- Trading

- Markets

650+ CFD & Forex Instruments

Highly comfortable trading conditions is one of the decisive factors for a trader when choosing an online broker. IFC Markets offers to traders the following 8 groups of financial instruments. Current changes in trading conditions can be found in "Company News" section.

Currency Pairs Trading

Forex trading means buying one currency while selling another at the same time. These two currencies form what’s called a currency pair.

Precious Metals CFD Trading

Precious metals trading is a long-established way for traders to diversify their exposure beyond traditional asset classes like stocks or currencies.

World Indices CFD Trading

Indices CFD trading allows traders to speculate on the overall performance of a group of stocks rather than individual shares.

Stock CFD Trading

Stock CFD trading lets you speculate on the price movements of global company shares without owning them.

Online Cryptocurrency Trading - Cryptocurrency CFDs *

Cryptocurrency CFDs are derivatives that allow traders to speculate crypto without becoming direct owners of the underlying asset.

Trade Commodity CFDs without an Expiration Date

CFD Trading Commodities gives traders a flexible way to invest in some of the world’s most important resources, such as gold, oil, natural gas, coffee, and wheat. Instead of physically buying or storing these assets, traders can speculate on their price movements through CFDs.

Futures CFD Trading

Commodity Futures Trading is a popular way to speculate on the price of raw materials like gold, oil, natural gas, wheat, and coffee.

Gold Instruments

Gold has always been one of the most popular assets in the world. From being a traditional safe haven investment to a hedge against inflation, gold plays a key role in global markets.

Trade CFDs on ETFs

CFD ETF trading is an ideal way to participate in ETF trading without owning the actual asset.

Library of Synthetic Instruments

The Library of Synthetic Instruments offers traders innovative ways to access global markets using specially designed instruments created by analysts at IFC Markets.

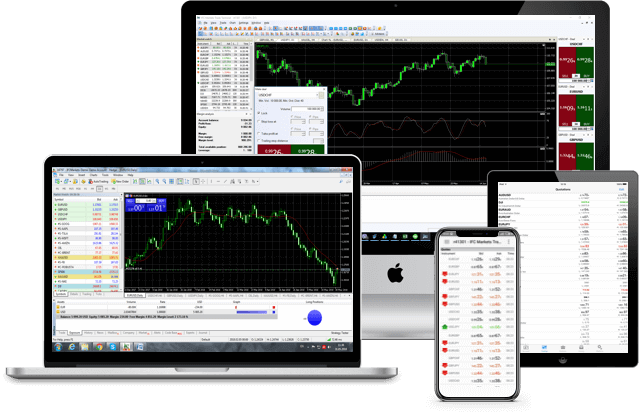

Try our Advanced, Professional Trading Platform

- 650+ Trading Instruments

- Server-based Trailing Stop

- Trading volume - starting from 100 units of base currency

- Portfolio Trading (PQM)

- Creation and trading of own instruments

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account