- 분석

- 기술적 분석

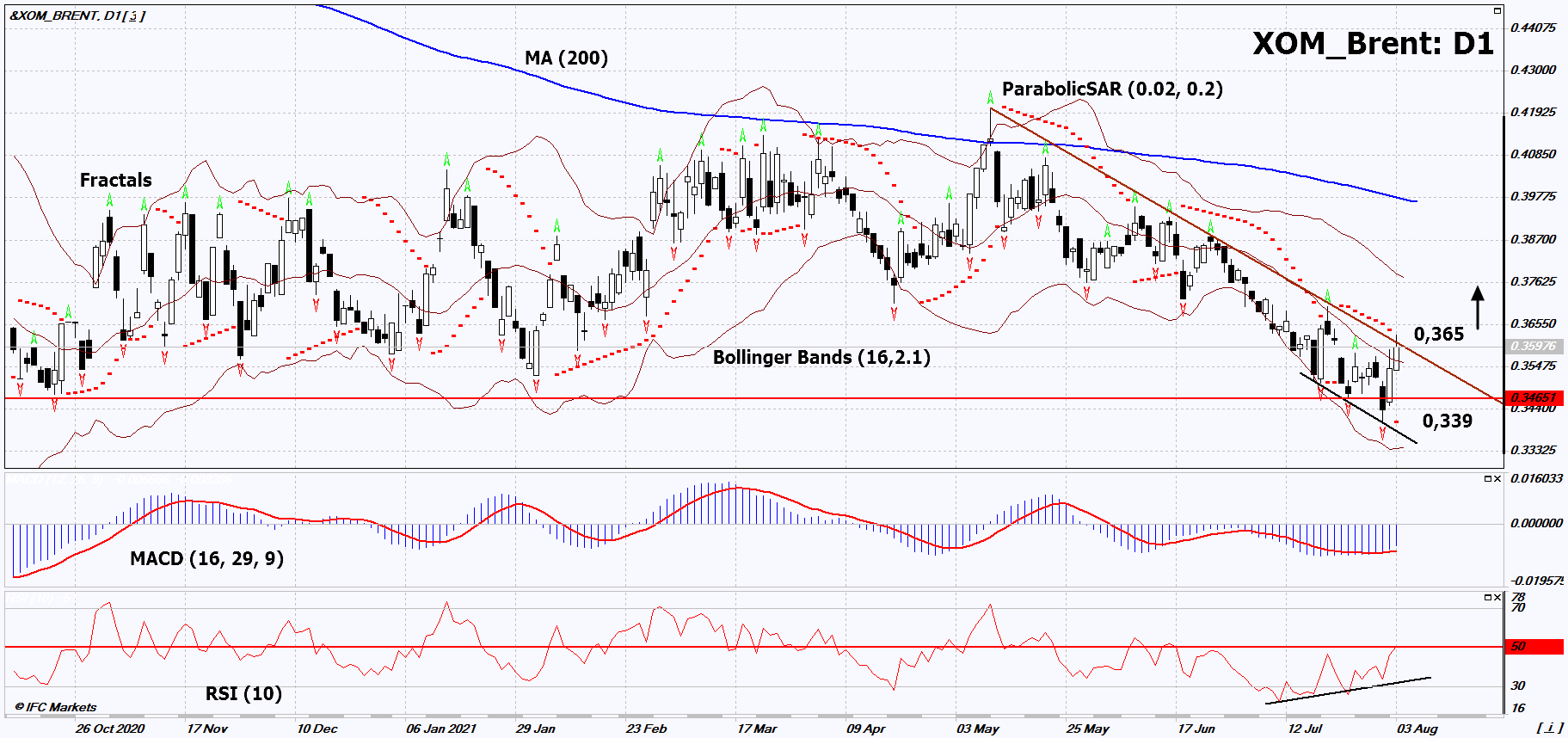

Exxon Stocks 기술적 분석 - Exxon Stocks 거래: 2021-08-04

XOM Oil 기술적 분석 요약

위에 0.365

Buy Stop

아래에 0.339

Stop Loss

| 인디케이터 | 신호 |

| RSI | 구매 |

| MACD | 구매 |

| MA(200) | 중립적 |

| Fractals | 중립적 |

| Parabolic SAR | 구매 |

| Bollinger Bands | 중립적 |

XOM Oil 차트 분석

XOM Oil 기술적 분석

On the daily timeframe, XOM_Brent: D1 approached the downtrend resistance line. It must be broken upward before opening a position. A number of technical analysis indicators have generated signals for further growth. We do not rule out a bullish movement if XOM_Brent rises above its last high: 0.365. This level can be used as an entry point. Initial risk limitation is possible below the Parabolic signal, the low since October 2013 and the last down fractal: 0.339. After opening a pending order, move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit / loss ratio in our favor. The most cautious traders, after making a deal, can go to the four-hour chart and set a stop-loss, moving it in the direction of movement. If the price overcomes the stop level (0.365) without activating the order (0.339), it is recommended to delete the order: there are internal changes in the market that were not taken into account.

PCI - XOM Oil 기본 분석

In this review, we suggest looking at the XOM_Brent personal composite tool (PCI). It reflects the price action of the shares of the American oil company Exxon Mobil Corporation against the deliverable futures for Brent crude oil. Will the XOM_Brent quotes rise?

The growth of this PCI means that Exxon Mobil shares are appreciating faster than oil. The company's 2Q2021 financials were better than expected. Earnings per share amounted to $ 1.1 against the forecast of $ 0.97. The total profit was $ 4.7 billion. In the 2nd quarter of 2020, the financial result was much worse. The loss per share was $ 0.26, and the total loss was $ 1.1 billion. Exxon Mobil's revenues in the 2nd quarter of 2021 reached $ 67.7 billion and exceeded the forecast of $ 65 billion. the current share price is about 6% per annum. In turn, oil quotes are now declining amid an increase in the number of patients with the new strain of the Delta coronavirus in the United States and China. This can reduce the demand for fuel. Also, expectations of a new round of talks between Iran and Western countries on easing sanctions and the "nuclear deal" have a negative impact on the price of oil. Earlier, Iran was going to increase oil production by 1.5 million barrels per day if the sanctions were lifted.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.