません。アイエフシーマーケットおよび当社は、本レポートに含まれる不確実性、不正確性、不完全性、誤謬、文章上の誤り等に起因して、お客様または第三者が損害(直接的か間接的かを問いません。)を被った場合でも、一切の責任を負いません。