- Analytics

- Market Overview

The euro slipped within neutral range - 3.8.2015

American stock indices slipped on Friday due to weak macroeconomic and corporate releases. University of Michigan Consumer Confidence Index in July dropped against expectations. It happened because of slow wages growth in the second quarter – the increase was the lowest in 33 years. Exon Mobil and Chevron published worse-than-expected reports, their shares lost 4.6% and 4.9% respectively. At the moment more than a half of S&P 500 companies reported earnings. Investors estimate the overall income to rise 0.9% and earnings to fall 3.3%. The American stocks trade volume was 1.5% above the monthly average, making 6.8bln shares. Today at 14:30 CET Personal Income and Expenditure data will be released in the US. At 16:00 CET the ISM institute will publish Construction Spending and Manufacturing Indices. It is worth mentioning that S&P 500 has been traded for 6 months in a narrow 6% range. According to Lipper (Thomson Reuters agency subdivision), the last week investors withdrew $2.8 from share funds. However, this runoff was offset by companies that have been lately buying their own stocks with enthusiasm. Last week Dow Jones added 0.7%, while S&P 500 and Nasdaq gained 1.2% and 0.8%.

European indices have been advancing for 5 consequent days. Today they have risen due to good reports from Commerzbank and Heineken. The HSBC bank informed about selling its associated company to Brazilian Banco Bradesco for $5.2bln. This data produced additional support to stocks. The exchange in Athens officially opened after a 5-week closure, Greek ATG plunged 20%. However, it is still traded 35% above its historical low in 2012. The index has been calculated since 1991. The euro slightly declined within the neutral range. Currency market do not demonstrate high volatility today because investors' mixed reaction to ATG dynamics. No important macroeconomic news is expected today in eurozone.

Nikkei sagged following 3 days of growth. Kobe Steel and Nissin Steel shares lost 4.2% and 9.7% respectively due to Chinese economic slowdown. Car Sales dropped in July in Japan. Moreover, investors responded negatively to results of the meeting concerning the Trans-Pacific Partnership (TPP) agreement. To be noted, 12 probable country-members of the treaty control 40% of the global trade. China does not take part in TPP.

Caixin China Purchasing Manager Index in July dropped unexpectedly this morning. It can put additional weight on commodity futures. The Australian dollar marked a slight decrease on this information.

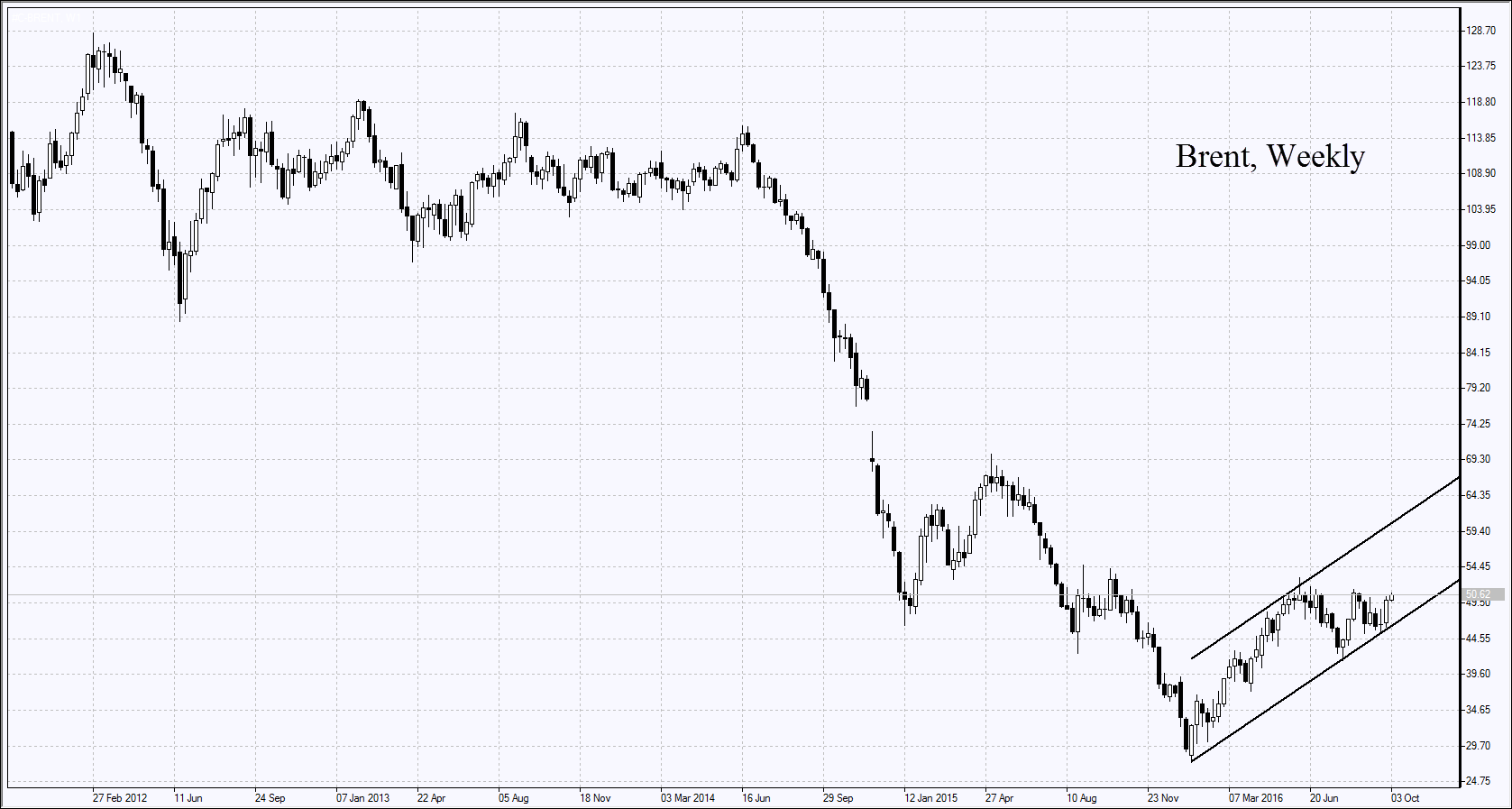

Brent oil recorded a 6-month low as Iranian oil minister stated the country was ready to increase production by 500 thousand barrels per day as soon as the US or the European Union place orders after sanctions lifting. The production will grow 1 million barrels per day from 2.85 mln in July to 3.8.-3.9mln within a month. The experts used to say that it would take 12 months to increase production by 1 mln barrels per day rather than one.

Soy bean and corn futures have been falling on expectations of good weather in US Middle West. According to American Department of Agriculture, China canceled a deal, refusing to buy 200 tons of soy and producing additional pressure on soy prices.

See Also