The Bank of Japan at its monetary statement announced that will continue with quantitative and qualitative monetary easing for as long is needed to achieve inflation of 2% with CPI data signaling that is on the right path as inflation turned positive in June. BOJ maintained current monetary stance of increasing monetary base by 60-70 trillion Yen per annum, as well as key rate at record low level of 0.0-0.10%.

The Japanese Yen strengthened against its major counterparty with the

USDJPY pair drawing a resistance earlier at 96.82 and falling to fresh 1 ½ month low at 96.11. The downtrend is well established with recently supportive data for the Yen, thus we would expect lower levels in the intraday but we will minimize exposure before US Jobless Claims.

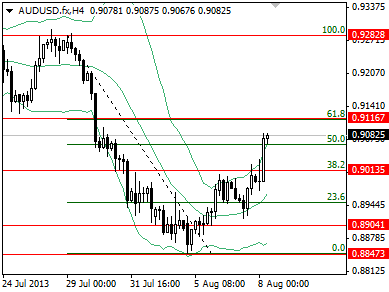

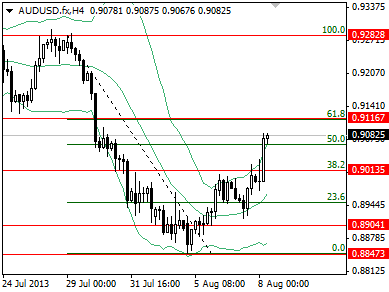

Chinese Trade Surplus narrowed to $17.8B in July but that was due to increasing Imports by 10.9% and Exports by 5.1%. Aussie was well underpinned by CNY Trade data as its major trader counterparty is China. The

AUDUSD corrected higher to 0.9086 with intraday bias being bullish we would expect the pair to go up to 61.8% of 0.9282 to 0.8847, at 0.9116.

Yesterday Bank of England Governor, Mark Carney, introduced policy guidance with knock out criteria for safekeeping price and financial stability. Inflation was in June at 2.9% and is expected to cool down to 2.0% in 18-24 months while growth outlook was upgraded by BOE amid recent improved GDP data and confidence indicators. Concerning Policy Guidance, monetary stance would not tighten unless unemployment rate reduce below 7.0% threshold while asset purchases could increase if warranted. Unemployment rate is currently at 7.8% and projected to drop to 7.3% in 2-year time. However that relation between monetary policy and unemployment rate will be “knocked out” if firstly, inflation in 18-24 months is estimated to be above 2.5%, second inflation expectations are not well anchored and third financial stability is threatened. In our opinion BOE is becoming more effective in setting monetary policy with accommodative stance remaining unchanged that has a positive impact on sterling value. The GBPUSD edged up to 1.5530, overpassing key resistance at 1.5415 and could go up to 1.56.