The

greenback was gaining ground across the board against its major counterparties after Janet Yellen was nominated as the next Fed Chairman, coupled by Fed Minutes of the 17-18 September meeting and eventually there are some chances for short term deal on debt limit to avoid default. The

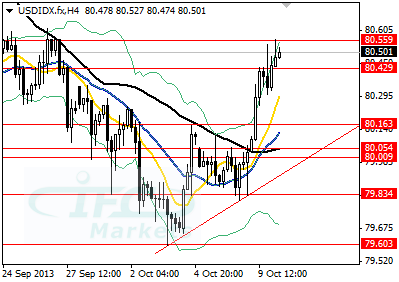

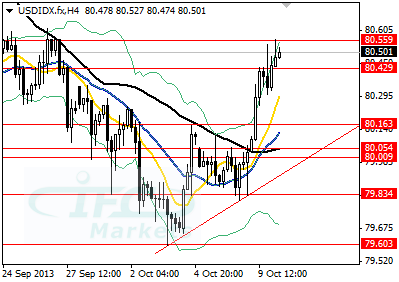

US dollar index advanced as high as 80.55 making its biggest corrective move after a month of declines.

USD Index

To further look into the key drivers of FX market, we firstly consider the

greenback appreciated due to uncertainty ruled out about who would succeed Ben Bernanke, despite that Janet Yellen is perceived as a dove among market participants,

Secondly, the release of the minutes showed that FOMC members talked a lot about moderating asset purchases, with some suggesting tapering by a small amount to signal that Fed moves cautiously. Other members suggested tapering treasury purchases only and keeping the pace of $40B MBS purchases per month to maintain support on housing sector, eventually FOMC members voted to hold the program unchanged. Only Esther L. George voted against holding asset purchases at $85B, supporting tapering. Lastly, it was revealed that most members expect asset tapering to begin in 2013, backing

greenback.

Thirdly, it appears that Democrats and Republicans could agree on a shot term increase for the debt ceiling, to give more time for talks about fiscal issues. At the same time Obama invited lawmakers to the White House to resolve government shutdown. Earlier on Thursday risk appetite recovered slightly on hopes for ending US political impasse with last night US

stock indices turning positive before closing.

Elsewhere, the

EURUSD dipped to support at 1.3486 and is now recovering back to 1.3500, the

GBPUSD softened to support at 1.5920 and remains steady slightly above that level ahead of BOE decision, no change is expected. The

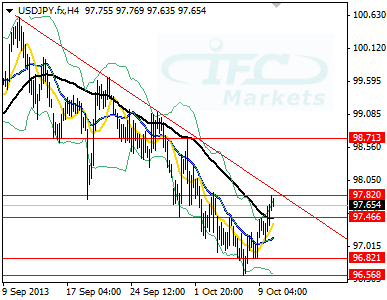

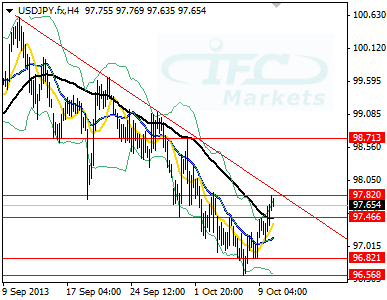

USDJPY breached resistance at 97.46 and climbed to 97.82 limited by falling trend line as recent stronger Japanese data improved risk sentiment and thus weakened

Yen.

USDJPY

Lastly, the

Aussie against the US dollar dropped to 0.9388 as the greenback strengthened but earlier today release of unemployment rate unexpectedly falling to 5.6% supported the pair which was lastly seen approaching 0.9420.