- Analytics

- Market Overview

Eventful week begins - 30.11.2015

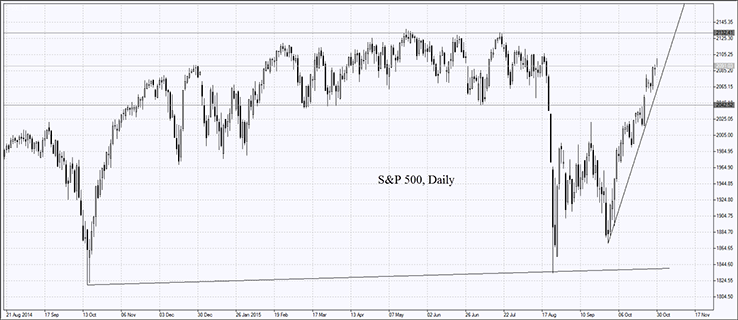

On Friday the US stocks were almost flat. The exchanges were open three hours less after the Thanksgiving Day on Thursday. The trading volume was only 2.8bn shares which is well below the last 7 trading days average of 7bn. shares. The Walt Disney stocks slid 3% after the report its cabel network ESPN lost almost 3mln subscribers this year. Markets were disappointed by the start of the US sale season on Black Friday. The Urban Outfitters stocks edged 2.7% lower, the Gap Inc stocks lost 2.5%, the Signet Jewelers stocks fell 1.7%. The Men's Wearhouse, Tiffany & Co and Best Buy fell slightly more than 1%, while Wal-Mart, J.C. Penney and Amazon.com lost almost 1% each. Sales may increase by 3.7% during the Pre-New Year season this year, according to the National Retail Federation. This is less than the last-year growth of 4.1%. Given the historically low US unemployment, such slowed growth can be explained by low wages. The National Retail Federation conducted a survey that showed the Americans were ready to spend $300 on average on this Thanksgiving Day, compared to $381 last year. Amid the stock market stagnation, the US dollar index live data show the index hit a fresh 8.5 month high. On December 3 the ECB meeting is scheduled where the additional measures to stimulate the European economy may be adopted. Monetary easing weakens the euro making the US dollar stronger. Dollar edged up 3% in a month and almost 11% since the start of the year. The current week will be eventful. On December 4 the US labour market data will be released that are key for the Fed interest rate hike decision on the next meeting due on December 16. Today at 16:00 CET the US pending home sales for October will be released, the tentative outlook is positive.

