- Analytics

- Market Overview

Fed minutes point to tightening soon - 13.10.2016

US stocks inch higher despite minutes show rate hike likely soon

US stocks closed mostly higher on Wednesday despite Fed minutes confirming policy makers plan to hike rates soon. The dollar ended higher as minutes showed Federal Open Market Committee members supported monetary tightening but wanted to see more data pointing to accelerating inflation and growth.

The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six major currencies, rose 0.28% to 97.959. The Dow Jones industrial average gained 0.1% to 18144.20 with the shares of Nike and Apple leading the blue chip index higher. The S&P 500 added 0.1% settling at 2139.21 led by real estate, utilities and telecom stocks. The Nasdaq lost 0.2% to 5239.02 with selloff in biotechnology stocks dragging the technology index lower. The minutes revealed policy makers plan to hike rates “relatively soon” but held off raising interest rates at September meeting as they wanted to see more evidence of full employment and gains in inflation. Market participants are expecting currently the Fed will raise rates in December, with rate hike expectations limiting gains in stock prices. On Wednesday, New York Fed President William Dudley said interest rate hikes will be “gentle.” Falling corporate earnings expectations for the third quarter, the sixth straight quarterly decline, weigh market sentiment despite expectations sales should rebound after six quarters of declines. Today at 14:30 CET Initial Jobless Claims and Continuing Claims will be released in US. At the same time September Import Prices will be published, the tentative outlook positive. At 18:15 CET Fed President Harker will speak about the US economy in Philadelphia.

Selloff in technology and energy stocks weighs on euro-zone markets

European stocks closed lower on Wednesday following selloff in technology stocks and declining oil prices. The euro weakened against the dollar ahead of Fed minutes while Pound recovered from multiyear lows after UK Prime Minister Theresa May agreed to allow members of parliament scrutinize the government’s strategy over the UK leaving the European Union.

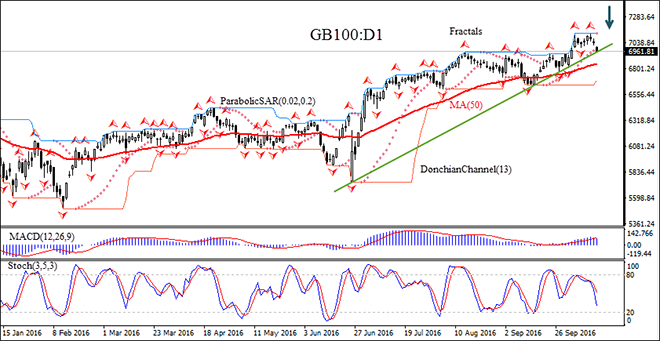

Investors were concerned UK may end locked out of European Union common market in a hard exit deal, and Parliament’s vote on the deal is seen as increasing the chance UK could stay in the common market. The Stoxx Europe 600 fell 0.5%. Technology stocks sold off after Ericsson shares sank 20% on profit warning third-quarter earnings will be “significantly lower” than expected. Markets closed lower despite positive economic data: euro-zone industrial production strengthened in August. Germany’s DAX 30 index finished 0.5% lower at 10523.07. France’s CAC 40 lost 0.4% and UK’s FTSE 100 fell 0.7% to 7024.01. Today September final Consumer Price Index came in unchanged in Germany at 0.7% annual rate.

Asian markets fall on weak Chinese trade data

Asian stocks are falling today with disappointing Chinese trade data adding to cautious investor mood. The 10% drop in Chinese exports in September over the same period a year ago in dollar terms was sharper-than-expected while imports fell 1.9% instead of expected 0.7% growth. Weak Chinese trade data raised concerns the world’s second-largest economy is slowing down. The Shanghai Composite Index is 0.1% up while Hong Kong’s Hang Seng index is down 1.6%. Australia’s All Ordinaries Index fell 0.6%. The Nikkei finished 0.4% lower at 16774.24 today as yen strengthened.

Oil declines as OPEC output and US inventories rise

Oil futures prices are falling today on reports OPEC production has risen to the highest level in eight years and US crude stockpiles rose last week. OPEC on Wednesday reported its oil production climbed in September to 33.39 million barrels per day (bpd), up 220 thousand bpd in August. The American Petroleum Institute reported yesterday US crude inventories rose by 2.7 million barrels to 470.9 million barrels last week, the first rise following five straight weeks of declines. December Brent crude fell 1.1% to $51.81 a barrel on London’s ICE Futures exchange on Wednesday. At 17:00 CET today the Energy Information Agency will release US Crude Oil Inventories.

See Also