Senate passed yesterday a shot-term deal by 81 votes for and 18 against, to end partial government closure and safe the biggest economy from debt default. US House also approved the agreement by 285-144 votes. However, that is short-term plan and there are chances for the political impasse risk to return soon in the markets as the government is funded until January 15 2014 and borrowing limit is raised until February 7 2014.

Risk appetite improved during US session with US equities closing in green, the

S&P 500 gained 1.38%, Dow Jones industrial Average was up by 1.36% to 15,373.83 and

NASDAQ advanced by 1.20%. Asian equities followed with the NIKKEI 225 climbing by 0.83% to 14,586.51 and S&P/ASX 200 rose by 0.38%.

FX investors seem to be expecting this outcome on US fiscal negotiations as the FX

currency pairs did not react sharply. The

USDJPY jumped as high as 99.00 while we have been expecting a more upside movement, though then dipped back to 98.50. The limited bullish reaction could be also due to the short-term characteristic of the plan agreed between officials.

In addition, there is growing speculation now that the Fed would most likely start asset tapering from mid-2014 instead by the end of 2013 that has been previously anticipated. Therefore, that has increased selling pressure on the

greenback which is also weighed by the possibility that the biggest US creditors(China and Japan) likely to limit their investments in US Treasuries, seeking for opportunities in other nations. Recent Washington events revealed a deep political risk on financial markets. Therefore, the US dollar index dropped from 80.53 to 80.22 in recent trading as the greenback has been weakening against its major peers.

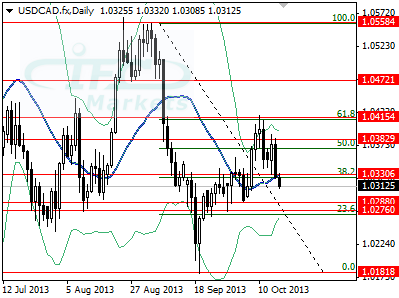

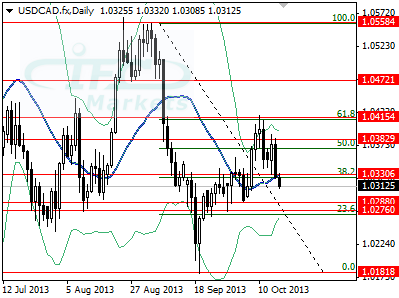

The

USDCAD fell sharply from cap at 1.0415 and breached support at 1.0330 after the end of US lawmakers’ discussions, forming a reversal pattern in technical terms. We would expect more downside potential in the following sessions since we consider the last bullish attempt a corrective wave because it rose exactly at 61.8% of 1.0558 to 1.0181, at 1.0415.

USDCAD