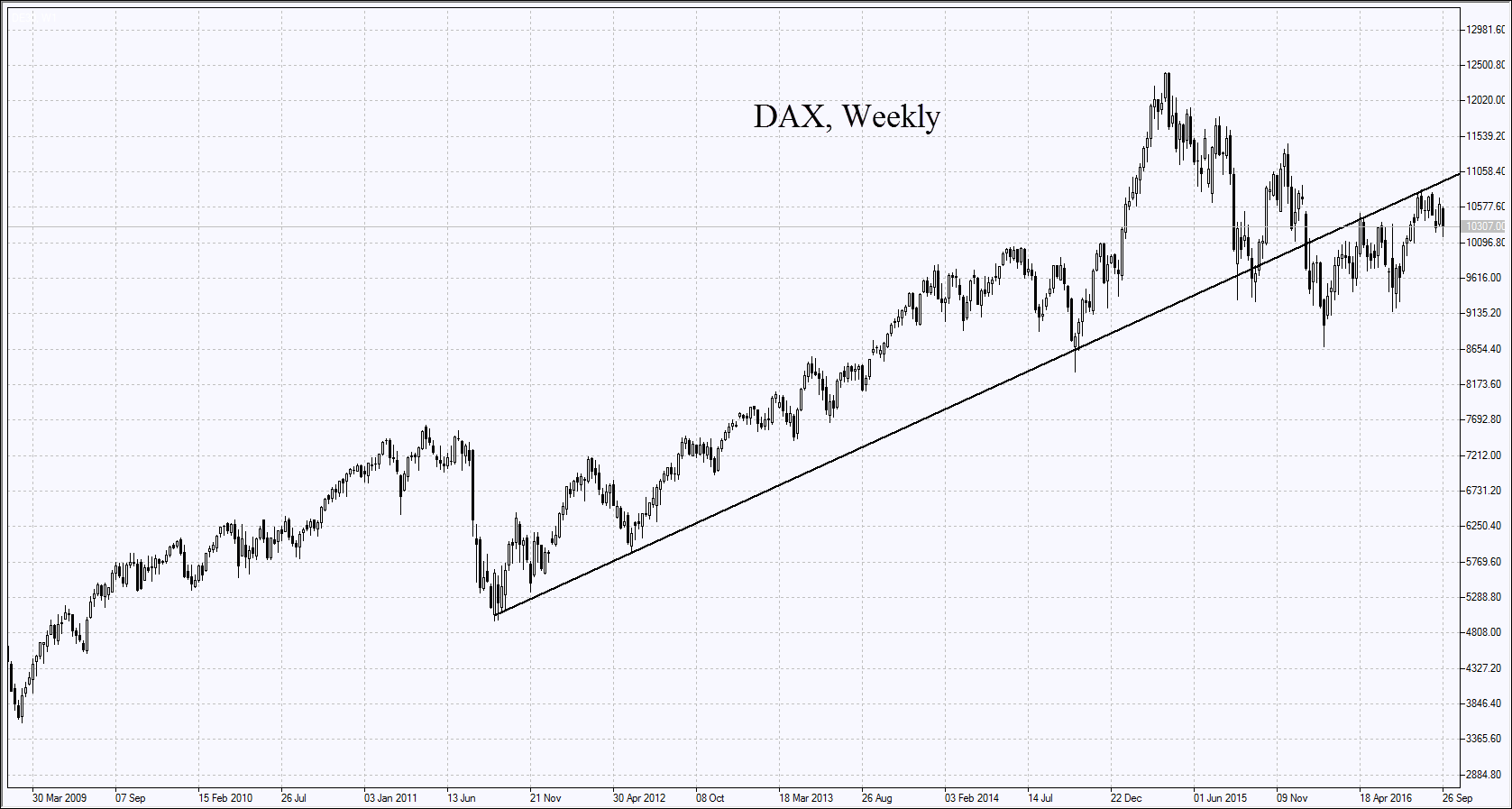

European stocks are extending last week’s gains today fuelled by the probable further monetary easing by ECB that improves the liquidity. The Belgian financial group Kleinwort Benson saw its stocks soar by 12% amid the competition of its potential investors: the French Oddo & Cie bank and the Chinese Fosun. The German air carrier Lufthansa managed to agree with the ground staff trade union Verdi and settled the payments for 33 thousand staff members. Its stocks edged up 2.1%. The air carrier will have to settle the payments to the pilots and cabin crew. Today in the morning the weak German retail sales for October were released. At 14:00 CET the German inflation will be released. If the reading meets the forecast, it may support the euro, in our opinion.

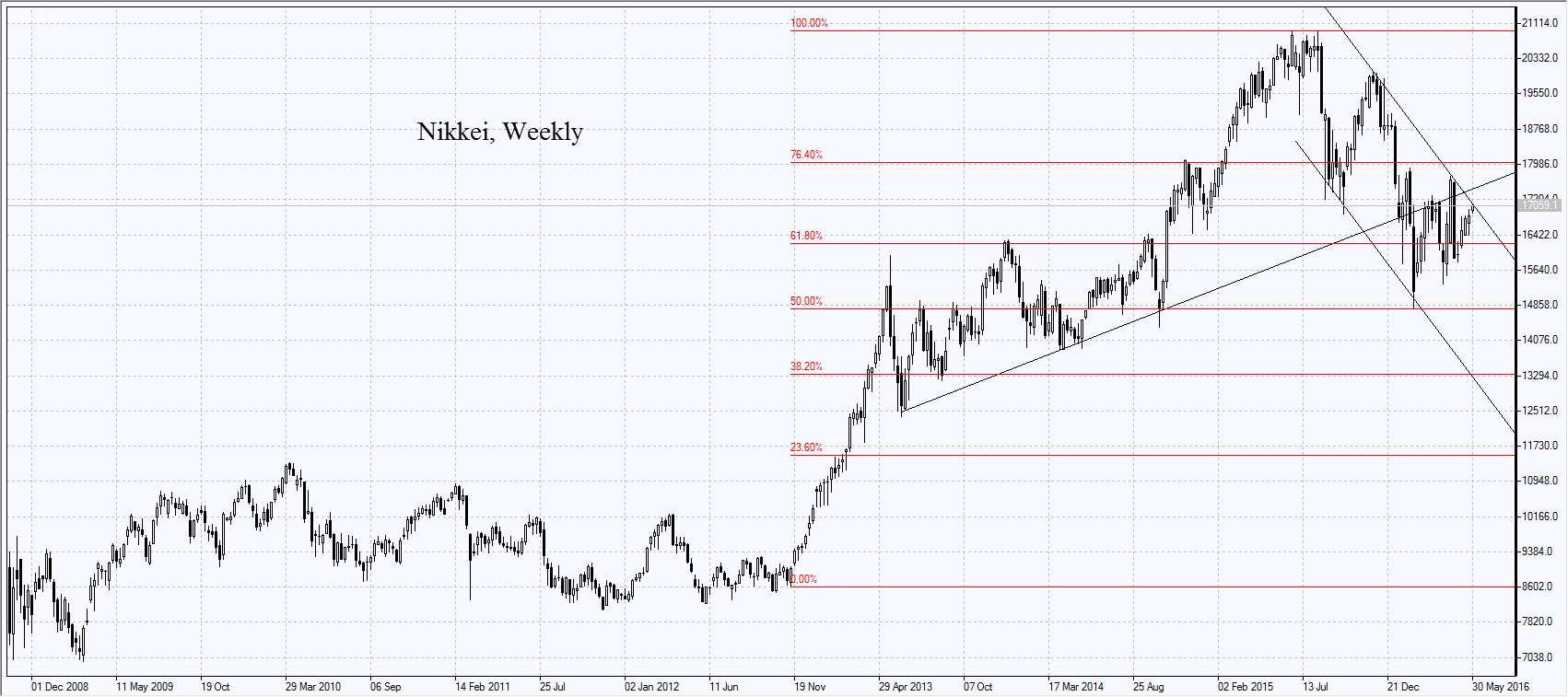

Nikkei index live data show the index slumped today extending yesterday’s losses. Last week it failed to test the psychological resistance at 20000 starting to fall after that. Today early in the morning the industrial production and the building permits for October were released in Japan being lower than expected. The yen is weakening after the Japan’s prime minister Shinzo Abe said on Friday the additional monetary stimulus was possible. The tumbling Chinese stocks on Friday had a strong negative impact on the Nikkei index. The fall was triggered by the news the Chinese officials began to investigate the major local investment companies and the investors’ concerns that the Chinese economic growth was unstable. Tomorrow at 2:00 CET the China’s November PMI will be released, the outlook is rather negative. The data from China may influence the Japanese stock market as well as commodities futures.

OPEC forecasts the global oil demand to expand by 1.25mln barrels a day in 2016 which pushed lower the Brent prices on Friday. The investors do not expect the OPEC production volumes to contract after its meeting on December 4.

See Also