Major currency pairs go into consolidation mode ahead of September Non-Farm Payrolls and market participants speculate over the number the report would reveal. Consensus stands at 180K increase in employment, slightly above the August reading at 169K while the unemployment rate is anticipated to remain unchanged at 7.3%. On the 1st of October the ADP Employment report registered an increase from a downward revised figure at 159K in August to 166K in Sep. coupled by ISM Employment report increasing to 55.4 in Sep. from 53.3 in August, thus we expect this trend to continue over the NFP as well.

Furthermore, in case of a weaker than projected NFP we would expect to see a greater harm on the

US dollar than a benefit by stronger than projected reading. That is because traders have already priced in a delay in asset tapering initiation but that is not guaranteed without improving figures on employment and for jobless rate to hold its downward move. The

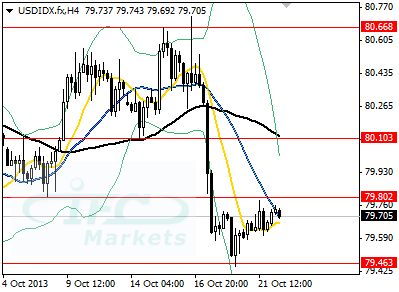

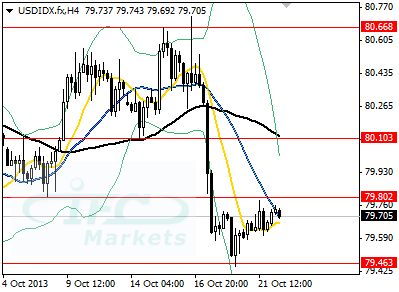

US dollar index has been smashed in recent trading, falling to 79.46, as the 16-day government shutdown would take a toll on biggest economy 2013 growth of around 0.4%

US Dollar Index

We are expecting employment report with great interest as well, although we prefer to avoid projections we can make possible scenarios. Firstly, we could see a conflicting result should the NFP reading be significantly below estimates because that could have a negative impact on risk sentiment initially. However as traders realize that a weaker report would further delay Fed asset purchases reduction, risk appetite would most probably recover and then improve. In the latter case, we consider

USDJPY could dip below 98.00 initially as the

greenback would weaken and the

Yen would strengthen but then the pair could enter in sideways. The

AUDUSD could be a good opportunity to buy because is likely to breach cap at 0.9677 and continue all the way up to 0.99.

Nevertheless, should the reading be well above expectations

US dollar would strengthen across the board and that would further continue as speculation would be triggered over asset tapering likely in early 2014. Being bearish on

AUDUSD could be a good strategy in that case as well as bearish on

EURUSD could be proved profitable. Lastly in case of not surprises current trends in the FX market are probably going to continue.