- Analytics

- Market Overview

The US dollar tries to grow - 18.5.2015

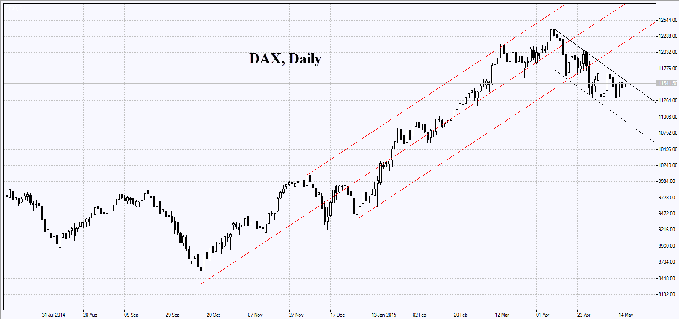

No important economic statistics were announced on Friday, so European indices were traded in a narrow range. Today these dynamics are supposed to continue due to the lack of essential news. Unresolved Greek issue and some corporate reports restrain European stocks as well. BHP Billiton shares lost 5% as its affiliated company South32 carried out an unsuccessful trade. Austrian energy company OMV retreated 1.8% after releasing a weak corporate report. German minister of economic affairs Gabriel Sigmar stated that without economic reforms Greece was unlikely to obtain new credits. Due to these factors the euro have been pulling back from its three-month high, recorded on Friday.

Nikkei has expanded today on positive domestic news. Factory Orders in March were twice as good as expected. Nomura Securities investment bank opened a new trust fund, which may amount to ¥50 bln. Dai-ichi Life insurance company is going to raise coupon payments, so its shares gained 10.6%. On Friday Haruhiko Kuroda will speak after Bank of Japan meeting.

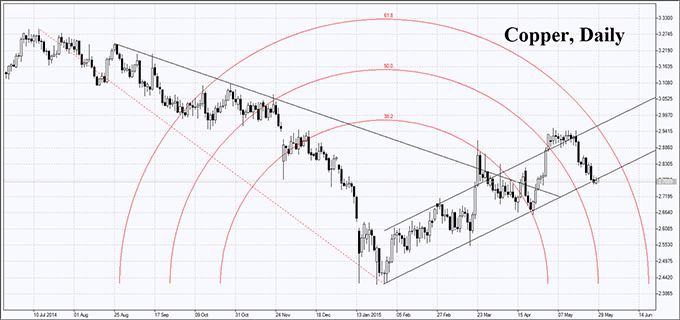

Gold futures have been expanding today for 5 consequent trading sessions, renewing the three-month high amid weak American statistics. Precious metals move in the opposite direction to the American dollar. According to Commodity Futures Trading Commission (CFTC), net long gold, silver and copper volume was increased last weak. Market participants are looking forward to FRS announcements. If Fed representatives are bent towards keeping the current rate, precious metals quotes may advance further.

Copper price remains stable as GFMS agency reported the global production rose 3% in the first quarter due to Congo, Chile and the US. GFMS specialists believe that the current year copper production will also increase 3%. It may result in oversupply, amounting to 400 thousand tons. It is worth mentioning that copper has rallied 20% since the beginning of the year. Chinese companies actively buy copper, since it is used as credit security in the country. According to CFTC, net long copper volume has risen to its strongest since July, 2014.

See Also