- Analytics

- Market Overview

US dollar inched - 27.3.2015

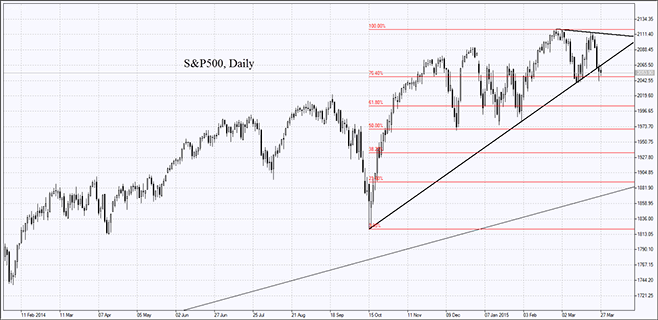

American stocks marked the fourth day of loss on Thursday as US Dollar Index increased. Memory card producer SanDisc cut its earnings forecast and its shares slumped 18.4%. As a result, most semiconductor companies' shares fell, driving down American indices.

Good macroeconomic statistics underpinned the dollar. Initial jobless claims contracted 9 000, outstripping forecasts. Markit Services PMI in March rose to its 6-month strongest. The American stocks trade volume was 3% above the monthly average making up 7 bln shares. Today at 13:30 CET GDP and Personal Spending will be released in the US together with Michigan final Consumer Confidence. The tentative outlook is positive. At 20:45 CET Janet Yellen will hold a conference. Some investors considered early-year economic development to be sluggish. Despite that, they expect FRS to announce it is going to put on hold rate hike.

It is worth mentioning that American index and European stocks futures are in decline. The euro has retreated for 2 consequent days. This morning negative Import Prices in Germany were published. No important economic data are expected in the EU today.

Nikkei has closed in the red zone for 3 straight days. After 6-week winning series it has lost 1.4%. Last night Japanese agencies released macroeconomic data indicating declining inflation. That weakened the yen because investors are concerned that Bank of Japan raises money emission. Currently Japanese central bank conducts easy monetary policy and considers increasing base inflation necessary. Dropping Retail Sales produced additional pressure on Nikkei. Most market participants believe that the index shows a regular pullback and expect further growth. They suppose that Government Pension Investment Fund hasn't reallocated yet its investment portfolio and will buy more domestic stocks.

Oil prices have slipped today following a sharp surge the day before. Investors think that the bombing of Yemen by Saudi Arabia won't affect global oil supply. Meanwhile Iranian oil minister stated that oil quotes will expand to $70 per barrel by the end of 2015. He believes that they fell to their weakest in January and are going to surge.

International Grains Council forecasts contracting wheat and corn production the season 2015/2016, which may lead to under-supply. According to the Council's data, corn crops will decline to 941 mln tons, as compared to 974 mln the previous season. Consumption will show a slower decrease: from 974 mln tons to 961 mln. It will occur because the share of crops in cattle and barn fodder was reduced. Corn reserves will fall from 191 mln tons to 171 mln by the end of 2015/2016 season. According to International Grains Council, wheat production this season will drop to 709 mln tons, while consumption will inch to 711 mln tons. As a result, global wheat reserves will slip from 198 to 196 mln tons. To be pointed out, while corn prices have been relatively stable this week, wheat futures have lost about 5%. Good weather in Great Plains region and around Ohio valley drove wheat prices down. More than that, Department of Agriculture (USDA) reported that wheat exports decreased to their low last year. We remind that, USDA will release two important reports on crops on Tuesday. They may significantly affect market.

See Also