- Analytics

- Market Overview

Bullish oil market boosts risk appetite - 11.10.2016

US stocks follow oil higher

US stocks closed higher on Monday lifted by optimism over rising oil prices as comments by Saudi Energy Minister and Russian President Putin bolstered expectations OPEC would reach a deal to cut production. The dollar strengthened: the live dollar index data show the ICE US Dollar Index, a measure of the dollar’s value against a basket of six major currencies, rose 0.2% to 96.872.

The Dow Jones industrial average rose 0.5% to 18329.04 led by 2% jump in shares of Exxon Mobil and 1.8% gain in Apple and Merck shares. The S&P 500 closed 0.5% higher settling at 2163.66 led by 1.5% gain in energy stocks. The Nasdaq composite ended 0.7% higher at 4893.77. Energy companies advanced after Saudi Arabia’s energy minister Khalid al-Falih said he was optimistic that major oil producers could agree to cut production this year and crude price could rise to $60 a barrel. Russian President Vladimir Putin’s confirmation of his intention to freeze or even cut crude output added to market optimism. No important economic data were released on Monday as government offices were closed for Columbus Day holiday. Earnings season unofficially begins today with Alcoa Inc. reports. Expectations are not different from previous quarters with S&P 500 constituents expected to extend their earnings recession to a sixth straight quarter. Declining earnings are limiting advances in market indexes together with expectation of a rate hike by Federal Reserve by the end of the year. Today at 12:00 CET National Federation of Independent Business August Small Business Index will be released. The tentative outlook is positive for dollar. At 16:00 CET Labor Market Conditions Index will be published, and at 20:00 CET September Federal Budget will be published.

Higher oil lifts European stocks

European stocks rose on Monday led by energy and financial stocks. The euro and British Pound extended losses against the dollar.

The Stoxx Europe 600 closed 0.7% higher. Spanish Repsol rallied 3% and Norwegian Statoil added 2.7% after bullish comments by Saudi Arabia’s energy minister Khalid al-Falih and Russian President Vladimir Putin about the prospect of crude oil output cut by OPEC. Deutsche Bank closed 3.4% higher rebounding from early losses after news bank’s chief executive John Cryan didn’t reach a deal late last week with the Justice Department over the selling of mortgage-related securities. Analysts note the revelation that Deutsche Bank may have received special treatment in bank stress tests lifted the stock of Germany’s biggest bank, pointing to the support of the European Central Bank as a lender of last resort in a crisis. Germany’s DAX 30 index rallied 1.3% to 10624.08. France’s CAC 40 gained 1.1% and UK’s FTSE 100 closed 0.8% higher at 7097.50. Today at 11:00 CET October ZEW Economic Sentiment will be published in euro-zone, the outlook is positive for euro.

Nikkei leads Asian stocks

Asian stocks are rising today led by 1.0% gain in Nikkei as weaker yen boosted investors’ risk appetite and mining companies advanced on oil gains overnight. Chinese stocks are advancing today after Beijing announced plans to reduce rising corporate debt by encouraging mergers and acquisitions, bankruptcies, debt-to-equity swaps and debt securitization. The Shanghai Composite Index gained 0.6% while the Hang Seng index dropped 1.3% on profit taking after trading resumed following Monday's holiday. Australia’s All Ordinaries Index ended 0.12% higher with Australian dollar retreating.

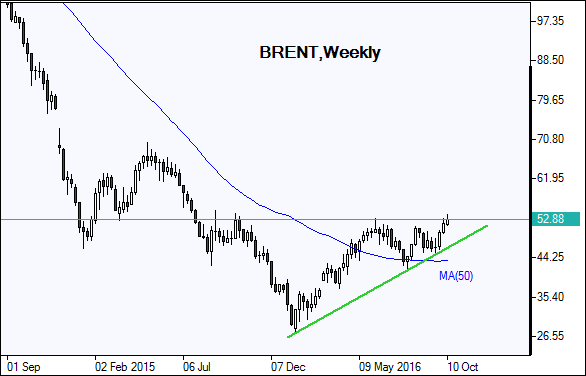

Oil prices are retreating

Oil futures prices are pulling back today after a boost on Monday as bullish comments by Saudi Arabia’s energy minister and Russian President Vladimir Putin in Istanbul indicated major oil produces may agree on output cut at OPEC meeting on November 30 in Vienna to keep output between 32.5 million and 33 million barrels a day. It is hard to predict whether OPEC would actually manage to come to an agreement on who is going to cut and by how much. Igor Sechin, the head of Russia’s Rosneft major oil producer, said his company will not cut or freeze oil production as part of a possible agreement with OPEC. The December contract for Brent jumped 2.3% to $53.14 a barrel on London’s ICE Futures exchange on Monday, the highest since August 31, 2015.

See Also