- Analisi

- Analisi Tecnica

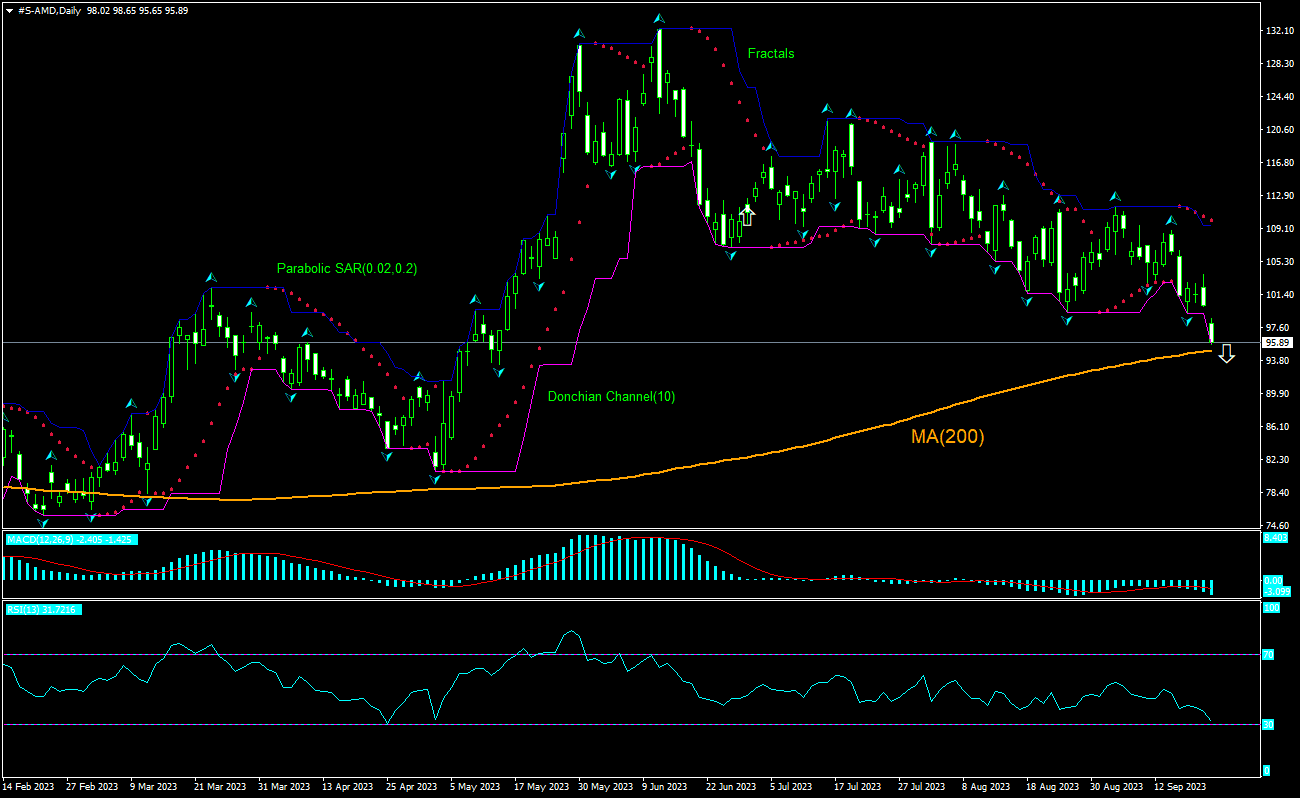

Advanced Micro Devices Inc. Analisi Tecnica - Advanced Micro Devices Inc. Trading: 2023-09-22

Advanced Micro Devices Inc. Technical Analysis Summary

Sotto 95.65

Sell Stop

Sopra 103.74

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Sell |

| Parabolic SAR | Sell |

Advanced Micro Devices Inc. Chart Analysis

Advanced Micro Devices Inc. Analisi Tecnica

The technical analysis of the AMD stock price chart on daily timeframe shows #S-AMD,Daily is declining to test the 200-day moving average MA(200) which is starting to level off. RSI indicator is poised to enter the “Oversold “ zone. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 95.65. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 103.74. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (103.74) without reaching the order (95.65), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisi Fondamentale Azioni - Advanced Micro Devices Inc.

AMD stock continued sliding despite the chip maker’s launch of new processors. Will the AMD stock price continue retreating?

This Monday AMD announced availability of new processors from its 4th Generation EPYC CPU family of workload-optimized processors. The chip maker says new AMD EPYC™ 8004 Series processors deliver exceptional energy efficiency and strong performance in single-socket packages supported by Dell Technologies, Ericsson, Lenovo, Supermicro and others, and are validated for Microsoft Azure Stack HCI. The next day the company announced AMD Kria K24 System-on-Module (SOM) and KD240 Drives Starter Kit. These latest additions to the Kria portfolio of adaptive SOMs and developer kits offer shorter times to market for powering electric drives and motor controllers used in compute-intensive digital signal processing applications without requiring FPGA programming expertise (Field Programmable Gate Arrays - semiconductor devices that are based around a matrix of configurable logic blocks connected via programmable interconnects). The K24 SOM (commercial and industrial versions) and KD240 Drives Starter Kit are available to order now via direct order and worldwide channel distributors. Shares of the company added 0.8% on Monday but then resumed their retreating. Widening the product line by launching new processors is bullish for a chip maker’s stock price. However, the current setup is bearish for AMD stock price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account Note:

Questa panormaica è di carattere informativo-educativo e viene pubblicata gratuitamente. Tutti i dati compresi nella panoramica sono ottenuti da fonti pubbliche conosciute più o meno affidabili. Inoltre non c'è alcuna garanzia che le informazioni fornite siano precise e complete. Le panoramiche non vengono aggiornate. Tutta l'informazione in ciascuna panoramica, compresi indicatori, opinioni, grafici e o quant'altro, è fornita a scopo conoscitivo e non è un consiglio finanziario. Tutto il testo e qualsiasi delle sue parti, e anche i grafici non possono essere considerati un'offerta per effettuare un'operazione con un qualsiasi asset. IFC Markets e i suoi impiegati in alcun caso non sono responsabili per qualsiasi azione intrapresa sulla base delle informazioni contenute.