- 분석

- 최고 승자 / 패자

Top Gainers/Losers: Euro and Dollar

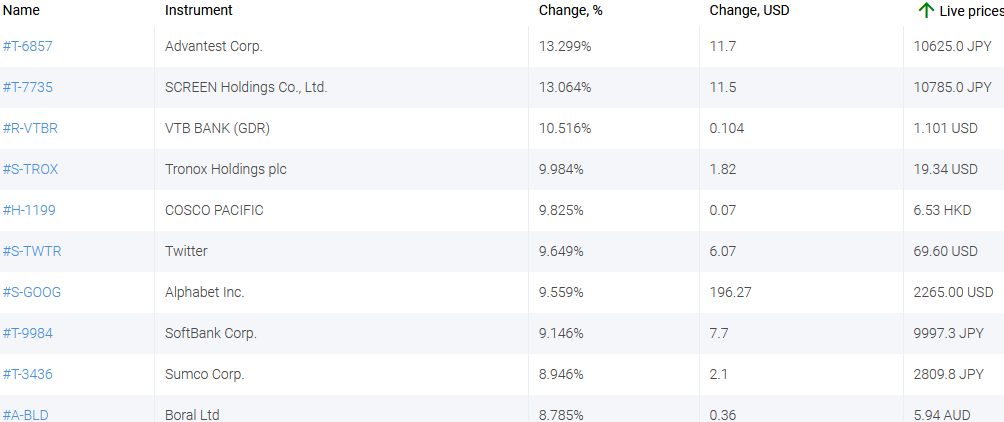

Top Gainers – The World Market

Top Gainers – The World Market

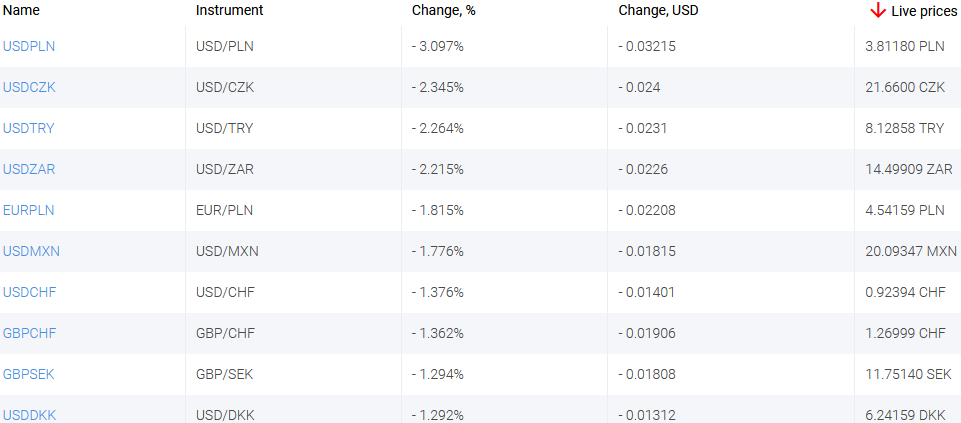

Over the past 7 days, the US dollar weakened against almost all currencies. The main reason for this was Joe Biden's new plan to improve American infrastructure in the amount of $2 trillion. The overall package of economic stimulus measures may reach $4 trillion, which increases inflationary risks. The American economy is showing signs of active recovery from the coronavirus pandemic. Nevertheless, according to the March FOMC Minutes, the Fed intends to maintain low rates and soft monetary policy. This is another factor leading to the weakening of the greenback. In turn, the euro strengthened in anticipation of the resumption of mass vaccinations in Europe. In addition, in March the growth of the Markit PMI in the manufacturing and services sectors in Europe exceeded forecasts.

1.Advantest Corporation, +13,3% – a Japanese manufacturer of semiconductor, fiber-optic, measuring and digital equipment

2. SCREEN Holdings Co., Ltd, +13% – a Japanese manufacturer of semiconductor technology, liquid crystal displays, optical disks and information carriers

Top Losers – The World Market

Top Losers – The World Market

1. China Minsheng Banking Corp Ltd – a Chinese bank

2. China Evergrande Group – Chinese real estate and development company.

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. USDRUB, EURRUB - the growth of these charts means the weakening of the Russian ruble against the US dollar and the euro.

2. EURHKD, EURGBP - the growth of these charts means the strengthening of the euro against the Hong Kong dollar and the British pound.

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. USDPLN, USDCZK - the drop in these charts means the weakening of the US dollar against the Polish zloty and the Czech koruna.

2. USDTRY, USDZAR - the drop in these charts means the strengthening of the Turkish lira and the South African rand against the US dollar.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.

LAST_TOPGAINERS

Over the past 7 days, the American dollar has remained almost unchanged. According to the CME FedWatch tool, there is an 89% probability of the U.S. Federal Reserve raising interest rates at the meeting on July 26th. The Swiss franc has strengthened due to positive economic indicators such as Credit...

Over the past 7 days, the US dollar index has declined. As expected, the Federal Reserve (Fed) maintained its interest rate at 5.25% during the meeting on June 14. Now, investors are monitoring economic statistics and trying to forecast the change in the Fed's rate at the next meeting on July 26. The...

Over the past 7 days, the US dollar index has remained largely unchanged. It has been trading in a narrow range of 103.2-104.4 points for the 4th week in a row. Investors are awaiting the outcome of the Federal Reserve meeting on June 14. Tesla shares have risen due to the opening of new gigafactories...